US Cultured Meat Market Size, Share, and COVID-19 Impact Analysis, By Source (Poultry, Beef, Seafood, Pork, Duck), By End Use (Nuggets, Burgers, Meatballs, Sausages, Hot Dogs), and US Cultured Meat Market Insights Forecasts 2023 – 2033

Industry: Food & BeveragesUS Cultured Meat Market Insights Forecasts to 2033

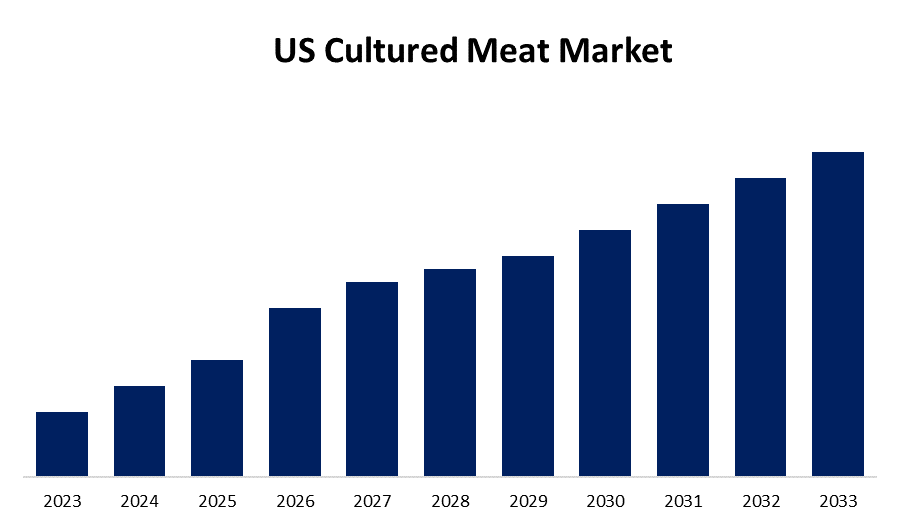

- The Market Size is Growing at a CAGR of 9.25% from 2023 to 2033.

- The US Cultured Meat Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The US Cultured Meat Market size is Expected to Hold a Significant Share by 2033, at a CAGR of 9.25% during the forecast period 2023 to 2033.

Market Overview

Lab-grown meat, also referred to as cultured meat or cell-based meat, is meat that is created in a laboratory using cellular agriculture as an alternative to conventional animal farming techniques. In order to produce muscle tissue that can be extracted and turned into meat products, animal cells are cultivated in a regulated setting. The goal of lab-grown meat is to offer a morally and environmentally sound substitute for traditional animal agriculture. It can lessen the negative effects on the environment, ease worries about animal welfare, and deal with issues with resource use and food security. Though the technology and production methods are still being refined, it is increasingly becoming possible to purchase lab-grown meat on a bigger scale for a price. The global transition toward sustainable food systems is being fueled by the increasing advances in technology in the field of alternative proteins. With the growing need to combat meat shortages in light of population growth and environmental impacts, alternative proteins and meat replacements are garnering interest on a global scale.

Report Coverage

This research report categorizes the market for the US cultured meat market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US cultured meat market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US cultured meat market.

US Cultured Meat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.25% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Source, By End Use and COVID-19 Impact Analysis. |

| Companies covered:: | Aleph Farms, Avant Meats Company Limited, Biftek INC, Mosa Meat, BlueNalu, Inc., BioFood Systems Ltd, WildType, New Age Eats, SuperMeat, Meatable, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The US market for lab-grown meat is expanding, mostly due to rising concerns about animal welfare. Often referred to as cultured or cell-based meat, lab-grown beef provides a more morally and humane substitute for conventional animal production practices. Customers are becoming more conscious of the conditions under which animals are raised for meat production, and as a result, animal welfare has grown in importance. Conventional animal husbandry frequently uses methods including confinement, overcrowding, and the use of hormones and antibiotics that create ethical questions. Customers' preferences are shifting in favor of more compassionate and cruelty-free products as a result of these activities. The expanding vegan population and consumer attitudes toward animal welfare will fuel the expansion of cultured meat. While the market is still in its early stages, large-scale cultured meat production is being researched and developed. The main players in the sector are concentrating on getting regulatory clearances so they start selling cultured meat products.

Restraining Factors

In order to maximize manufacturing processes, culture medium, and tissue engineering techniques, the relatively new subject of lab-grown meat requires constant study and development. Included in the total manufacturing costs are the expenses related to scientific study, experimentation, and technical improvements these factor hampers the US cultured meat market.

Market Segment

- In 2023, the poultry segment accounted for the largest revenue share over the forecast period.

Based on source, the US cultured meat market is segmented into poultry, beef, seafood, pork, duck. Among these, the poultry segment accounted for the largest revenue share over the forecast period. The use of lab-grown fowl allays animal welfare concerns by removing the need to raise and kill birds. Poultry meat is produced directly from animal cells, making it a more morally and humanely acceptable beef substitute. Environmental problems related to land use, water use, and greenhouse gas emissions are linked to poultry production.

- In 2023, the burgers segment accounted for the largest revenue share over the forecast period.

Based on End Use, the US cultured meat market is segmented into nuggets, burgers, meatballs, sausages, hot dogs. Among these, the burgers segment accounted for the largest revenue share over the forecast period. Because a growing number of consumers are choosing meat substitutes that are ethical and ecological. Burgers made with cultured meat lessen the meat industry's negative environmental effects. Cultivated meat is being tested by a number of startups and major businesses, which is anticipated to help the market expand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US cultured meat market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aleph Farms

- Avant Meats Company Limited

- Biftek INC

- Mosa Meat

- BlueNalu, Inc.

- BioFood Systems Ltd

- WildType

- New Age Eats

- SuperMeat

- Meatable

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, the United States now has legal authority to offer lab-grown meat to people for the first time. The US Department of Agriculture has approved Upside Foods and Good Meat, two companies that specialize in cultured meat, to manufacture and market chicken products that are cultivated in massive metal vats from clusters of sample animal cells.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the US cultured meat Market based on the below-mentioned segments:

US Cultured Meat Market, By Source

- Poultry

- Beef

- Seafood

- Pork

- Duck

US Cultured Meat Market, By End Use

- Nuggets

- Burgers

- Meatballs

- Sausages

- Hot Dogs

Need help to buy this report?