United States and Canada Liquid Waste Management Market Size, Share, and COVID-19 Impact Analysis, By Category (CWT and Onsite Facilities), By Waste Type (Residential and Commercial), and United States and Canada Liquid Waste Management Market Insights, Industry Trend, Forecasts to 2033.

Industry: Advanced MaterialsUnited States and Canada Liquid Waste Management Market Insights Forecasts to 2033

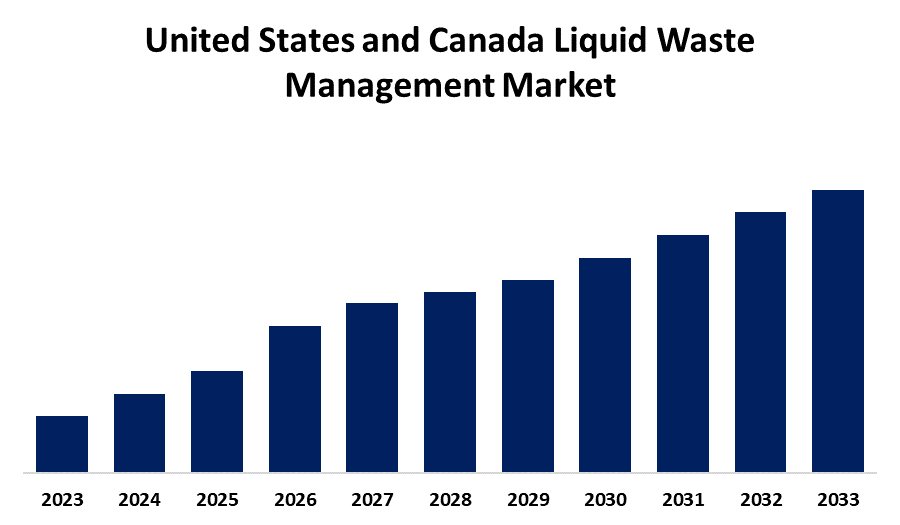

- The Market is Growing at a CAGR of 3.1% from 2023 to 2033

- The U.S. and Canada Liquid Waste Management Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US and Canada Liquid Waste Management Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 3.1% from 2023 to 2033.

Market Overview

Protocols and guidelines to prevent pollutants from being generated, gathered, and disposed of in non-hazardous liquid form and then released into storm drain systems or watercourses. Wastewater, fats, oils, or grease (FOG), used oil, liquids, solids, gasses, or sludges, as well as dangerous household liquids, are examples of liquid waste. These are the liquids that pose a risk to the environment or public health. They can also be thrown away commercial items that are categorized as "Liquid Industrial Waste," like insecticides and cleaning solutions, as well as leftovers from manufacturing processes. In addition to general waste restrictions, there are specific regulations that govern the creation, handling, handling, handling, and disposal of hazardous and liquid wastes. Additionally, water is regarded as liquid waste when it has been utilized once and is unfit for human consumption or other uses. There are two types of liquid waste: household and industrial. Manufacturing operations produce industrial wastewater, which is challenging to treat. Water released from residential and commercial buildings, hotels, and educational institutions is referred to as domestic wastewater.

Report Coverage

This research report categorizes the market for United States and Canada liquid waste management market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. and Canada liquid waste management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US and Canada liquid waste management market.

US and Canada Liquid Waste Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.1% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Category, By Waste Type and COVID-19 Impact Analysis. |

| Companies covered:: | Veolia Environmental Services, SUEZ, Clean Harbors, Inc., GFL Environmental Inc., Covanta Holding Corporation, Republic Services, WM Intellectual Property Holdings, L.L.C, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States' wastewater treatment system has progressed slowly in recent years; only $45 billion of the expected $271 billion raised for improvements has been spent thus far. This indicates that just 14,748 water treatment facilities serve 76% of the country's population. Additionally, due to accumulation in the aged equipment of the pipes, these facilities are becoming less and less efficient each. Since many of the treatment facilities that are now in use are unable to handle the volume of liquid waste that they are receiving, overflow into lakes and rivers occurs. Due to its extreme difficulty in handling, liquid waste is a crucial component of waste management. Liquid wastes are difficult to pick up and eliminate from an environment, in contrast to solid wastes. The creatures in the ecosystem, the plants people eat, and the people who live nearby are all subsequently contaminated by this pollution.

Restraining Factors

Regulations related to waste processing are becoming stricter, which is forcing businesses to use new technology to comply. Nevertheless, developing and implementing these new technologies can be expensive and difficult.

Market Segmentation

The US and Canada liquid waste management market share is classified into category and waste type.

- The CWT segment is anticipated to hold a significant share of the U.S. and Canada liquid waste management market during the forecast period.

Based on the category, the United States and Canada liquid waste management market is divided into CWT and onsite facilities. Among these, the CWT segment is anticipated to hold a significant share of the U.S. and Canada liquid waste management market during the forecast period. As per the U.S. EPA, 34 billion gallons of sewage are treated daily by centralized waste treatment facilities, which are the primary wastewater treatment plants. big-scale facilities called centralized treatment plants are used to treat wastewater and provide services to big cities or regions.

- The residential segment is anticipated to hold a significant share of the United States and Canada liquid waste management market during the forecast period.

Based on the waste type, the US and Canada liquid waste management market is divided into residential and commercial. Among these, the residential segment is anticipated to hold a significant share of the United States and Canada liquid waste management market during the forecast period. The majority of the nation's liquid waste was produced in the domestic sector by activities including cooking, washing, and toilet flushing. The produced liquid waste is effectively conveyed to treatment facilities by way of the sewage network. More than 75% of Americans, according to the U.S. EPA, live near adequate wastewater treatment facilities. The rest of the population treats and disposes of the wastewater generated at home using septic tanks and other on-site methods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US and Canada liquid waste management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Veolia Environmental Services

- SUEZ

- Clean Harbors, Inc.

- GFL Environmental Inc.

- Covanta Holding Corporation

- Republic Services

- WM Intellectual Property Holdings, L.L.C

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2022, Veolia North America (VNA), an entirely owned division of Veolia Group, recently announced the merging of its operations with Suez's assets in the United States and Canada, after the finalization of the two firms' merger, which was revealed earlier this year. This establishes VNA, with 10,000 people, as the largest water and wastewater treatment firm in the United States serving cities and towns.

Market Segment

This study forecasts revenue at the U.S. and Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States and Canada Liquid Waste Management Market based on the below-mentioned segments:

United States and Canada Liquid Waste Management Market, By Category

- CWT

- Onsite Facilities

United States and Canada Liquid Waste Management Market, By Waste Type

- Residential

- Commercial

Need help to buy this report?