Global Unmanned Construction System Market Size, Share, and COVID-19 Impact Analysis, By Type (Unmanned Construction Software, Unmanned Construction Hardware), By Application (Public Construction, Roadworks), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Unmanned Construction System Market Insights Forecasts to 2033

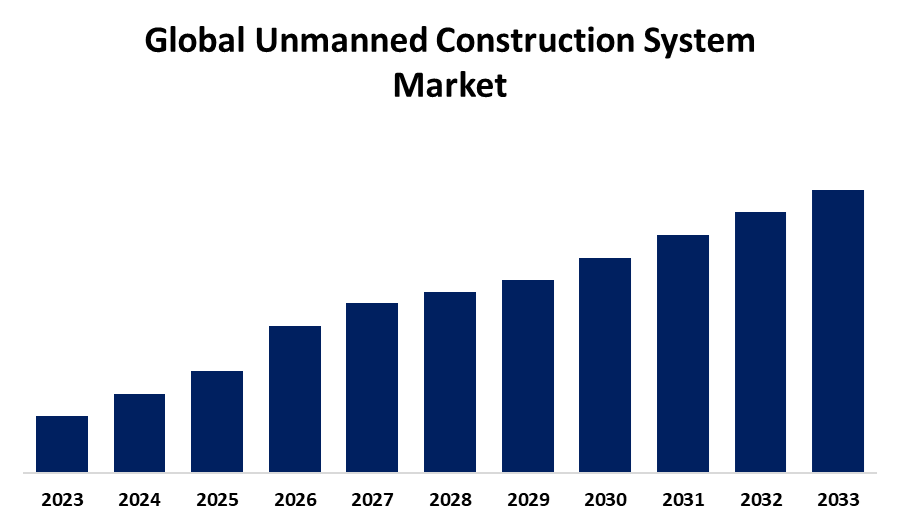

- The Market Size is Growing at a CAGR of 9.54% from 2023 to 2033

- The Worldwide Unmanned Construction System Size is Expected to Hold a Significant Share by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Unmanned Construction System Market is anticipated to hold a significant share by 2033, growing at a CAGR of 9.54% from 2023 to 2033. The global unmanned construction system market is increasing due to the growing automation of construction operations, which lowers costs and increases efficiency. Asia-Pacific is leading, followed by North America, which is fast adopting advanced technologies. Challenges include high costs, but innovations and government support create opportunities.

Market Overview

The unmanned construction system market is the industry concerned with the development, deployment, and utilization of automated or remotely controlled technologies in construction operations. Such systems cater to solutions ranging from autonomous construction vehicles and drones to robotic machinery, AI-driven management platforms, and sensor-based monitoring systems. The Unmanned Construction System Market uses automation through technologies, including drones, robots, and even AI-driven machinery, to support the efficiency, safety, and sustainability of construction applications. Typically, these applications include earthmoving, surveying, and material handling in various sectors such as infrastructure, mining, and energy. Growth is spurred by advancements in robotics, Industry 4.0 adoption, and a heightened need for safer, more efficient construction solutions.

The unmanned construction systems market, in recent times, has seen several novel launches and developments. For instance, in 2024, DEVELON displayed its "Future Xite" concept, encompassing AI and automation technologies to make construction equipment autonomous and enhance safety with smart collision mitigation, and zero-emission machinery. Innovations in this line include remote operation through digital twins and enhancement in 3D grading and safety monitoring systems. Moreover, Doosan continues to introduce Concept-X technologies, including drones for 3D site surveys, AI-driven workload management, and fully autonomous construction equipment. This complete solution will be fully commercialized by 2025.

Opportunities and Trends in the Global Unmanned Construction System Market:

Trends like AI integration, 3D site mapping, remote-controlled equipment, and autonomous vehicles enhance the global market for unmanned construction systems. More specific opportunities in this area include adopting Industry 4.0 technologies, demand for zero-emission construction solutions, and rapid infrastructure development in emerging economies. The usage of drones for surveying and the use of digital twins for project management also accelerate growth in this area.

