United States Wine Market Size, Share, and COVID-19 Impact Analysis, By Product (Dessert Wine, Table Wine, Sparkling Wine, and Others), By Distribution Channel (On-trade and Off-trade), and U.S. Wine Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited States Wine Market Insights Forecasts to 2033

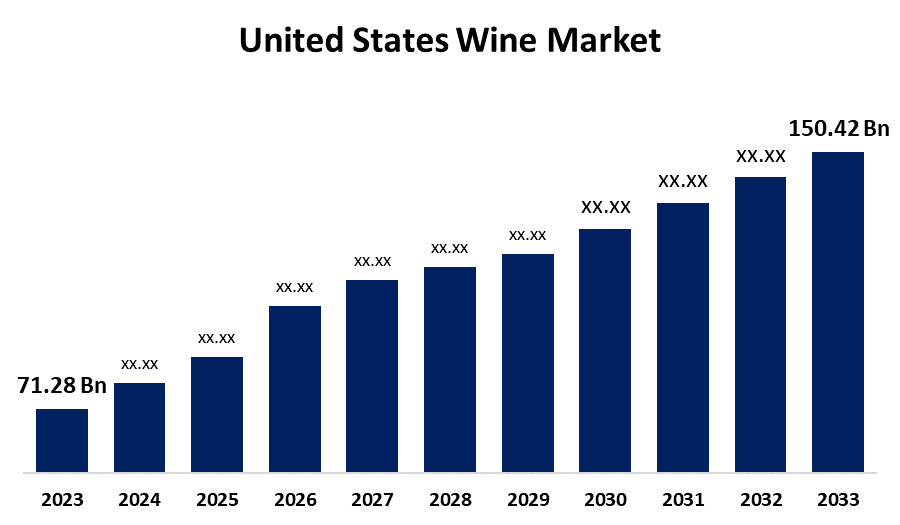

- The United States Wine Market Size Was Estimated at USD 71.28 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.75% from 2023 to 2033

- The USA Wine Market Size is Expected to Reach USD 150.42 Billion by 2033

Get more details on this report -

The United States Wine Market Size is Expected to reach USD 150.42 Billion by 2033, Growing at a CAGR of 7.75% from 2023 to 2033.

Market Overview

The United States wine market includes wine production, distribution, and consumption in the country. U.S. wine is growing in popularity because it has many benefits, including a sizable consumer base, a lot of disposable income, a wide variety of wines, advantageous import regulations, and a robust distribution system. Wine sales in the U.S. are booming due to innovation in flavor, color, and packaging, with emerging regions like Willamette Valley, Finger Lakes, Santa Rita Hills, and Columbia Valley gaining prominence. Additionally, the United States wine tourism industry is expanding, drawing customers seeking immersive experiences such as vineyard tours and tastings, and helping wine areas financially. Furthermore, government initiatives aid market expansion. For instance, in July 2024, the Regional Agriculture Promotion Program (RAPP) was established by USDA to assist wineries in growing their businesses and reaching new markets. In addition, the U.S. government supports vineyard operations by offering subsidies through initiatives like Rural Development grants and Farm Service Agency loans.

Report Coverage

This research report categorizes the market for the U.S. wine market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US wine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA wine market.

United States Wine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 71.28 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.75% |

| 2033 Value Projection: | USD 150.42 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | E. & J. Gallo Winery, Constellation Brands, Inc., The Wine Group, Accolade Wines, Castel Freres, Casella Family Brands, Bronco Wine Company, Trinchero Family Estates, Pernod Ricard, Deutsch Family Wine & Spirits, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The United States wine market's growth is attributed to changing consumer preferences, shifting from luxury to daily consumption, leading to increased demand for a variety of wines, from traditional to exotic. The US wine market is experiencing a surge in organic and sustainable wines due to consumers' environmental consciousness. This trend has led to an increase in wineries adopting these practices and a wider range of options. Additionally, wine tourism is gaining popularity, with regions like Napa Valley and Sonoma County becoming popular tourist destinations.

Restraining Factors

The market for wine in the United States poses significant challenges such as declining wine consumption due to competition from beer and spirits, strict regulations raising operating expenses, and climate change impacting grape harvests and quality. Furthermore, changes in consumer preferences for sustainability and low-alcohol beverages necessitate adjustments, and economic uncertainty affects consumers' discretionary expenditure on expensive wines.

Market Segmentation

The U.S. wine market share is classified into product and distribution channel.

- The table wine segment accounted for the largest market share of 78.31% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the U.S. wine market is divided into dessert wine, table wine, sparkling wine, and others. Among these, the table wine segment accounted for the largest market share of 78.31% in 2023 and is expected to grow at a significant CAGR during the forecast period. The market is expanding as consumers need affordable, high-quality, everyday wines that are adaptable. The need for approachable wines that go well with a range of meals has been spurred by shifting lifestyle patterns, such as a preference for informal eating and social events.

- The off-trade segment accounted for the highest market share of 70.25% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the distribution channel, the U.S. wine market is classified into on-trade and off-trade. Among these, the off-trade segment accounted for the highest market share of 70.25% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing because of changing customer preferences and changing buying patterns, the wine market in the United States is growing through off-trade channels. In addition, a growing number of customers are choosing to purchase wine online from merchants, vineyards, and subscription services due to the convenience and customized options offered by e-commerce and direct-to-consumer (DTC) sales.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. wine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- E. & J. Gallo Winery

- Constellation Brands, Inc.

- The Wine Group

- Accolade Wines

- Castel Frères

- Casella Family Brands

- Bronco Wine Company

- Trinchero Family Estates

- Pernod Ricard

- Deutsch Family Wine & Spirits

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Demeine Estates and United Airlines collaborated to serve Napa Valley wines in Polaris business class, thereby encouraging wine tourism in California.

- In March 2024, the Island Grove Wine Company embraced sustainability by introducing environmentally friendly wine kegs and cans.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. wine market based on the below-mentioned segments:

U.S. Wine Market, By Product

- Dessert Wine

- Table Wine

- Sparkling Wine

- Others

U.S. Wine Market, By Distribution Channel

- On-trade

- Off-trade

Need help to buy this report?