Global Unmanned Underwater Vehicles Market Size, Share, and COVID-19 Impact Analysis, By Type (Remotely Operated Vehicles, Autonomous Underwater Vehicles, and Hybrid Underwater Vehicles), By Application (Commercial Exploration, Defense, Scientific Research, and Others), By Propulsion System (Mechanical, Electric, Hybrid, and Others), By Payload (Sensor, Synthetic Aperture Sonar, Cameras, Inertial Navigation Systems, and Others), By Product Type (Small Vehicles, High-Capacity Electric Vehicles, Work Class Vehicles, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Automotive & TransportationGlobal Unmanned Underwater Vehicles Market Insights Forecasts to 2032

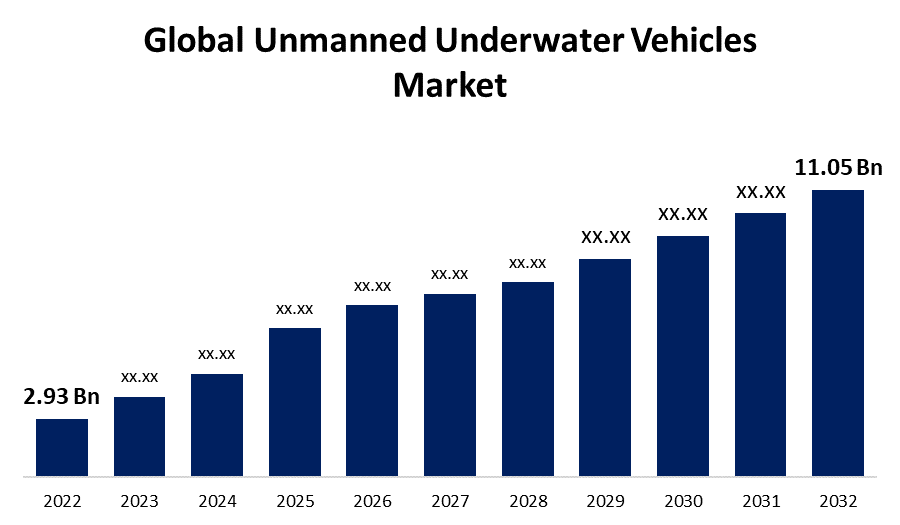

- The Global Unmanned Underwater Vehicles Market Size was valued at USD 2.93 Billion in 2022.

- The Market Size is Growing at a CAGR of 14.2% from 2022 to 2032

- The Worldwide Unmanned Underwater Vehicles Market size is expected to reach USD 11.05 Billion by 2032

- Asia-Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Unmanned Underwater Vehicles Market Size is expected to reach USD 11.05 Billion by 2032, at a CAGR of 14.2% during the forecast period 2022 to 2032.

Market Overview

Unmanned Underwater Vehicles (UUVs) are advanced technological devices designed to operate underwater without human intervention. These vehicles, also known as underwater drones, are used for a wide range of applications, including scientific research, military operations, and commercial ventures. UUVs are equipped with sensors, cameras, and other specialized instruments to gather data, explore marine environments, and perform various tasks. They can navigate autonomously or be remotely controlled from the surface, providing a cost-effective and safer alternative to manned underwater missions. UUVs have revolutionized ocean exploration, enabling scientists to study marine ecosystems, map the seafloor, and monitor underwater infrastructure. In military contexts, UUVs play a crucial role in mine detection, surveillance, and reconnaissance operations. With ongoing advancements in technology, the capabilities of UUVs continue to expand, opening up new possibilities for underwater exploration and utilization.

Report Coverage

This research report categorizes the market for unmanned underwater vehicles market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the unmanned underwater vehicles market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the unmanned underwater vehicles market.

Global Unmanned Underwater Vehicles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 2.93 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 14.2% |

| 2032 Value Projection: | USD 11.05 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Propulsion System, By Payload, By Product, By Region |

| Companies covered:: | Boeing, Fugro, General Dynamics Corp., Saab AB, Kongsberg Maritime, Oceaneering International Inc., Bluefin Robotics, BAE Systems, Boston Engineering Corp., Lockheed Martin Corp. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Unmanned Underwater Vehicles (UUVs) market is driven by several key factors due to increasing demand for oceanic research and exploration is propelling market growth. UUVs offer enhanced capabilities for collecting data, conducting surveys, and studying marine ecosystems, enabling scientists to gather valuable information. The rising need for maritime security and defense applications is driving market expansion. UUVs play a crucial role in underwater surveillance, mine detection, and reconnaissance, providing a cost-effective and efficient solution for military operations. Additionally, the growing demand for underwater infrastructure inspection and maintenance is fueling market growth. UUVs can inspect pipelines, cables, and underwater structures, reducing human intervention and improving operational efficiency. Furthermore, advancements in technology, such as improved autonomy, miniaturization, and sensor capabilities, are contributing to the market's growth by expanding the range of applications and enhancing UUV performance.

Restraining Factors

The Unmanned Underwater Vehicles (UUVs) market faces several restraints such as the high costs associated with developing and operating UUVs pose a challenge to market growth. The advanced technologies and specialized components required for UUVs contribute to their high price, limiting their affordability for some potential buyers. The limitations in endurance and battery life hinder the widespread adoption of UUVs. While efforts are being made to improve their operational time, UUVs still face limitations in terms of sustained underwater missions. Additionally, regulatory constraints and legal considerations regarding the use of UUVs in certain regions and applications may also impede market expansion. Overall, the technical challenges of navigating complex underwater environments and avoiding obstacles pose further limitations to UUV deployment and effectiveness.