Report Coverage

This research report categorizes the global unmanned construction system market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global unmanned construction system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global unmanned construction system market.

Global Unmanned Construction System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 9.54% |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, and By Region. |

| Companies covered:: | Robo Industries Inc, Built Robotics, Mortenson, Doosan Infracore, XCMG, Porsche Automobil Holding SE, Robo Industries, Komatsu, LiuGong, Fujita, Construction Robotics, Fastbrick Robotics, HAL Robotics., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Safety-related demands, labour shortages and the increasing demand for efficiency through automation within markets like drones and robotics drive the unmanned construction systems market. Sustainability goals, such as reduced energy use and waste, also present an imperative to drive adoption. Alignment can be seen with decarbonization efforts and global infrastructure growth initiatives. The recent technological advances in the unmanned construction systems market are a significant improvement. Companies now integrate more advanced robotics to undertake bricklaying, excavation, and welding. Such systems have improved precision and efficiency while reducing labour needs. For instance, in September 2024, Teledyne FLIR LLC, which is a US subsidiary of Teledyne Technologies Incorporated, was awarded contracts with two five-year requirements, says the company. These will involve providing its lineup of unmanned ground robots to the US government as well as support.

Restraints & Challenges

The unmanned construction systems market suffers from high initial investment cost requirements, limited technological expertise, and reliance on reliable infrastructure to support advanced automation. Regulatory barriers and the safety concerns of autonomous equipment provide further restraints to market adoption. Notable additional restraints include interoperability between systems and resistance to change in traditional practices.

Market Segmentation

The global unmanned construction system market share is classified into type and application.

• The unmanned construction hardware segment is expected to hold the largest share of the global unmanned construction system market during the forecast period.

Based on type, the global unmanned construction system market is categorized as unmanned construction software and unmanned construction hardware. Among these, the unmanned construction hardware segment is expected to hold the largest share of the global unmanned construction system market during the forecast period. This dominance is induced by the increasing adoption of advanced robotics, drones, and autonomous machinery in construction activities. This is so because, in the hardware, inherent task automation such as excavation, material handling, and site surveying significantly contribute to market growth.

• The roadworks segment is expected to grow at the fastest CAGR during the forecast period.

Based on the application, the global unmanned construction system market is categorized as public construction and roadworks. Among these, the roadworks segment is expected to grow at the fastest CAGR during the forecast period. Innovations such as robotic roadwork systems during autonomous excavation possess exciting benefits that include better safety and lower labour reliance while exhibiting an environmental-friendly outcome. They help dig accurately with minimal impact on urban infrastructure and are the main reasons why the demand for autonomous roadworks is growing so rapidly, further facilitated by cost savings and operation simplicity.

Regional Segment Analysis of the Global Unmanned Construction System Market

• North America (U.S., Canada, Mexico)

• Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

• Asia Pacific (China, Japan, India, Rest of APAC)

• South America (Brazil and the Rest of South America)

• The Middle East and Africa (UAE, South Africa, Rest of MEA)

