United States X-ray Systems Market Size, Share, and COVID-19 Impact Analysis, By Modality (Mammography, Radiography, and Fluoroscopy), By Technology (Computed Radiography and Digital Radiography), By End Use (Diagnostic Imaging Centers, Hospitals, and Others), and U.S. X-ray Systems Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareUnited States X-ray Systems Market Insights Forecasts to 2033

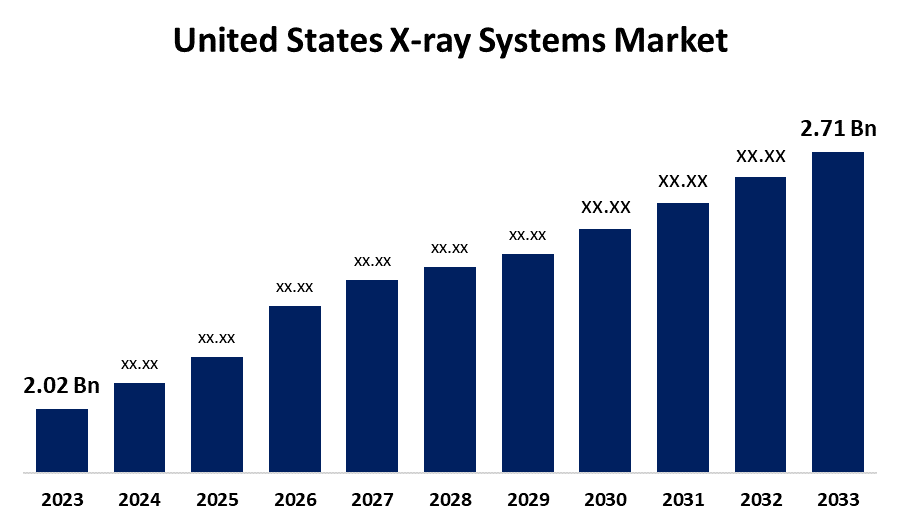

- The United States X-ray Systems Market Size Was Estimated at USD 2.02 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.98% from 2023 to 2033

- The USA X-ray Systems Market Size is Expected to Reach USD 2.71 Billion By 2033

Get more details on this report -

The United States X-ray Systems Market Size is Expected to reach USD 2.71 Billion By 2033, Growing at a CAGR of 2.98% from 2023 to 2033.

Market Overview

The market for X-ray systems in the United States is the area of the healthcare sector devoted to the creation, manufacturing, and distribution of X-ray imaging systems. These systems are crucial diagnostic instruments that are used in medical imaging to view the body's internal structures. This helps with the diagnosis and treatment of several ailments, such as tumors, infections, and fractures. They function by exposing a body or object to a regulated dose of radiation and then recording the images on film or a detector. These systems include mobile X-ray machines, computed tomography (CT) scanners, digital radiography (DR), and fluoroscopy devices. The market for X-ray systems is anticipated to grow and demand will increase due in large part to the increasing demand for early diagnosis and illness detection. Additionally, the market is expanding because of favorable reimbursement policies, an aging population, the rising prevalence of chronic diseases, and technological improvements. In addition, the market for X-ray systems is expected to increase significantly due to the rapid technological improvements made by manufacturers to improve image quality, the high acceptance rate of advanced X-ray systems, and the well-developed healthcare infrastructure.

Report Coverage

This research report categorizes the market for the U.S. x-ray systems market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US x-ray systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA x-ray systems market.

United States X-ray Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.02 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.98% |

| 2033 Value Projection: | USD 2.71 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Modality, By Technology, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Koninklijke Philips N.V., Siemens Healthineers AG, GE Healthcare, Mindray Medical International Limited, Hologic, Inc, AGFA, Canon Medical Systems, Shimadzu Corporation, FUJIFILM SonoSite, Inc., Carestream, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The US x-ray systems market has grown due to diagnostic imaging technologies are in high demand due to the aging population and the rising prevalence of chronic diseases like osteoporosis, cardiovascular disease, and cancer. X-ray machines are frequently used for both monitoring and diagnosing these disorders, especially during regular screenings and check-ups. Additionally, healthcare practitioners can perform imaging at the point of care because of the increasing usage of portable and transportable X-ray scanners, particularly for patients who are bedridden or in emergencies. This adaptability increases demand for portable X-ray equipment in emergency rooms, hospitals, and assisted living institutions.

Restraining Factors

The USA x-ray systems market faces challenges including expensive equipment, worries about radiation exposure, and strict FDA rules. In addition, advanced X-ray equipment, especially digital radiography, and CT scanners, have major initial expenditures for training, maintenance, and installation. This might be a deterrent to upgrading or using novel technologies for smaller healthcare facilities or organizations with tighter funds.

Market Segmentation

The U.S. x-ray systems market share is classified into modality, technology, and end use.

- The radiography segment accounted for the largest market share of 48.84% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the modality, the U.S. x-ray systems market is divided into mammography, radiography, and fluoroscopy. Among these, the radiography segment accounted for the largest market share of 48.84% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is fueled by growing applications in disease diagnosis, improvements in detector technology, and rising demand for digital radiography. In addition, hospitals and diagnostic facilities are using digital X-ray equipment more frequently because of their effectiveness, less radiation exposure, and excellent image quality.

- The digital radiography segment accounted for the largest market share of 65.55% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the technology, the U.S. x-ray systems market is categorized into computed radiography and digital radiography. Among these, the digital radiography segment accounted for the largest market share of 65.55% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is driven by its higher image quality, quicker processing times, and reduced radiation exposure. Additionally, growth in the market is also fueled by growing use in diagnostic centers, hospitals, and outpatient clinics as well as developments in portable DR systems and AI integration.

- The hospitals segment accounted for the highest market share of 38.42% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the end use, the U.S. x-ray systems market is classified into diagnostic imaging centers, hospitals, and others. Among these, the hospitals segment accounted for the highest market share of 38.42% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is driven by the growing need for accurate diagnosis, the expanding number of patients, and the growing usage of advanced imaging technology. In addition, hospitals make significant investments in cutting-edge X-ray equipment to support complicated procedures, improve workflow efficiency, and improve patient care.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. x-ray systems market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- GE Healthcare

- Mindray Medical International Limited

- Hologic, Inc

- AGFA

- Canon Medical Systems

- Shimadzu Corporation

- FUJIFILM SonoSite, Inc.

- Carestream

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, OXOS Medical®, a MedTech innovator creating easy, secure, and intelligent X-ray solutions, announced that its MC2 Portable X-ray System has received FDA 510(k) clearance and has arrived on the market.

- In November 2024, GE HealthCare and RadNet established a collaborative partnership to include AI-powered imaging technologies in X-ray machines. Enhancing breast cancer screening with AI-based workflows is the main goal of their first project.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. x-ray systems market based on the below-mentioned segments

U.S. X-ray Systems Market, By Modality

- Mammography

- Radiography

- Fluoroscopy

U.S. X-ray Systems Market, By Technology

- Computed Radiography

- Digital Radiography

U.S. X-ray Systems Market, By End Use

- Diagnostic Imaging Centers

- Hospitals

- Others

Need help to buy this report?