United States Industrial Tapes Market Size, Share, and COVID-19 Impact Analysis, By Tape Type (Adhesive Transfer Tapes, Double-Sided Tapes, Masking Tapes, Duct Tapes, Electrical Tapes, Specialty Tapes, and Others), By Material Type (Polypropylene (PP), Polyvinyl Chloride (PVC), Polyethylene (PE), Polyester (PET), and Others), By Application, (Industrial Machinery, Equipment Maintenance and Repair, Fabrication and Assembly, Product Packaging, Surface Protection, Sealing and Bonding, Insulation, and Others), By Industry Verticals (Manufacturing, Packaging, Aerospace and Defense, Marine, Oil and Gas, Agriculture, and Others), and United States Industrial Tapes Market Insights Forecasts 2023 - 2033

Industry: Advanced MaterialsUnited States Industrial Tapes Market Insights Forecasts to 2033

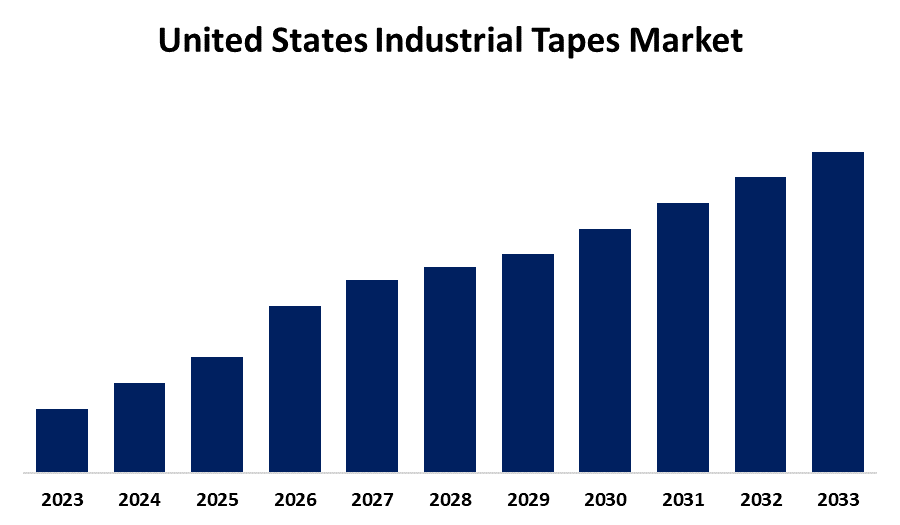

- The Market Size is Growing at a 4.7% CAGR from 2023 to 2033.

- The United States Industrial Tapes Market Size is Expected to Reach a Significant Share by 2033.

Get more details on this report -

The United States Industrial Tapes Market Size is Expected to Reach a Significant Share by 2033, Growing at a 4.7% CAGR from 2023 to 2033.

Market Overview

Industrial tapes are used for a variety of industrial tasks such as adhesive bonding, masking, packing, wrapping, and electrical sealing. They are created from a sticky chemical film and backing material. Compared to ordinary tapes, they have a stronger adhesive and are suitable for bonding heavy materials including metal, concrete, glass, wood, and rubber. Furthermore, industrial tapes are used in processes including HVAC (heating, ventilation, and air conditioning) operations, car assembly, and the assembly of electronic components. These tapes can also be utilized in UV radiation, extremely high and low temperatures, and solvents. They are also water and shock-resistant for certain processes, such as the construction of electrical equipment. The industrial tape market in the United States is expanding rapidly because several industries, including the automotive, aerospace, construction, electrical and electronics, and healthcare sectors, rely heavily on industrial tapes. The market need for industrial tapes is being driven by the expansion of several industries, especially in the United States.

Report Coverage

This research report categorizes the market for the United States industrial tapes market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States industrial tapes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States industrial tapes market.

