US Drug Utilization Management Market Size, Share, and COVID-19 Impact Analysis, By Program Type (In-House and Outsourced), By End-use (PBMs, Health Plan Providers/Payors, and Pharmacies), and US Drug Utilization Management Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareUS Drug Utilization Management Market Insights Forecasts to 2033

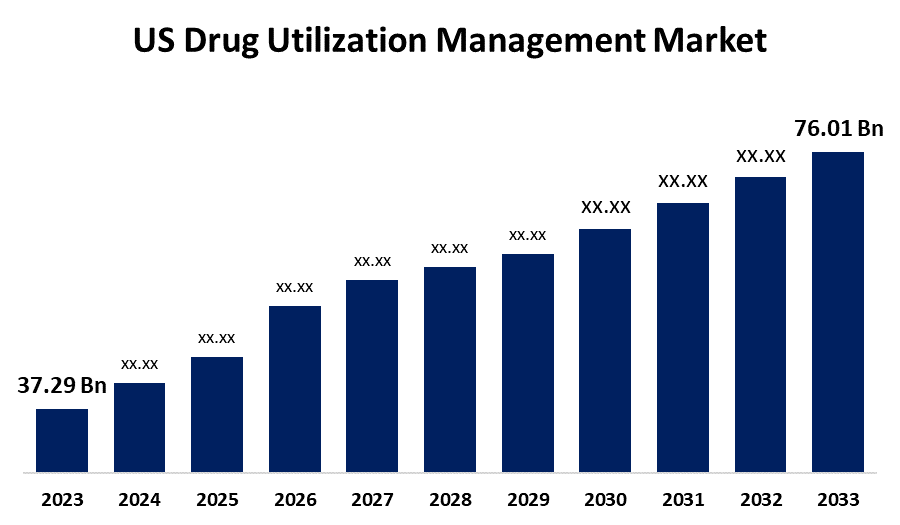

- The US Drug Utilization Management Market Size was valued at USD 37.29 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.38% from 2023 to 2033

- The US Drug Utilization Management Market Size is Expected to reach USD 76.01 Billion by 2033

Get more details on this report -

The US Drug Utilization Management Market SIze is anticipated to Exceed USD 76.01 Billion by 2033, Growing at a CAGR of 7.38% from 2023 to 2033.

Market Overview

Drug utilization management (DUM) is a process that is part of a human health plan. Drug utilization management aids in making sure that people are receiving the right drugs while serving to make medicine more reasonable. Health plan firms, doctors, hospitals, and pharmacists share information and work together to support advanced medicine for people. DUM programs, such as prior authorizations, step therapy, and quantity limits help to grab errors, lessen waste, improve safety, and have medicine reasonable by dropping costs. These types of programs are important for monitoring healthcare expenses, prompting patient care results, and enhancing the quality of treatment. The most effective utilization management approaches concentrate on four main components, including risk minimization, quality assurance, patient education, and in-depth review.

Report Coverage

This research report categorizes the market for the US drug utilization management market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US drug utilization management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US drug utilization management market.

US Drug Utilization Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 37.29 Billion |

| Forecast Period: | 2023-2033 |

| 2033 Value Projection: | USD 37.29 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Program Type, By End-use |

| Companies covered:: | Optum, Inc., Aetna, Inc. (CVS Health Corp.), Point32Health, Inc., Health Plan of San Mateo (HPSM), Providence, PerformRx, Prime Therapeutics LLC, Agadia Systems, Inc., Ultimate Health Plans, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The expansion of the drug utilization management market is driven by the rising healthcare expenses that have urged the need for policies that enhance medication use and control spending. Furthermore, advances in healthcare technologies have allowed more developed strategies for DUM, such as the use of data analytics and electronic health records to record and progress prescribing patterns. In addition, regulatory creativities expected to improve patient safety and quality of care have stimulated the acceptance of DUM practices between healthcare workers and insurers. Moreover, the change to value-based care models has incentivized investors to devise DUM strategies that improve patient results and fulfillment while comprising costs.

Restraining Factors

Regulatory and privacy problems have a significant effect on drug utilization management in the US Regulatory loads, such as state laws and federal regulations, hinder the growth of the drug utilization management market.

Market Segmentation

The US drug utilization management market share is classified into program type and end-use.

- The in-house segment is expected to hold the largest market share through the forecast period.

The US drug utilization management market is segmented by program type into in-house and outsourced. Among these, the in-house segment is expected to hold the largest market share through the forecast period. This is because of the cost-effective, utilization management, and administrative efficiencies it offers to health plans and companies. Pharmacy Benefits Managers (PBMs) device utilization strategies, like prior authorization and step therapy to encourage suitable medicine use. Furthermore, high utilization of prescription drugs in the US requires effective in-house programs for the management of prescription expenses completed by retail pharmacies.

- The PBMs segment dominates the market with the fastest growth rate over the predicted period.

The US drug utilization management market is segmented by end-use into PBMs, health plan providers/payors, and pharmacies. Among these, the PBMs segment dominates the market with the fastest growth rate over the predicted period. PBMs are active in transferring discounted drug prices and repayments from pharmaceutical manufacturers. PBMs aid regulators in medication prices for health insurance plans and companies by managing drug manufacturers and utilization. PBMs shorten procedures by managing administrative tasks, such as pharmacy network management, claims processing, and benefit plan design, decreasing the workload for insurers, companies, and pharmacies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US drug utilization management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Optum, Inc.

- Aetna, Inc. (CVS Health Corp.)

- Point32Health, Inc.

- Health Plan of San Mateo (HPSM)

- Providence

- PerformRx

- Prime Therapeutics LLC

- Agadia Systems, Inc.

- Ultimate Health Plans

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2021, to offer integrated PBM solutions, Point32Health, the non-profit parent organization of Harvard Pilgrim Health Care and Tufts Health Plan, entered into a multiyear relationship with Optum Rx. It was anticipated that this agreement would benefit Harvard Pilgrim & Tufts Health Plan members by improving services and costs.

Market Segment

This study forecasts revenue at US, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US drug utilization management market based on the below-mentioned segments

US Drug Utilization Management Market, By Program Type

- In-House

- Outsourced

US Drug Utilization Management Market, By End-use

- PBMs

- Health Plan Providers/Payors

- Pharmacies

Need help to buy this report?