Global Unmanned Electronic Warfare Market Size, Share, and COVID-19 Impact Analysis, By Product (Unmanned EW Equipment, Unmanned EW Operational Support), by Operation (Semi-autonomous, Fully Autonomous), by Platform (Unmanned Aerial Vehicles, Unmanned land Vehicles, Unmanned Marine vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Unmanned Electronic Warfare Market Insights Forecasts to 2033

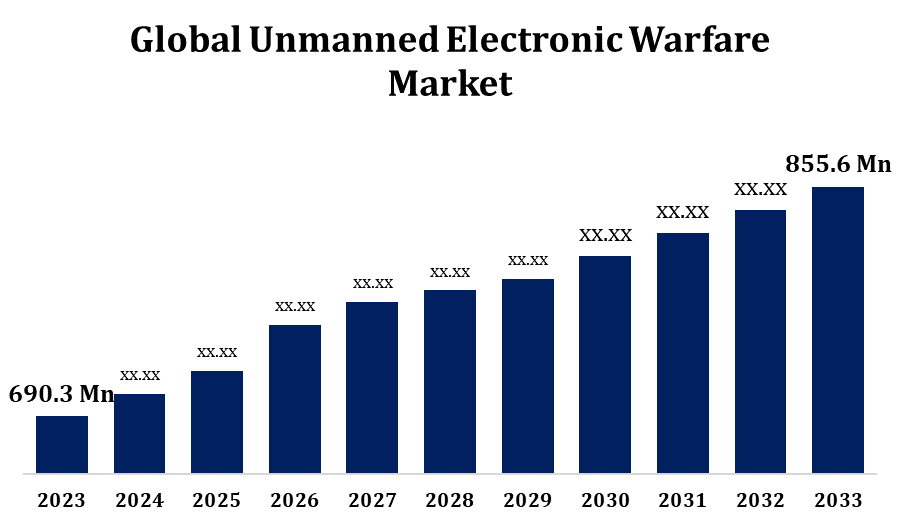

- The Unmanned Electronic Warfare Market was valued at USD 690.3 Million in 2023.

- The market is growing at a CAGR of 2.17% from 2023 to 2033.

- The global Unmanned Electronic Warfare Market is expected to reach USD 855.6 Million By 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Unmanned Electronic Warfare Market Size is expected to reach USD 855.6 Million By 2033, at a CAGR of 2.17% during the forecast period 2023 to 2033.

The unmanned electronic warfare market is experiencing rapid growth due to increasing defense budgets, technological advancements, and rising geopolitical tensions. Unmanned systems, including drones and autonomous vehicles, are being integrated with EW capabilities for intelligence gathering, jamming, and countermeasure operations. These systems enhance battlefield efficiency while minimizing human risk. Key drivers include the demand for electronic intelligence (ELINT), signals intelligence (SIGINT), and cyber warfare capabilities. The rise of AI and machine learning is further improving autonomous EW operations. North America dominates the market, with significant investments from the U.S. Department of Defense, while Asia-Pacific is emerging as a lucrative region. However, cybersecurity concerns and regulatory challenges may restrain growth. Leading players include Lockheed Martin, Northrop Grumman, and BAE Systems.

Unmanned Electronic Warfare Market Value Chain Analysis

The unmanned electronic warfare (EW) market value chain consists of multiple interconnected segments, including component suppliers, system integrators, software developers, service providers, and end users. Component suppliers provide key technologies such as sensors, antennas, jamming devices, and communication modules. System integrators, including defense contractors, assemble these components into unmanned EW platforms like drones and autonomous vehicles. Software developers create advanced algorithms for electronic attack, protection, and support functions. Service providers offer maintenance, training, and cybersecurity solutions. End users primarily include defense agencies, intelligence organizations, and homeland security departments. Collaboration between these stakeholders ensures seamless integration and operational efficiency. Key challenges include supply chain vulnerabilities and cybersecurity risks, while advancements in AI and software-defined EW systems drive innovation across the value chain.

Unmanned Electronic Warfare Market Opportunity Analysis

The unmanned electronic warfare (EW) market presents significant growth opportunities driven by rising defense expenditures, geopolitical tensions, and advancements in autonomous technology. The increasing reliance on unmanned aerial vehicles (UAVs) and autonomous systems for electronic attack, signals intelligence (SIGINT), and cyber warfare creates a demand for sophisticated EW solutions. Emerging markets in Asia-Pacific and the Middle East offer expansion opportunities due to military modernization programs. The integration of artificial intelligence (AI) and machine learning enhances real-time decision-making, improving operational effectiveness. Additionally, the development of software-defined EW systems and miniaturized jamming technologies opens new avenues for innovation. However, addressing cybersecurity vulnerabilities and regulatory challenges will be critical. Companies investing in AI-driven, networked EW systems will gain a competitive edge in this evolving landscape.

Global Unmanned Electronic Warfare Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 690.3 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.17% |

| 2033 Value Projection: | USD 855.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 141 |

| Segments covered: | By Product, By Operation, By Platform, By Region |

| Companies covered:: | Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Leonardo SPA (Italy), Saab AB (Sweden), BAE Systems (UK), Aselsan AS (Turkey), Elbit Systems (Israel), L3 Harris Technologies (US), and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Unmanned Electronic Warfare Market Dynamics

The growing adoption of unmanned warfare systems is driven by escalating transnational and regional security threats

The growing adoption of unmanned warfare systems is driven by escalating transnational and regional security threats, fueling the expansion of the unmanned electronic warfare (EW) market. Nations are increasingly investing in autonomous EW platforms, such as drones and unmanned ground vehicles, to enhance surveillance, electronic attack, and cyber defense capabilities. These systems provide strategic advantages by reducing human risk and enabling real-time threat response. The integration of AI, machine learning, and software-defined EW technologies further enhances operational efficiency. Key growth drivers include rising defense budgets, military modernization programs, and increased demand for electronic intelligence (ELINT) and signals intelligence (SIGINT). While North America leads in adoption, emerging markets in Asia-Pacific and the Middle East are experiencing rapid growth, creating new opportunities for industry players.