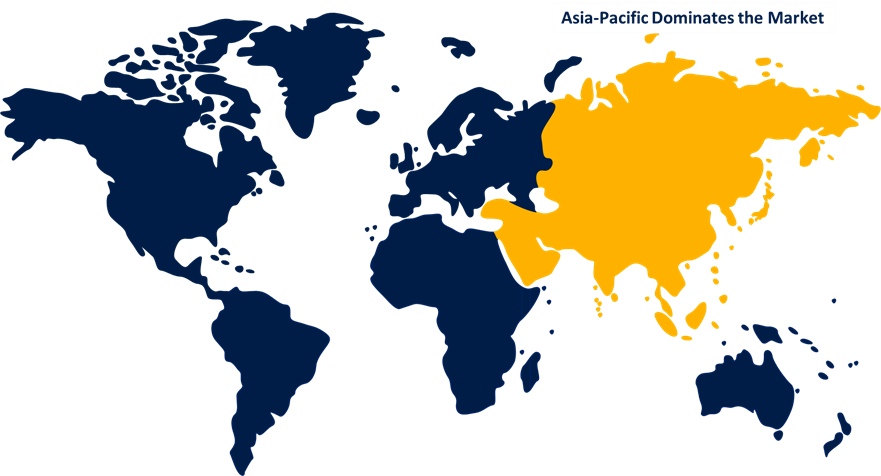

Asia Pacific is projected to hold the largest share of the global unmanned construction system market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global unmanned construction system market over the forecast period. Key factors driving the region are rapid urbanization, significant infrastructure projects, and increased adoption of automation technologies in construction. China, India, and Japan are leading the push toward integrating unmanned systems in construction, further boosting market growth. Furthermore, Asia-Pacific developments are resulting in substantial growth in the unmanned construction systems market due to technological innovation and strategic initiatives by key market players.

For instance, XCMG released several new unmanned construction machines in 2024 with an emphasis on autonomous excavators and bulldozers. These developments relate to reduced dependence on labour and increasing the efficiency of large infrastructure projects. The company's autonomous technology integration is gaining momentum in China's infrastructure sector. Also, Shantui's launch of unmanned equipment for earthworks and road construction supports automation in critical construction phases, reducing labour costs and increasing productivity on large-scale construction sites.

North America is expected to grow at the fastest CAGR growth of the global unmanned construction system market during the forecast period. In smart city projects, infrastructure development, autonomous machinery, and AI-driven software solutions, key drivers will dominate the industry. The key developments for 2024 include Caterpillar and Komatsu's strategic expansion of their autonomous construction fleets in the U.S. Another push that will be significantly delivered will be towards automated excavators and bulldozers, which promises to lift productivity on complex infrastructure projects. Furthermore, autonomous vehicle use in the construction sector, especially in the development of remote areas that are hazardous, is thus expected to boost the fast pace of growth in Canada. Regulation supporting the testing and development of unmanned vehicles within the construction industry also accelerates the market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global unmanned construction system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Robo Industries Inc

- Built Robotics

- Mortenson

- Doosan Infracore

- XCMG

- Porsche Automobil Holding SE

- Robo Industries

- Komatsu

- LiuGong

- Fujita

- Construction Robotics

- Fastbrick Robotics

- HAL Robotics.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

• In July 2024, Thales (France) signed an MoU with Garuda Aerospace (India) toward further development of the drone ecosystem in India. In addition to innovation, this would develop solutions that ensure safe and secure drone operations to help grow the applications of drones across the country.

• In May 2024, Flying Wedge Defence and Aerospace Technologies, an Indian aerospace and defence company, launched India's first indigenous bomber UAV in Bengaluru. The company showcased the FWD-200B, a medium-altitude, long-endurance (MALE) unmanned aerial vehicle that is designed and manufactured in India.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global unmanned construction system market based on the below-mentioned segments:

Global Unmanned Construction System Market, By Type

- Unmanned Construction Software

- Unmanned Construction Hardware

Global Unmanned Construction System Market, By Application

- Public Construction

- Roadworks

Global Unmanned Construction System Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global unmanned construction system market over the forecast period?The Unmanned Construction System Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 12.54% from 2023 to 2033.

-

2. Which region is expected to hold the highest share of the global unmanned construction system market?Asia Pacific is projected to hold the largest share of the global unmanned construction system market over the forecast period.

-

3. Who are the top key players in the global unmanned construction system market?Robo Industries Inc., Built Robotics, Mortenson, Doosan Infracore, XCMG, Porsche Automobil Holding SE, Robo Industries, Komatsu, LiuGong, Fujita, Construction Robotics, Fastbrick Robotics, HAL Robotics and Others.

Need help to buy this report?