United States Water Softening Systems Market Size, Share, and COVID-19 Impact Analysis, By Softener Type (Salt-based Ion Exchange Softener and Salt-Free Water Softener), By Application (Residential, Commercial, and Industrial), and US Water Softening Systems Market Insights, Industry Trend, Forecasts to 2033.

Industry: Machinery & EquipmentUnited States Water Softening Systems Market Insights Forecasts to 2033

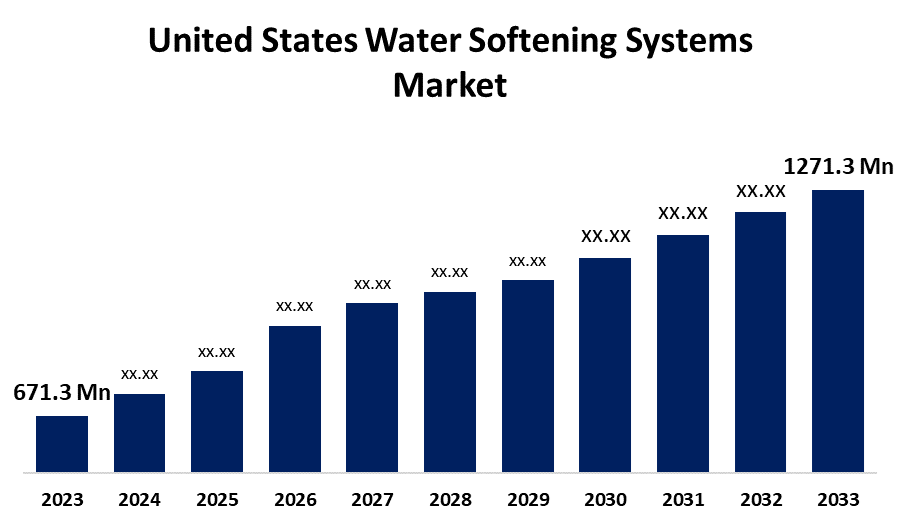

- The U.S. Water Softening Systems Market Size was valued at USD 671.3 Million in 2023.

- The Market is growing at a CAGR of 6.59% from 2023 to 2033

- The U.S. Water Softening Systems Market Size is Expected to Reach USD 1271.3 Million by 2033

Get more details on this report -

The U.S. Water Softening Systems Market is Anticipated to Exceed USD 1271.3 Million by 2033, growing at a CAGR of 6.59% from 2023 to 2033.

Market Overview

Water softening systems are frequently utilized for reducing water hardness caused by the precipitation of impurities or binding pollutants using ion-exchange resins, lime softening, reverse osmosis membranes, or nanofiltration. The issue with hard water is its potential risk as the accumulation of minerals can disrupt heat transfer, leading to boiler tube failure. Using soft water reduces the number of additional soaps and detergents required for laundry and cleaning, and increases the longevity of appliances like water heaters, dishwashers, and washing machines. A water softening system consists of three components: a brine tank, a mineral tank, and a control valve. These three works together to eliminate minerals from hard water, restore the system through cleaning, and monitor water flow on a regular basis. A water softener decreases the necessity for repairing rusty faucet heads, and water heaters, and the long time spent cleaning soap scum. A water softener conserves energy, time, and finances while safeguarding the home and belongings. Anticipated growth opportunities are forecasted due to advancements in water treatment technology and a focus on sustainability. Moreover, increased automation within the water treatment sector will drive the continued growth of the market by leading to variation in industrial filtration, equipment, and water treatment processes.

Report Coverage

This research report categorizes the market for the US water softening systems market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States water softening systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. water softening systems market.

United States Water Softening Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 671.3 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.59% |

| 2033 Value Projection: | USD 1271.3 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Softener Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | A. O. Smith Corporation, AmeriWater LLC, Applied Membranes, Inc., Axel Johnson, Inc., Berkshire Hathaway Inc., Culligan International, Marlo Incorporated, Watts Water Technologies, Inc., 3M Company, and Others key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumers are becoming more conscious of the health impacts of using hard water. This element stimulates the market for water-softening systems that can eradicate these problems. Approximately 90% of American households have access to hard water. Soft water is better for cleaning dishes because it doesn't require more detergent to be effective. The National Eczema Association's analysis found that prolonged exposure to hard water worsens symptoms of atopic dermatitis (AD) and could raise the risk of eczema in young children. Individuals with eczema are more prone to the impacts of hard water compared to those with normal skin. Increasing consumer health consciousness and the desire for long-lasting appliances will drive growth in the U.S. water-softening systems market.

Restraining Factors

Water treatment facilities do not have enough resources to treat this water properly, causing the wastewater to become salty. Recycled water is vital in farming for watering plants but water with high sodium levels can be damaging to crops. Approximately 40% of the chloride entering wastewater treatment plants comes from residential automatic water softeners.

Market Segmentation

The US water softening systems market share is classified into softener type and application.

- The salt-based ion exchange softener segment is expected to hold a significant market share through the forecast period.

The United States water softening systems market is segmented by softener type into salt-based ion exchange softener and salt-free water softener. Among these, the salt-based ion exchange softener segment is expected to hold a significant market share through the forecast period. Salt-based ion exchange softeners are frequently used due to their effective elimination of heavy minerals from hard water. Until now, only a small number of states in the U.S. have implemented regulations on salt-based ion exchange softeners because of environmental worries, resulting in consistent growth in the foreseeable future.

- The industrial segment is expected to dominate the US water softening systems market during the projected period.

Based on the application, the United States water softening systems market is divided into residential, commercial, and industrial. Among these, the industrial segment is expected to dominate the US Water Softening Systems market during the projected period. The increasing investment in various industrial facilities like semiconductor fabrication and thermal power plants is spurring the growth of water-softening systems in industrial environments. The Council of Economic Affairs stated that foreign direct investment increased by 247% in 2022 compared to the previous year due to the establishment and enlargement of current facilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States water softening systems market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- O. Smith Corporation

- AmeriWater LLC

- Applied Membranes, Inc.

- Axel Johnson, Inc.

- Berkshire Hathaway Inc.

- Culligan International

- Marlo Incorporated

- Watts Water Technologies, Inc.

- 3M Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Fortune Brands Innovations, a US-based company that produces home and security items, revealed the purchase of SprinWell Water Filter Systems, a company that offers household water filtration and softening solutions, through direct sales.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Water Softening Systems Market based on the below-mentioned segments:

United States Water Softening Systems Market, By Softener Type

- Salt-based Ion Exchange Softener

- Salt-Free Water Softener

United States Water Softening Systems Market, By Application

- Residential

- Commercial

- Industrial

Need help to buy this report?