Restraints & Challenges

Cybersecurity vulnerabilities pose a significant risk, as adversaries can hack or disrupt unmanned systems, compromising missions. Regulatory and compliance issues also hinder market expansion, with strict defense policies and export restrictions limiting technology transfer. The high cost of developing and maintaining advanced EW systems creates budget constraints for some nations. Additionally, interoperability challenges arise when integrating unmanned EW platforms with existing defense networks. The reliance on artificial intelligence (AI) and machine learning introduces concerns regarding system reliability and ethical implications. Supply chain disruptions, including shortages of critical components like semiconductors, further impact production and deployment.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Unmanned Electronic Warfare Market from 2023 to 2033. The U.S. Department of Defense (DoD) leads in the development and deployment of autonomous EW systems for intelligence gathering, electronic attack, and cyber warfare. Key defense contractors like Lockheed Martin, Northrop Grumman, and Raytheon Technologies are investing in AI-driven, software-defined EW solutions to enhance mission effectiveness. The growing focus on countering emerging threats, including cyberattacks and electronic jamming, is further boosting demand. Additionally, collaborations between defense agencies and private firms drive innovation in unmanned EW platforms.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The growth is due to increasing regional security threats, military modernization programs, and rising defense budgets. The developing countries are heavily investing in autonomous EW capabilities to enhance electronic attack, signals intelligence (SIGINT), and cyber warfare operations. China is leading in indigenous development, while India is strengthening its defense industry through collaborations and government initiatives like "Make in India." Japan and South Korea are advancing AI-driven EW solutions to counter evolving threats. The growing tensions in the South China Sea and Indo-Pacific region further accelerate demand for unmanned EW systems.

Segmentation Analysis

Insights by Platform

The unmanned aerial vehicle segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is due to the increasing demand for aerial electronic attack, surveillance, and signals intelligence (SIGINT) operations. UAVs equipped with EW capabilities enhance real-time battlefield awareness, electronic jamming, and cyber warfare, reducing the risks faced by human operators. Advancements in artificial intelligence (AI) and machine learning are further improving autonomous decision-making and threat response. The integration of software-defined radios and next-generation jamming technologies boosts UAV effectiveness in contested environments. Countries worldwide, especially the U.S., China, and Israel, are investing heavily in UAV-based EW platforms.

Insights by Product

The unmanned EW equipment segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is due to rising demand for advanced electronic attack, surveillance, and cyber defense capabilities. Key equipment includes electronic jammers, radar warning receivers, electronic countermeasure (ECM) systems, and signals intelligence (SIGINT) payloads integrated into unmanned platforms like drones and autonomous vehicles. Advancements in software-defined radios, artificial intelligence (AI), and miniaturized EW technologies are enhancing operational effectiveness. Nations worldwide, particularly the U.S., China, and European countries, are investing in cutting-edge EW equipment to counter evolving threats. The increasing adoption of network-centric warfare and swarm-based EW operations is further driving demand.

Insights by Operation

The Fully Autonomous segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is due to advancements in artificial intelligence (AI), machine learning, and autonomous decision-making capabilities. These systems reduce human intervention in electronic attack, signals intelligence (SIGINT), and cyber warfare operations, enabling faster threat detection and response. Fully autonomous EW platforms enhance mission effectiveness by operating in high-risk environments without direct human control. Countries like the U.S., China, and Russia are heavily investing in autonomous EW systems to maintain a strategic edge. The integration of AI-driven data processing and adaptive electronic countermeasures further boosts operational efficiency.

Recent Market Developments

- In March 2021, Lockheed Martin Corporation and Northrop Grumman Corporation secured contracts from the U.S. Missile Defense Agency (MDA) for the Next Generation Interceptor (NGI) program. Likewise, in April 2020, Lockheed Martin Corporation was awarded a USD 75 million contract by the U.S. Army to design, manufacture, and test operational electronic warfare (EW) pods.

Competitive Landscape

Major players in the market

- Lockheed Martin Corporation (US)

- Northrop Grumman Corporation (US)

- Thales Group (France)

- Leonardo SPA (Italy)

- Saab AB (Sweden)

- BAE Systems (UK)

- Aselsan AS (Turkey)

- Elbit Systems (Israel)

- L3 Harris Technologies (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Unmanned Electronic Warfare Market, Product Analysis

- Unmanned EW Equipment

- Unmanned EW Operational Support

Unmanned Electronic Warfare Market, Operation Analysis

- Semi-autonomous

- Fully Autonomous

Unmanned Electronic Warfare Market, Platform Analysis

- Unmanned Aerial Vehicles

- Unmanned land Vehicles

- Unmanned Marine vehicles

Unmanned Electronic Warfare Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Unmanned Electronic Warfare Market?The global Unmanned Electronic Warfare Market is expected to grow from USD 690.3 million in 2023 to USD 855.6 million by 2033, at a CAGR of 2.17% during the forecast period 2023-2033.

-

2. Who are the key market players of the Unmanned Electronic Warfare Market?Some of the key market players of the market are the Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Leonardo SPA (Italy), Saab AB (Sweden), BAE Systems (UK), Aselsan AS (Turkey), Elbit Systems (Israel) and L3 Harris Technologies (US).

-

3. Which segment holds the largest market share?The Fully Autonomous segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?