United States Whiskey Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Irish Whiskey, American Whiskey, Canadian Whiskey, Scotch Whiskey, and Others), By Quality (Premium, High-End Premium, Super Premium), By Distribution Channel (On-Trade, Off-Trade), and United States Whiskey Market Insights Forecasts 2023 - 2033.

Industry: Food & BeveragesUnited States Whiskey Market Insights Forecasts to 2033

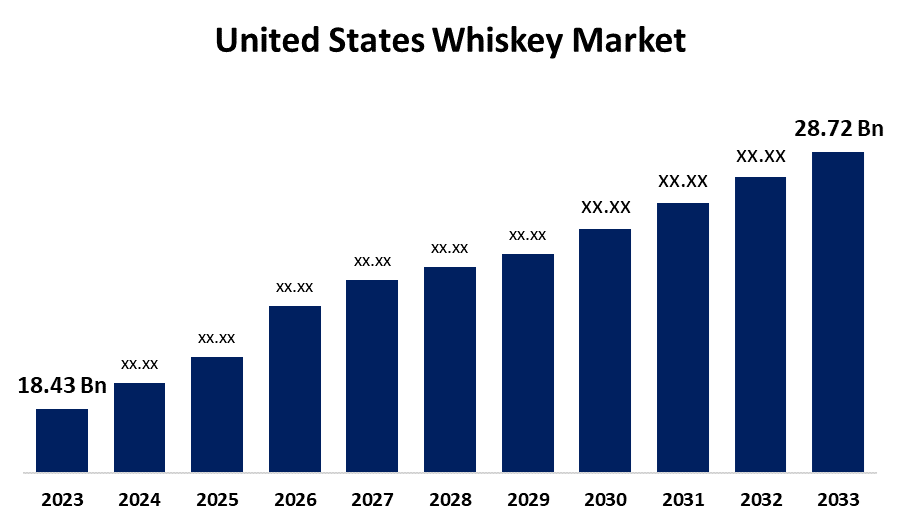

- The United States Whiskey Market Size was valued at USD 18.43 Billion in 2023

- The Market Size is Growing at a CAGR of 4.54% from 2023 to 2033.

- The United States Whiskey Market Size is Expected to Reach USD 28.72 Billion by 2033.

Get more details on this report -

The United States Whiskey Market size is Expected to Reach USD 28.72 Billion by 2033, at a CAGR of 4.54% during the forecast period 2023 to 2033.

Market Overview

A distilled alcoholic beverage produced from fermented grain mash is called whiskey. Its unique flavor and character come from the fact that it is usually matured in wooden casks. Grain varieties that can be utilized to make whiskey include barley, corn, rye, and wheat. There are many different kinds and styles of whiskey, and each has distinctive qualities that are determined by the kind of grain used, the method of distillation, and the area in which it is produced. Furthermore, one of the primary factors driving the whiskey market in the United States is a widespread increase in demand for handcrafted and high-end products. In line with these considerations, the market for distinctive and small-batch whisky products is being supported by changing client tastes and lifestyles, as well as an increase in interest in craft and artisanal items. Furthermore, the United States whiskey market is expanding as a result of customers' greater buying power, which has led to a growing preference for premium and high-quality items. In addition, the growing trend of whiskey tourism and tasting, which raises brand awareness and customer interest in whiskey, is helping to drive the United States whiskey market growth.

Report Coverage

This research report categorizes the market for the United States whiskey market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States whiskey market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States whiskey market.

United States Whiskey Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 18.43 Billion |

| Forecast Period: | 2023-2033 |

| 2033 Value Projection: | USD 28.72 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Quality, By Distribution Channel |

| Companies covered:: | Crown Royal, Bacardi Limited, Jim Beam, Pernod Ricard., Fireball, Allied Blenders and Distillers Pvt. Ltd., Jack Daniel’s, William Grant and Sons, Jameson and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The widespread use of products as a base for creative and innovative cocktails as a result of the growing popularity of craft cocktails is a growth factor for the United States whiskey market. Aside from that, distilleries are focusing on implementing sustainable practices and prioritizing eco-friendly production methods, which is driving market growth. Furthermore, rising product demand as a popular gift option for special occasions like birthdays, anniversaries, and holidays is driving market growth. Aside from that, key players and distilleries are constantly innovating and experimenting with new flavors, aging techniques, and production methods, resulting in a positive outlook for market growth. Other factors, such as widespread product availability on e-commerce and online platforms, innovative aging techniques, rising demand for high-quality whiskies as a status symbol, and expanding marketing campaigns, packaging design, and branding, are creating lucrative growth opportunities for the United States whiskey market.

Restraining Factors

Whiskey's high taxes could impact demand, causing buyers to opt for less expensive alternatives and lowering liquor manufacturers' profits. Governments enforce strict laws and policies governing the manufacture, sale, and consumption of alcoholic beverages. As a result, whiskey availability and distribution may be restricted in certain areas. These factors are impeding the growth of the whiskey market in the United States.

Market Segment

- In 2023, the scotch whiskey segment accounted for the largest revenue share over the forecast period.

Based on product type, the United States whiskey market is segmented into Irish whiskey, American whiskey, Canadian whiskey, scotch whiskey, and others. Among these, the scotch whiskey segment has the largest revenue share over the forecast period. Scotch whiskey is the most popular whiskey preference among other products. Furthermore, due to its production and rich, smooth flavor, it has also been used as a mixer in cocktails, expanding the market and retaining young consumers. As a result, the scotch whiskey segment is dominating the United States whiskey market.

- In 2023, the premium segment is witnessing significant growth over the forecast period.

Based on quality, the United States whiskey market is segmented into premium, high-end premium, and super premium. Among these, the premium segment is witnessing significant growth over the forecast period. This is due to rising demand for traditional beverages and an increase in the number of clubs and pubs in the market, both of which increase demand for the product. The preference for alcoholic beverages with authentic flavors and strong tastes has increased demand for premium drinks in the United States whiskey market.

- In 2023, the off-trade segment is witnessing significant growth over the forecast period.

Based on distribution channels, the United States whiskey market is segmented into on-trade and off-trade. Among these, the off-trade segment is witnessing significant growth over the forecast period. This is a result of an increase in the number of retail outlets, such as supermarkets, hypermarkets, wine and liquor stores, and convenience stores. Supermarket chains account for the majority of whiskey sales volume. This is due to sales promotions through in-store approaches such as price reductions, tastings for specific products, and other factors that are driving the growth of the off-trade segment in the United States whiskey market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States whiskey market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Crown Royal

- Bacardi Limited

- Jim Beam

- Pernod Ricard.

- Fireball

- Allied Blenders and Distillers Pvt. Ltd.

- Jack Daniel’s

- William Grant and Sons

- Jameson

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, Bearface Canadian Whisky has announced the release of Matsutake 01 in the United States, a spirit infused with wild Matsutake mushrooms that it claims taps into the trend for umami flavors.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Whiskey Market based on the below-mentioned segments:

United States Whiskey Market, By Product Type

- Irish Whiskey

- American Whiskey

- Canadian Whiskey

- Scotch Whiskey

- Others

United States Whiskey Market, By Quality

- Premium

- High-End Premium

- Super Premium

United States Whiskey Market, By Distribution Channel

- On-Trade

- Off-Trade

Need help to buy this report?