Market Segmentation

- In 2022, the autonomous underwater vehicles segment accounted for around 32.5% market share

On the basis of the type, the global unmanned underwater vehicles market is segmented into remotely operated vehicles, autonomous underwater vehicles, and hybrid underwater vehicles. The autonomous underwater vehicles (AUVs) segment has emerged as the dominant player, holding the largest market share in the Unmanned Underwater Vehicles (UUVs) market. This can be attributed to several factors such as AUVs offer significant advantages over remotely operated vehicles (ROVs) and other types of UUVs, as they can operate autonomously without the need for direct human control or intervention. This autonomy enables AUVs to conduct missions with greater efficiency and independence. Advancements in AUV technology, including improved navigation systems, enhanced sensor capabilities, and longer endurance, have expanded their range of applications and increased their attractiveness to end-users. Moreover, the growing demand for AUVs in sectors such as oil and gas exploration, scientific research, and underwater mapping has contributed to their larger market share. The versatility, efficiency, and expanding capabilities of AUVs have positioned them as the leading segment in the UUVs market.

- In 2022, the defense segment dominated with more than 35.4% market share

Based on the type of application, the global unmanned underwater vehicles market is segmented into commercial exploration, defense, scientific research, and others. The defense segment exerts dominance in the market share of Unmanned Underwater Vehicles (UUVs). This can be attributed to playing a critical role in various defense applications, including maritime surveillance, mine countermeasures, and intelligence, surveillance, and reconnaissance (ISR) operations. The ability of UUVs to autonomously operate in underwater environments, gather data, and perform missions without putting human lives at risk is highly valued by defense organizations. The increasing focus on enhancing maritime security and defense capabilities has led to a surge in defense investments in UUV technologies. Additionally, advancements in UUV technology, such as improved sensors, longer endurance, and enhanced communication systems, have further strengthened the position of the defense segment in the market. The defense segment's dominance is expected to continue, driven by the continuous need for unmanned solutions in defense operations.

Regional Segment Analysis of the Unmanned Underwater Vehicles Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

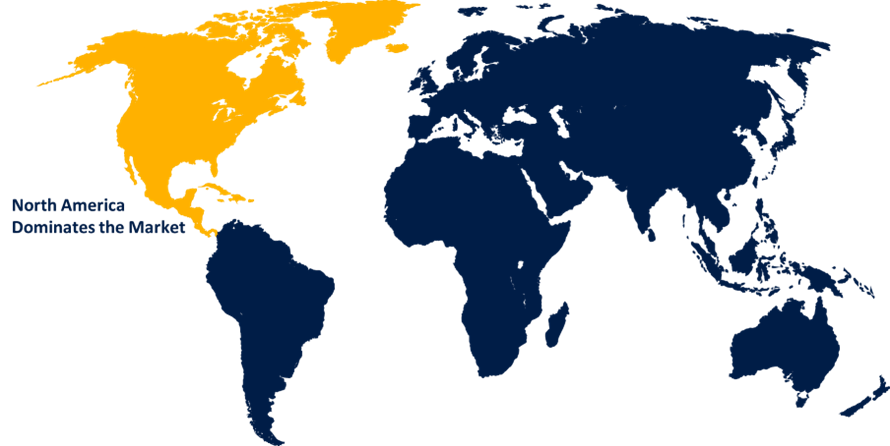

North America dominated the market with more than 34.6% revenue share in 2022.

Get more details on this report -

North America dominates the Unmanned Underwater Vehicles (UUVs) market with the largest market share. This can be attributed to several factors because North America has a strong presence of key industry players and technologically advanced companies involved in UUV development and manufacturing. These companies have established expertise in the field, leading to innovative product offerings and technological advancements. The region benefits from a robust defense and maritime industry, with a high demand for UUVs in military applications such as surveillance, reconnaissance, and mine countermeasures. Additionally, North America has a significant focus on scientific research and exploration of marine environments, which drives the adoption of UUVs in oceanic research applications. Moreover, favorable government initiatives and investments in UUV technologies further bolster the market growth in North America.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global unmanned underwater vehicles market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Boeing

- Fugro

- General Dynamics Corp.

- Saab AB

- Kongsberg Maritime

- Oceaneering International Inc.

- Bluefin Robotics

- BAE Systems

- Boston Engineering Corp.

- Lockheed Martin Corp.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2022, Austal USA has revealed its collaboration with Saildrone, a California-based company, to construct the Saildrone Surveyor, an autonomous surface vehicle, in Alabama. This partnership aims to deliver an advanced solution for enhancing maritime domain awareness, conducting hydrographic surveys, and fulfilling various missions that demand extensive and continuous coverage to the U.S. Navy and other government agencies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global unmanned underwater vehicles market based on the below-mentioned segments:

Unmanned Underwater Vehicles Market, By Type

- Remotely Operated Vehicles

- Autonomous Underwater Vehicles

- Hybrid Underwater Vehicles

Unmanned Underwater Vehicles Market, By Application

- Commercial Exploration

- Defense

- Scientific Research

- Others

Unmanned Underwater Vehicles Market, By Propulsion System

- Mechanical

- Electric

- Hybrid

- Others

Unmanned Underwater Vehicles Market, By Payload

- Sensor

- Synthetic Aperture Sonar

- Cameras

- Inertial Navigation Systems

- Others

Unmanned Underwater Vehicles Market, By Product Type

- Small Vehicles

- High-Capacity Electric Vehicles

- Work Class Vehicles

- Others

Unmanned Underwater Vehicles Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?