United States Water Purifiers Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Point-of-Use Filters, and Point-of-Entry Filters), By Category (RO filter, UV filter, Gravity filter, and others), By Application (Residential, and Commercial), and United States Water Purifiers Market Insights Forecasts 2023 - 2033.

Industry: Consumer GoodsUnited States Water Purifiers Market Insights Forecasts to 2033

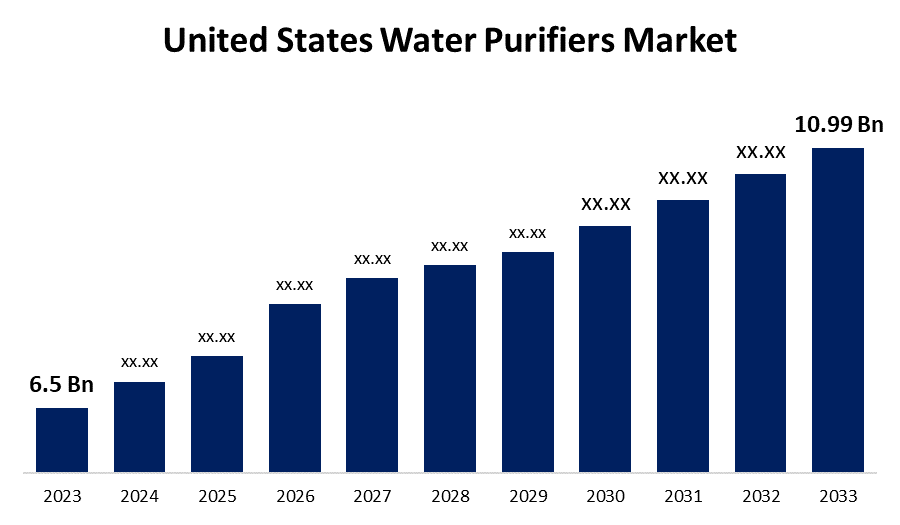

- The United States Water Purifiers Market Size was valued at USD 6.5 Billion in 2023

- The Market Size is Growing at a CAGR of 5.39% from 2023 to 2033.

- The United States Water Purifiers Market Size is Expected to Reach USD 10.99 Billion by 2033.

Get more details on this report -

The United States Water Purifiers Market size is expected to reach USD 10.99 Billion by 2033, at a CAGR of 5.39% during the forecast period 2023 to 2033.

Market Overview

Water purifiers are used to remove impurities and contaminants from water. They also improve the smell, visual appearance, and taste of drinking water. WHO and the U.S. Water treatment systems have gained traction in the country due to high-cost effectiveness and awareness programs by agencies such as the EPA. Filter media removes contaminants from raw water and improves its quality. This trend is witnessed by the growing adoption of health apps that help regulate healthy drinking habits. As purified water offers many benefits, consumers have turned to water purifier manufacturers to install purification systems in residential and commercial spaces to ensure a regular, clean supply. Water purifiers achieve purification by removing harmful substances including bacteria, viruses, algae, fungi, parasites, metals, lead, and chemical pollutants. Various technologies are used in purifiers such as activated carbon, reverse osmosis, UV germicidal irradiation, and distillation. Some water purifiers are compact, and designed for use in homes or offices, while others are larger systems that are used to treat water in municipal facilities or industrial settings.

Report Coverage

This research report categorizes the market for the United States water purifiers market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States water purifiers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States water purifiers market.

United States Water Purifiers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.39% |

| 2033 Value Projection: | USD 10.99 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By category, By Application |

| Companies covered:: | O. Smith Corporation, Brita LP, Omnipure Filter Company, Helen of Troy, APEC Water System, Instapure Brands, Inc., Crystal Quest, Pentair PLC, Paragon Water Systems, Inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing population growth in the United States mainly affects the demand for water purifiers. This trend is further reinforced by the fact that urban dwellers often have higher disposable incomes, allowing them to invest in water purifiers as a long-term solution to their water needs. Along with this, a growing emphasis on eco-consciousness and sustainability is driving the market. Additionally, changing lifestyles and consumer preferences are also contributing to the growth of the water purifier market in the United States. An important market driver for the United States water purifier industry is the growing awareness among the general public about water contamination and related health concerns. This increased awareness has led to an increase in the demand for water purifiers in the residential, commercial, and industrial sectors. Technological advancements and product innovation have played an important role in driving the US water purifier industry.

Restraining Factors

High maintenance cost due to the required replacement of water filters is a significant challenge for the growth of the market. Manufacturers require certifications and permits from regulatory agencies before placing water purification products on the market. Difficulties or delays in obtaining these approvals might impede both product release and market entry.

Market Segment

- In 2023, the point-of-use filters segment accounted for the largest revenue share over the forecast period.

Based on product type, the United States water purifiers market is segmented into point-of-use filters and point-of-entry filters. Among these, the point-of-use filters segment accounted for the largest revenue share over the forecast period. These filters have compact setups and can be easily installed without taking up much space. The low noise capability makes this filter suitable for light applications where water is the final use. Reverse osmosis point-of-use water filters are growing popular owing to their high-quality manufacturing and space-saving design.

- In 2023, the RO filter segment accounted for the largest revenue share over the forecast period.

Based on category, the United States water purifiers market is segmented into RO filters, UV filters, gravity filters, and others. Among these, the RO filter segment accounted for the largest revenue share over the forecast period. RO filters come in different sizes and offer high efficiency to provide high-quality potable water. These are advanced filters that remove 99% of contaminants. RO filters are expensive and specially designed to achieve bottled water quality.

- In 2023, the residential segment accounted for the largest revenue share over the forecast period.

Based on application, the United States water purifiers market is segmented into residential and commercial. Among these, the residential segment accounted for the largest revenue share over the forecast period. Compared to commercial buildings, domestic buildings use large amounts of water for cooking, bathing, washing, and other activities. According to the US EPA (Environmental Protection Agency), the average American household uses about 300 gallons of water per day. Approximately 17% for laundry, 19% for faucet and 20% for shower. Moreover, rapid urbanization in the country is expected to develop more demand for water purification for domestic use during the forecast period. Thus, with the growing need for clean water, the US water purifier market is projected to grow over the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States water purifiers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- O. Smith Corporation

- Brita LP

- Omnipure Filter Company

- Helen of Troy

- APEC Water System

- Instapure Brands, Inc.

- Crystal Quest

- Pentair PLC

- Paragon Water Systems, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Amway, a US health and wellness corporation, unveiled the eSpring Water Purifier, a new device that uses powerful, cutting-edge UV-C LED technology. The purifier strives to improve sustainability and consumer health.

- In June 2022, A.O. Smith Corporation announced that it had acquired Florida-based water treatment firm Atlantic Filters. The move is expected to allow the company to expand its capabilities in Florida and beyond.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Water Purifiers Market based on the below-mentioned segments:

United States Water Purifiers Market, By Product Type

- Point-of-Use Filters

- Point-of-Entry Filters

United States Water Purifiers Market, By Category

- RO filter

- UV filter

- Gravity filter

- Others

United States Water Purifiers Market, By Application

- Residential

- Commercial

Need help to buy this report?