United States Industrial Tapes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.7% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Tape Type, By Material Type, By Application, By Industry Verticals and COVID-19 Impact Analysis. |

| Companies covered:: | 3M Company, Avery Dennison Corporation, Nitto Denko Corporation, Intertape Polymer Group Inc., Berry Group, Tesa SE, Saint-Gobain, Shurtape Technologies, Scapa Group plc, Lintec Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The manufacturing, food and beverage, and medical device industries are just a few of the areas that have seen a sharp increase in demand for industrial tapes due to the fast-paced development of industrialization. The industrial tapes industry in the US is expanding thanks in part to this tendency. The remarkable physical and chemical qualities that these tapes possess such as their flexibility, durability, chemical resistance, resistance to moisture and temperature, and high productivity are a significant contributing cause to this beneficial effect. A growing portion of the US market is being driven by these unique qualities for industrial tapes. Industries are using lightweight materials more and more to improve overall performance, reduce emissions, and increase fuel economy. Industrial tapes are essential for joining lightweight materials such as composites, aluminum, and plastic, which drives demand for them.

Restraining Factors

The use of industrial tapes will decline as a result of the government's current focus on managing hazardous wastes and efforts to make products as sustainable as possible. Industrial tapes might occasionally contain hazardous chemicals that improve their properties and functionality. Throughout the projection period, the expansion of the industrial tapes market in the United States will be impeded by strict regulations that will force companies producing the tapes to find sustainable alternatives.

Market Segment

- In 2023, the duct tape segment accounted for the largest revenue share over the forecast period.

Based on tape type, the United States industrial tapes market is segmented into adhesive transfer tapes, double-sided tapes, masking tapes, duct tapes, electrical tapes, specialty tapes, and others. Among these, the duct tape segment has the largest revenue share over the forecast period. The optimum applications for duct tapes are uneven surfaces because they are mainly composed of pressure-sensitive adhesive. The duct tape segment is anticipated to develop as a result of applications like packaging, sealing carpet padding, and other general-purpose tasks like patching, mending, and repairing.

- In 2023, the polypropylene (PP) segment is witnessing significant growth over the forecast period.

Based on material type, the United States industrial tapes market is segmented into polypropylene (PP), polyvinyl chloride (PVC), polyethylene (PE), polyester (PET), and others. Among these, the polypropylene (PP) segment is witnessing significant growth over the forecast period. This is because the strength, flexibility, and chemical and moisture resistance are all well-balanced, making polypropylene a popular choice for a variety of industrial applications. In applications where strength and damage resistance are critical, such as packing, bundling, and labeling, polypropylene tapes are widely used in the United States.

- In 2023, the product packaging segment is growing significantly over the forecast period.

Based on application, the United States industrial tapes market is segmented into industrial machinery, equipment maintenance and repair, fabrication and assembly, product packaging, surface protection, sealing and bonding, insulation, and others. Among these, the product packaging segment is growing significantly over the forecast period. In product packaging, industrial tape is used to seal boxes or containers before delivery. It is of higher quality than regular at-home tapes. Furthermore, the usage of industrial tape in the packaging business benefits both firms and customers because it allows products to be delivered securely from the company to the consumer. Because of these causes, the product packaging segment is growing significantly.

- In 2023, the manufacturing segment is witnessing significant growth over the forecast period.

Based on industry verticals, the United States industrial tapes market is segmented into manufacturing, packaging, aerospace and defense, marine, oil and gas, agriculture, and others. Among these, the manufacturing segment is witnessing significant growth over the forecast period. Tapes with particular qualities are needed for a range of assembling, packing, and maintenance applications in the manufacturing industry. In the manufacturing industry, tapes are utilized not just for binding but also for labeling, electrical insulation, and thermal management. Due to these factors, the manufacturing segment is growing rapidly in the United States industrial tapes market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States industrial tapes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M Company

- Avery Dennison Corporation

- Nitto Denko Corporation

- Intertape Polymer Group Inc.

- Berry Group

- Tesa SE

- Saint-Gobain

- Shurtape Technologies

- Scapa Group plc

- Lintec Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Industrial Tapes Market based on the below-mentioned segments:

United States Industrial Tapes Market, By Tape Type

- Adhesive Transfer Tapes

- Double-Sided Tapes

- Masking Tapes

- Duct Tapes

- Electrical Tapes

- Specialty Tapes

- Others

United States Industrial Tapes Market, By Material Type

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polyester (PET)

- Others

United States Industrial Tapes Market, By Application

- Industrial Machinery

- Equipment Maintenance and Repair

- Fabrication and Assembly

- Product Packaging

- Surface Protection

- Sealing and Bonding

- Insulation

- Others

United States Industrial Tapes Market, By Industry Verticals

- Manufacturing

- Packaging

- Aerospace and Defense

- Marine

- Oil and Gas

- Agriculture

- Others

Need help to buy this report?