US Insurtech Market Size, Share, and COVID-19 Impact Analysis, By Type (Auto, Business, Health, Home, Specialty, and Travel), By Service (Consulting, Support & Maintenance, and Managed Services), By Technology (Blockchain, Cloud Computing, IoT, Robo Advisory, and Machine Learning), and US Insurtech Market Insights, Industry Trend, Forecasts to 2033.

Industry: Information & TechnologyUS Insurtech Market Insights Forecasts to 2033

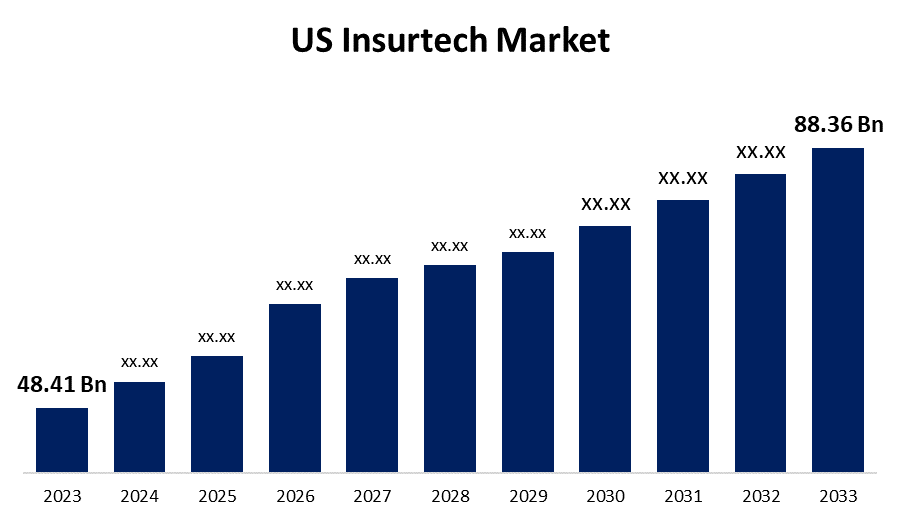

- The US Insurtech Market Size was valued at USD 48.41 Billion in 2023.

- The Market is Growing at a CAGR of 6.20% from 2023 to 2033

- The US Insurtech Market Size is expected to reach USD 88.36 Billion by 2033

Get more details on this report -

The US Insurtech Market is anticipated to exceed USD 88.36 Billion by 2033, growing at a CAGR of 6.20% from 2023 to 2033.

Market Overview

InsurTech, a subset of FinTech, or financial technology, is the innovative use of technology in the insurance industry. Insurtech companies leverage various technologies such as artificial intelligence (AI), machine learning (ML), big data analytics, the Internet of Things (IoT), and blockchain to streamline processes, enhance underwriting accuracy, automate claims handling, and personalize insurance products. Insurtech has facilitated the emergence of new insurance models, such as peer-to-peer (P2P) insurance, on-demand insurance, and usage-based insurance (UBI). These models provide adjustable pricing based on individual risk profiles along with more specialized coverage alternatives. Insurtech enterprises operating in the United States prioritize enhancing the client experience through the provision of accessible digital platforms, quicker policy procurement procedures, and expedited claims resolution. Digital technology allows companies to better understand their customers' demands and adapt their offers to meet those evolving wants.

Report Coverage

This research report categorizes the market for the US insurtech market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US insurtech market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US insurtech market.

US Insurtech Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 48.41 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.20% |

| 2033 Value Projection: | USD 88.36 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Service, By Technology |

| Companies covered:: | Gusto, Root Insurance, Coalition, Bright Health, Clover Health, Collective Health, Next Insurance, Oscar, Ethos Life, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The industry is being driven by factors such as growing client expectations, more digitization, and the requirement for customized insurance services. The insurance industry's current business models are rapidly becoming more digital, which is fuelling the expansion of the insurtech market. Furthermore, real-time tracking and monitoring of insured activity for specific business lines is made possible by technologies like artificial intelligence (AI), machine learning, blockchain, and cloud computing. These technologies also simplify and modernize business operations, which is a major factor propelling the growth of the global insurtech market.

Restraining Factors

The growth of the insurance technology market is hindered by high investment costs. As a result, while marketing goods that make use of cutting-edge technology, insurance companies encounter new difficulties.

Market Segmentation

The US insurtech market share is classified into type, service, and technology.

- The health segment is expected to hold the largest market share through the forecast period.

The US insurtech market is segmented by type into auto, business, health, home, specialty, and travel. Among these, the health segment is expected to hold the largest market share through the forecast period. The demand for the health segment is expected to be fueled by the growing need for digital platforms that link exchanges, brokers, providers, and carriers in the health insurance industry. To better serve and comprehend their clients, life and health insurers are concentrating on leveraging advanced analytics.

- The managed services segment dominates the market with the largest market share over the predicted period.

The US insurtech market is segmented by service into consulting, support & maintenance, and managed services. Among these, the managed services segment dominates the market with the largest market share over the predicted period. Managed service providers, by fusing new technology with experience and skill, may provide insurers a measured doorway to transformation. Insurers can also benefit from managed services providers' best practices, procedures, and regulatory concerns.

- The cloud computing segment is expected to hold the largest share of the US insurtech market during the forecast period.

Based on the technology, the US insurtech market is divided into the blockchain, cloud computing, IoT, robo advisory, and machine learning. Among these, the cloud computing segment is expected to hold the largest share of the US insurtech market during the forecast period. Because of its flexibility, ease of deployment, and resourcefulness, cloud computing has completely changed the insurance business. The growth is anticipated to be driven by the increasing amount of data that insurance firms gather in conjunction with the widespread acceptance of Bring Your Own Device (BYOD) policies. Cloud computing solutions are becoming more and more popular among insurance organizations because of their quick deployment times, affordability, and scalability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US insurtech market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gusto

- Root Insurance

- Coalition

- Bright Health

- Clover Health

- Collective Health

- Next Insurance

- Oscar

- Ethos Life

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Vista Equity Partners, a renowned international investment group, purchased Duck Creek Technologies, the intelligent solutions provider leading the way in property and liability (P&C) and general insurance trends.

Market Segment

This study forecasts revenue at US, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US insurtech market based on the below-mentioned segments:

US Insurtech Market, By Type

- Auto

- Business

- Health

- Home

- Specialty

- Travel

US Insurtech Market, By Service

- Consulting

- Support & Maintenance

- Managed Services

US Insurtech Market, By Technology

- Blockchain

- Cloud Computing

- IoT

- Robo Advisory

- Machine Learning

Need help to buy this report?