US Hemoglobinopathies Market Size, Share, and COVID-19 Impact Analysis, By Type (Thalassemia and Sickle Cell Disease), By Therapy (Monoclonal Antibody Medication, ACE inhibitors, and Hydroxyurea), and US Hemoglobinopathies Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUS Hemoglobinopathies Market Insights Forecasts to 2033

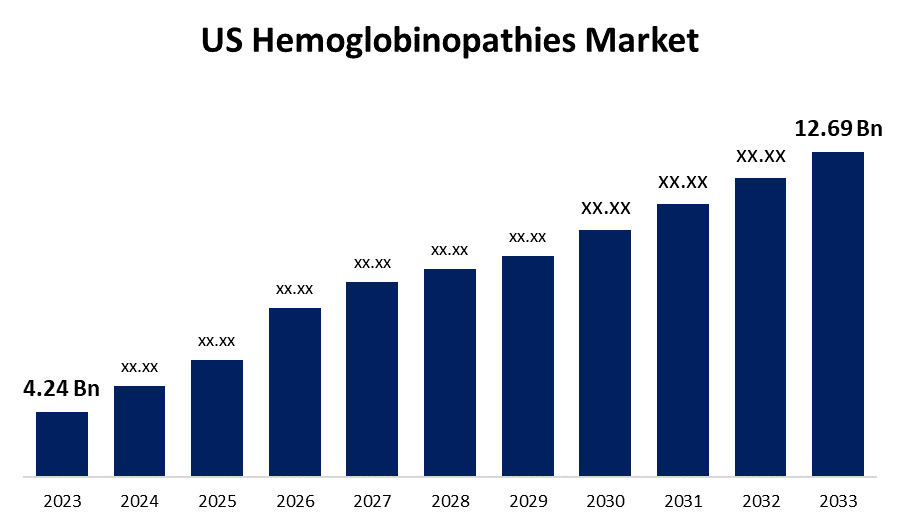

- The US Hemoglobinopathies Market Size was valued at USD 4.24 Billion in 2023.

- The Market Size is Growing at a CAGR of 11.59% from 2023 to 2033

- The US Hemoglobinopathies Market Size is expected to reach USD 12.69 Billion by 2033

Get more details on this report -

US Hemoglobinopathies Market Size is anticipated to exceed USD 12.69 Billion by 2033, growing at a CAGR of 11.59% from 2023 to 2033.

Market Overview

Hereditary diseases of globin, the protein that makes up hemoglobin (Hb), are known as hemoglobinopathies. The thalassaemia syndromes are caused by mutations that lower the level of globin proteins (partial or complete gene deletions are the most prevalent cause of alpha thalassaemia). A class of genetic diseases known as hemoglobinopathies is passed down from parents to their children. Mutations in the hemoglobin molecule's gene cause hemoglobinopathies. Hemoglobin (Hb) variant, which results from a mutation in the hemoglobin gene, and thalassemia, which is caused by insufficient hemoglobin production, are the two primary kinds of hemoglobinopathies. Numerous health issues have been brought on by several hemoglobinopathies, which include beta thalassemia, sickle cell disease, hemoglobin variation, and thalassemia. Blurred eyesight, cardiac issues, decreased growth, gallstones, enlarged spleen, and stroke are further health issues linked to the condition. A rise in the frequency of diseases is the primary driver of market expansion. SDC problems are reported in one in every 16,300 Hispanic-American infants. African American babies are at least 1 in 13 born with sickle cell disease.

Report Coverage

This research report categorizes the market for the US hemoglobinopathies market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hemoglobinopathies market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the hemoglobinopathies market.

US Hemoglobinopathies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.24 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 11.59% |

| 2033 Value Projection: | USD 12.69 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Therapy |

| Companies covered:: | Sangamo Therapeutics, Inc., Pfizer, Inc., Bioverativ Inc., Global Blood Therapeutics, Inc., Novartis AG, Bluebird bio, Inc., Emmaus Life Sciences Inc., Celgene Corp., Prolong Pharmaceuticals, LLC, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is expanding significantly due to several factors, one of which is the development and commercialization of novel treatments including gene editing and gene therapy. By focusing on the underlying genetic defects in hemoglobinopathies, these innovative methods aim to increase market share. The pharmaceutical industry is witnessing a noteworthy trend of higher expenditure in research and development (R&D). This increase in funding is mostly the result of an unrelenting search for novel therapeutic approaches and a never-ending pursuit of innovation. The increasing number of firms' and organizations' initiatives aimed at raising public awareness regarding hemoglobinopathies is contributing to the acceleration of market growth in the United States.

Restraining Factors

Factors such as efficacy, safety, cost, and accessibility can determine the adoption rate of these substitutes and their overall impact on the market.

Market Segmentation

The US hemoglobinopathies market share is classified into type and therapy.

- The sickle cell disease segment is expected to hold the largest market share through the forecast period.

The US hemoglobinopathies market is segmented by type into thalassemia and sickle cell disease. Among these, the sickle cell disease segment is expected to hold the largest market share through the forecast period. Expanding Biopharmaceutical Companies' and Nonprofits' Initiatives Promote Better Access to Treatment for Sickle Cell Disease (SCD). Disease diagnosis-focused awareness efforts are a major factor in the market's expansion.

- The monoclonal antibody medication segment dominates the market with the largest market share over the predicted period.

The US hemoglobinopathies market is segmented by therapy into monoclonal antibody medication, ace inhibitors, and hydroxyurea. Among these, the monoclonal antibody medication segment dominates the market with the largest market share over the predicted period. Because there are enough medications available for the condition. Thalassemia demonstrates a strong response to monoclonal antibody treatment. The freshly created and authorized treatments by the top players in the market are fueling its expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US hemoglobinopathies market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sangamo Therapeutics, Inc.

- Pfizer, Inc.

- Bioverativ Inc.

- Global Blood Therapeutics, Inc.

- Novartis AG

- Bluebird bio, Inc.

- Emmaus Life Sciences Inc.

- Celgene Corp.

- Prolong Pharmaceuticals, LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, Bluebird Bio's lovotibeglogene autotemcel (lovo-cel), also marketed as Lyfgenia, has been approved by the FDA to treat sickle cell disease (SCD) in patients 12 years of age and older.

Market Segment

This study forecasts revenue at US, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US Hemoglobinopathies Market based on the below-mentioned segments:

US Hemoglobinopathies Market, By Type

- Thalassemia

- Sickle Cell Disease

US Hemoglobinopathies Market, By Therapy

- Monoclonal Antibody Medication

- ACE inhibitors

- Hydroxyurea

Need help to buy this report?