United States Water Bottle Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Insulated, Non-Insulated, Filter Water Bottle, Infuser Water Bottle, and Others), By Material Type (Plastic, Stainless Steel, Glass, and Others), and US Water Bottle Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsUnited States Water Bottle Market Insights Forecasts to 2033

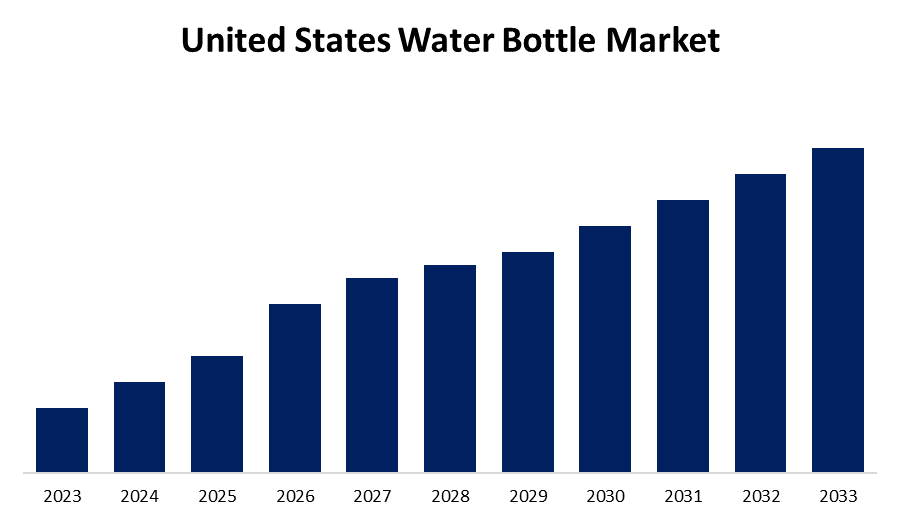

- The Market Size is Growing at a CAGR of 4.7% from 2023 to 2033

- The U.S. Water Bottle Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US Water Bottle Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 4.7% from 2023 to 2033.

Market Overview

A water bottle is just as vital as a wallet, smartphone, or car key to keep hydrated all day long. Drinking water helps eliminate toxins from the body and supports normal cell function. Water helps the body stay hydrated and maintain high energy levels. In the market, a variety of water bottles are offered, ranging from plastic and glass to stainless steel ones, featuring both simple and innovative designs. People carefully select their water bottles to minimize plastic pollution and shield themselves from harmful chemicals. Consuming an adequate quantity of water is essential for overall well-being. Having an unlimited water supply often leads individuals to increase their water intake, making it crucial to carry a water bottle and stay hydrated, especially during the summer months. Stainless steel bottles have gained popularity recently due to their strength, adaptability, eco-friendliness, and attractive appearance. It is offered in a variety of colors and patterns, making it an appealing option for those looking for stylish and practical drinkware.

Report Coverage

This research report categorizes the market for the US water bottle market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States water bottle market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. water bottle market.

United States Water Bottle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.7% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Material Type |

| Companies covered:: | Thermos L.L.C., Tupperware Brands Corporation, Klean Kanteen, CamelBak, S’well, Contigo Brands, Aquasana, Inc., HYDAWAY, Thermo Fisher Scientific Inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Manufacturers are frequently launching new technology-infused bottles to appeal to customers. The introduction of smart water bottles with features like hydration reminders and temperature displays is drawing in consumers and is expected to boost demand for the product in the coming years. Businesses are contributing to the reduction of single-use plastic by promoting reusable water bottles, which also aligns with the increasing demand for such products. The growing need for reusable water bottles for both sports and travel has boosted the market's expansion. Furthermore, the affordability of reusable water bottles also enhances product sales. Consumers are becoming more focused on their health and the environment, and the current generation requires sustainable and environmentally friendly drinkware.

Restraining Factors

Tough government rules on single-use plastic are expected to hinder the growth of plastic water bottles, and stainless steel is costly for the average person to buy.

Market Segmentation

The US water bottle market share is classified into product type and material type.

- The insulated segment is expected to hold a significant market share through the forecast period.

The United States water bottle market is segmented, by product type into insulated, non-insulated, filter water bottles, infuser water bottles, and others. Among these, the insulated segment is expected to hold a significant market share through the forecast period. The market is primarily controlled by insulated bottles that use vacuum insulation to maintain beverages at either ice-cold or piping-hot temperatures for extended periods. These bottles are equipped with temperature regulation and a sturdy exterior, making them an excellent option for commuting, working out, and traveling. These are commonly used as excellent gym bottles and come in various options like a sipper water bottle, sports water bottle, office water bottle, or sports bottle.

- The plastic segment is expected to dominate the US water bottle market during the projected period.

Based on the material type, the United States water bottle market is divided into plastic, stainless steel, glass, and others. Among these, the plastic segment is expected to dominate the US water bottle market during the projected period. Plastic water bottles are attractive, strong, frequently affordable, and easy to carry. These are more cost-effective to produce than glass, aluminum, or steel, which greatly contributes to their popularity and market dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States water bottle market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermos L.L.C.

- Tupperware Brands Corporation

- Klean Kanteen

- CamelBak

- S'well

- Contigo Brands

- Aquasana, Inc.

- HYDAWAY

- Thermo Fisher Scientific Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2022, Cove introduced the initial eco-friendly water bottles in collaboration with Erewhon. These containers are produced with PHA, a naturally sourced biopolymer, that is sustainably harvested and can naturally decompose. They are renewable, non-toxic, recyclable, free of plastic, and can be composted.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Water Bottle Market based on the below-mentioned segments:

United States Water Bottle Market, By Product Type

- Insulated

- Non-Insulated

- Filter Water Bottle

- Infuser Water Bottle

- Others

United States Water Bottle Market, By Material Type

- Plastic

- Stainless Steel

- Glass

- Others

Need help to buy this report?