US Legal Technology Market Size, Share, and COVID-19 Impact Analysis, By Solution (Software and Services), By Type (E-discovery, Legal Research, Contract Lifecycle Management, and Time-Tracking & Billing), By End User (Law Firms and Corporate Legal Departments), and US Legal Technology Market Insights, Industry Trend, Forecasts to 2033

Industry: Information & TechnologyUS Legal Technology Market Insights Forecasts to 2033

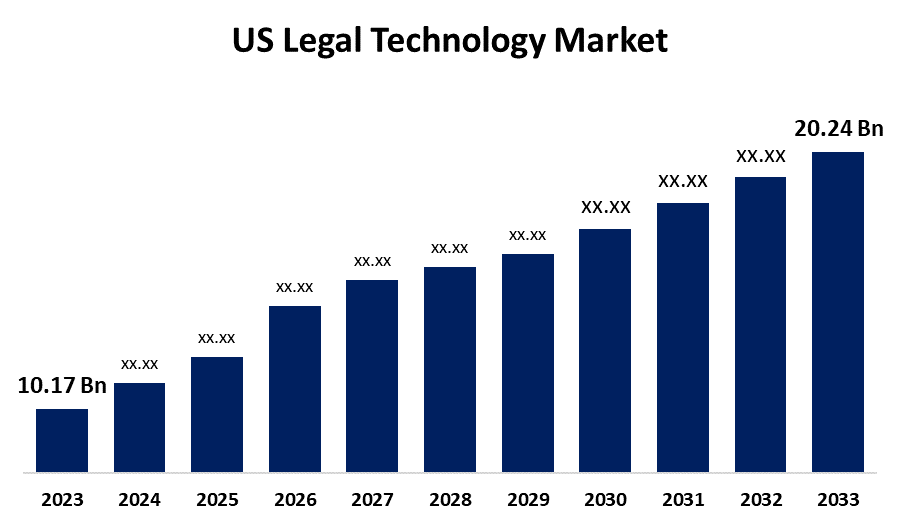

- The US Legal Technology Market Size was valued at USD 10.17 Billion in 2023.

- The Market is growing at a CAGR of 7.12 % from 2023 to 2033

- The US Legal Technology Market Size is expected to reach USD 20.24 Billion by 2033

Get more details on this report -

US Legal Technology Market Size is anticipated to exceed USD 20.24 Billion by 2033, growing at a CAGR of 7.12 % from 2023 to 2033.

Market Overview

Technology used to provide legal services and support the legal sector is known as legal technology. Rather than traditional devices, like as computers, printers, and scanners, which are not unique to the legal sector, it usually refers to software. The majority of this technology is frequently developed to facilitate more effective legal practice for lawyers and law firms. Litigation technology, practice management programs, and other legal software systems are a few examples. Software or an application that can assist with e-discovery and expedite various parts of the litigation process is known as litigation technology. Litigation technology comes in a variety of forms; it could be as basic as presenting evidence using PowerPoint or as complex as software that streamlines the handling of trial papers. Legal technology, or legal tech, is the term for hardware and software that improves the efficiency of legal services and procedures for legal activities. To assist with different aspects of their work, including organizing cases, automating paperwork, locating electronic evidence, analyzing contracts, doing legal research, and managing compliance, legal practitioners as well as companies make use of a variety of tools and platforms.

Report Coverage

This research report categorizes the market for the US legal technology market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the legal technology market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the legal technology market.

US Legal Technology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 10.17 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.12 % |

| 2033 Value Projection: | USD 20.24 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 158 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Solution, By Type, By End User and COVID-19 Impact Analysis. |

| Companies covered:: | Icertis, Inc., ProfitSolv, LLC, Filevine Inc., Knovos, LLC, Everlaw, Inc., DocuSign, Inc., LexisNexis Legal & Professional Company, Mystacks, Inc., Casetext Inc., TimeSolv Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

To increase the productivity and profitability of law firms, there is a growing investment in technologies that automate and optimize legal procedures. This is anticipated to propel the legal technology industry into significant growth in the future years. Moreover, the legal industry is undergoing a revolution due to artificial intelligence (AI) solutions that provide document review automation, predictive analytics, and natural language processing (NLP).

Restraining Factors

The legal technology market is greatly affected by regulations, as practitioners in the field must traverse intricate regulatory frameworks about cybersecurity and data protection. Strict laws and regulations must also be followed by technological solutions in the legal industry to guarantee data security, privacy, and moral application of technology. These factors hinder the growth of the legal technology market.

Market Segmentation

The US legal technology market share is classified into solution, type, and end user.

- The software segment is expected to hold the largest market share through the forecast period.

The US legal technology market is segmented by solution into software and services. Among these, the software segment is expected to hold the largest market share through the forecast period. In the legal technology industry, software solutions that support virtual collaboration, communication, and document sharing are in high demand due to the growing trend toward digital transformation and the widespread use of remote work practices.

- The contract lifecycle management segment dominates the market with the largest market share over the predicted period.

The US legal technology market is segmented by type into e-discovery, legal research, contract lifecycle management, and time-tracking & billing. Among these, the contract lifecycle management segment dominates the market with the largest market share over the predicted period. CLM solutions that expedite contract administration, provide visibility and guarantee contract compliance are in higher demand as companies enter into expanding contracts with partners, suppliers, customers, and other stakeholders.

- The law firms segment is expected to hold the largest share of the US legal technology market during the forecast period.

Based on the end user, the US legal technology market is divided into law firms and corporate legal departments. Among these, the law firms segment is expected to hold the largest share of the US legal technology market during the forecast period. This is caused by the intensifying competitiveness in a sector that is changing quickly. Law companies are embracing digital transformation, implementing creative solutions, and setting themselves apart from rivals as technology advances and disrupts established legal procedures.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US legal technology market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Icertis, Inc.

- ProfitSolv, LLC

- Filevine Inc.

- Knovos, LLC

- Everlaw, Inc.

- DocuSign, Inc.

- LexisNexis Legal & Professional Company

- Mystacks, Inc.

- Casetext Inc.

- TimeSolv Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Filevine's Lead Docket launched an AI-powered feature called LeadsAI to enable legal client intake process automation. LeadsAI generates a summary of lead intake forms, including lead details, correspondence, and notes. This feature incorporates AI to produce relevant data points from a lead for faster and more efficient decision-making.

Market Segment

This study forecasts revenue at US, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US Legal Technology Market based on the below-mentioned segments:

US Legal Technology Market, By Solution

- Software

- Services

US Legal Technology Market, By Type

- E-discovery

- Legal Research

- Contract Lifecycle Management

- Time-Tracking & Billing

US Legal Technology Market, By End User

- Law Firms

- Corporate Legal Departments

Need help to buy this report?