US Baby Diaper Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Cloth Diaper, Disposable Diaper, Training Nappies, Swim Pants, and Biodegradable Diapers), By Distribution Channel (Hypermarkets, Convenience Stores, Retail Stores, Speciality Store, and Online Channels), and US Baby Diaper Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsUS Baby Diaper Market Insights Forecasts to 2033

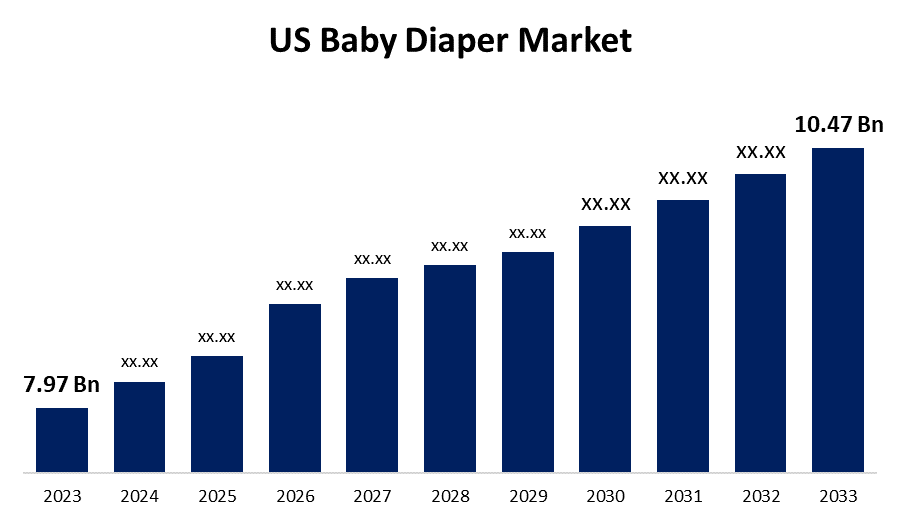

- The US Baby Diaper Market Size was valued at USD 7.97 Billion in 2023.

- The Market is growing at a CAGR of 2.77% % from 2023 to 2033

- The US Baby Diaper Market Size is Expected to Reach USD 10.47 Billion by 2033

Get more details on this report -

The US Baby Diaper Market is Anticipated to Exceed USD 10.47 Billion by 2033, growing at a CAGR of 2.77% % from 2023 to 2033. Due to rising disposable income and rising costs for child care, the demand for baby diapers is rising quickly across the country.

Market Overview

Baby diapers are pads designed to absorb and retain bodily fluids. These diapers are worn by toddlers who have not yet been toilet trained due to their young age. Baby diapers are frequently made to be worn like pants to provide optimum comfort to babies while also preventing leaking. Most baby diapers are constructed of polypropylene nonwoven films. The advantage of these smart diapers is that they require far less frequent diaper changes, which helps to relieve parents' stress. Furthermore, manufacturers have developed an app that warns parents when their infant wets the diaper. A sensor is put into the baby's diaper to detect humidity and notify the parent via a smartphone application. Furthermore, advances in baby diaper design have resulted in lower environmental impact, as leading manufacturers introduce thinner diapers, less packaging, and increased efficiency throughout all stages of product creation and distribution. Thus, the development of smart diapers and innovative baby diaper designs is accelerating the growth of the baby diapers market. Furthermore, throughout the projected period, the market is anticipated to see development possibilities due to growing consumer awareness of the quality of diapers used and rising demand for biodegradable baby diapers.

Report Coverage

This research report categorizes the market for the US baby diaper market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US baby diaper market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US baby diaper market.

US Baby Diaper Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.97 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.77% |

| 2033 Value Projection: | USD 10.47 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Bumkins, Charlie Banana USA LLC, Earth’s Best (The Hain Celestial Group Inc.), ECOABLE, Seventh Generation Inc, Flip Diapers (Cotton Babies Inc.), GeffenBaby.com, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

One of the primary driving forces behind the US infant diapers market is parents' heightened awareness of their baby's hygiene. The very absorbent liner of diapers effectively absorbs moisture. As a result, it has become significantly more popular than cloth nappies. Diapers are simple to put on and remove, making them ideal for small newborns and toddlers. Furthermore, maintaining the delicate area dry inhibits the spread of bacteria and other germs. As a result, diapers are in great demand and rising rapidly in the United States. The growing number of smartphone users in the United States with access to online consumer goods platforms is propelling the expansion of the US infant diaper industry.

Restraining Factors

Baby diapers can induce an allergic reaction due to babies' skin is fragile and sensitive, and anything with harsh chemicals might injure their skin. Furthermore, diapers may be poisonous due to their synthetic composition, and the chemical is expected to impede the expansion of the infant diaper market.

Market Segmentation

The US baby diaper market share is classified into product types and distribution channel.

- The disposable diaper segment is expected to hold the largest market share through the forecast period.

The US baby diaper market is segmented by product types into cloth diapers, disposable diapers, training nappies, swim pants, and biodegradable diapers. Among these, the disposable diaper segment is expected to hold the largest market share through the forecast period. The materials used to make these diapers are softer, more pleasant, and lighter in weight, allowing the skin to breathe. Furthermore, disposable diapers have stronger soaking properties than other product types, so they are regarded as more hygienic.

- The convenience stores segment is expected to hold the largest market share of the US baby diaper market during the forecast period.

Based on the distribution channel, the US baby diaper market is divided into hypermarkets, convenience stores, retail stores, specialty stores, and online channels. Among these, the convenience stores segment is expected to hold the largest market share of the US baby diaper market during the forecast period. Due to their easy availability in every community across the United States, convenience stores have the biggest market share. These businesses provide a wide choice of supplies and typically open at night, which is essential for emergencies such as diapers running out at midnight.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US baby diaper market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bumkins

- Charlie Banana USA LLC

- Earth's Best (The Hain Celestial Group Inc.)

- ECOABLE

- Seventh Generation Inc

- Flip Diapers (Cotton Babies Inc.)

- GeffenBaby.com

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, Dyper has announced the launch of its unique new diaper and fully reusable kraft paper wrapping, which are now manufactured in North America, marking a huge step forward in both the disposable diaper and packing industries.

Market Segment

This study forecasts revenue at the US, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US Baby Diaper Market based on the below-mentioned segments:

US Baby Diaper Market, By Product Type

- Cloth Diaper

- Disposable Diaper

- Training Nappies

- Swim Pants

- Biodegradable Diaper

US Baby Diaper Market, By Distribution Channel

- Hypermarkets

- Convenience Stores

- Retail Stores

- Speciality Store

- Online Channels

Need help to buy this report?