US Non-Woven Fabric Market Size, Share, and COVID-19 Impact Analysis, By Technology (Spunbond, Wet-laid, Dry-laid, and Other Technologies), By Materials (Polyester (Polyester Staple Fiber and Polyester Resin, Polypropylene, Polyethylene, Rayon, Fluff Pulp, and Others), and US Non-Woven Fabric Market Insights, Industry Trend, Forecasts to 2033.

Industry: Energy & PowerUS Non-Woven Fabric Market Insights Forecasts to 2033

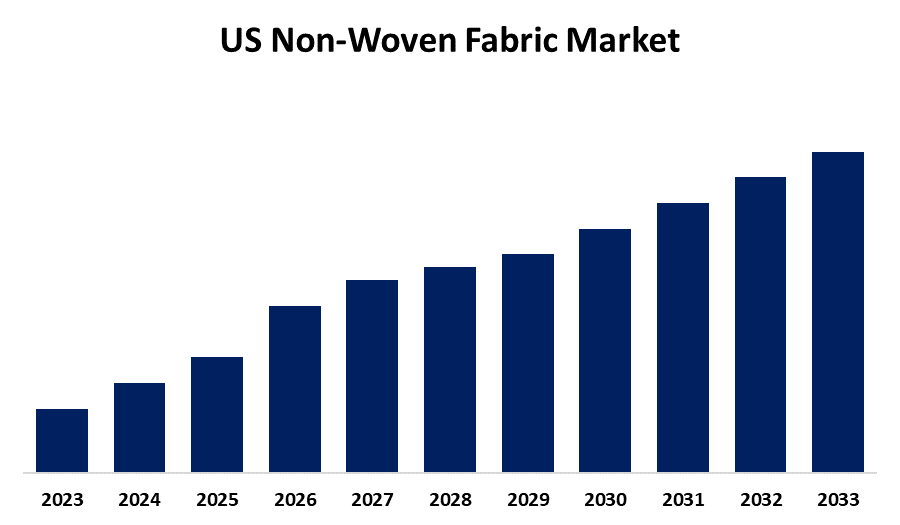

- The Market is Growing at a CAGR of 6.04% from 2023 to 2033

- The US Non-Woven Fabric Market Size is Anticipated to hold a significant share by 2033.

Get more details on this report -

The US Non-Woven Fabric Market is Anticipated to hold a significant share by 2033, growing at a CAGR of 0.94% from 2023 to 2033. The market is increasing because of rising demand in hygiene, medical, and industrial applications, driven by technological advancements, sustainability trends, and increasing adoption in the filtration, automotive, and construction sectors.

Market Overview

The US non-woven fabric market refers to the industry focused on the production, distribution, and application of non-woven fabrics, which are engineered textiles made by bonding or interlocking fibers through mechanical, thermal, or chemical processes, rather than traditional weaving or knitting. These fabrics offer unique properties such as durability, breathability, absorbency, and cost-effectiveness, making them widely used across industries. Moreover, growth in the U.S. non-woven fabric market is expected to be driven by increasing demand for eco-friendly and biodegradable materials, spurred by sustainability concerns. Expanding applications in medical textiles, which are fueled by infection control needs, also drive growth. Investments in advanced manufacturing technologies increase efficiency and product quality. The construction and automotive industries are also adopting non-wovens for durability and lightweight benefits. Growth in filtration solutions, driven by air pollution control and water purification, further fortifies market growth.

Report Coverage

This research report categorizes the market for the US non-woven Fabric market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US non-woven fabric market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US non-woven Fabric market.

US Non-Woven Fabric Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 0.94% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Technology, By Phase |

| Companies covered:: | 3M, Ahlstrom-Munksjo, Berry Global Inc., DuPont, Freudenberg Performance Materials, Fybon Nonwovens Inc., Glatfelter Corporation, Jasztex Inc., Johns Manville, KCWW, Lydall Inc., PFNonwovens Holding SRO, Suominen Corporation, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The US non-woven fabric market is more useful as the demand for hygiene, medical, and industrial-grade high-performance material continues to increase. There is a rising awareness of sustainable fabrics which are recyclable. Protective textiles in the health and workplace sector boost demand. Advances in automated production procedures help improve efficiency, whereas the increasing use of geotextiles in infrastructure projects accelerates market growth. For instance, in June 2022, in response to increased demand from customers in the United States for more sustainable solutions, Berry's first two nonwoven manufacturing locations in America achieved the international sustainability and carbon certification (ISCC) PLUS. SCS Global Services has awarded the certificate to the company's operations in Mooresville, North Carolina, and Waynesboro, Virginia. Both plants produce spunbond, spunlace, and spunmelt nonwovens for usage in infant diapers, feminine care, adult incontinence, and wipes.

Restraining Factors

Fluctuating raw material costs, environmental concerns of synthetic fibers, high initial investment in advanced technology, and competition from alternative textile materials that limit growth are some challenges to the U.S. non-woven fabric market.

Market Segmentation

The US non-woven fabric market share is classified into technology and materials.

- The spunbond segment accounted for the largest share of the US Non-Woven Fabric market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of technology, the US non-woven fabric market is divided into spunbond, wet-laid, dry-laid, and other. Among these, the cast resin segment accounted for the largest share of the US non-woven fabric market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is attributed to its cost-effectiveness, high durability, and versatility across the hygiene, medical, and packaging industries. Its capacity for manufacturing lightweight, breathable, and strong fabrics at a highly fast production rate makes it a preferred choice for applications such as diapers, masks, and medical gowns.

- The polypropylene segment accounted for a substantial share of the US non-woven fabric market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of materials, the US non-woven fabric market is divided into polyester, polypropylene, polyethylene, rayon, fluff pulp, and others. Among these, the polypropylene segment accounted for a substantial share of the US non-woven fabric market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is primarily due to factors such as lightweight, cost-effectiveness, durability, and versatility. Hygiene products, medical applications, packaging, and filtration are some of the sectors most abundantly utilized. Moisture resistance, breathability, and recyclability also improve demand and make it the first choice for disposable and high-performance non-woven fabric applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US non-woven fabric market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Ahlstrom-Munksjo

- Berry Global Inc.

- DuPont

- Freudenberg Performance Materials

- Fybon Nonwovens Inc.

- Glatfelter Corporation

- Jasztex Inc.

- Johns Manville

- KCWW

- Lydall Inc.

- PFNonwovens Holding SRO

- Suominen Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

- This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US Non-Woven Fabric market based on the below-mentioned segments

US Non-Woven Fabric Market, By Technology

- Spunbond

- Wet-laid

- Dry-laid

- Other Technologies

US Non-Woven Fabric Market, By Phase

- Polyester

- Polypropylene

- Polyethylene

- Rayon

- Fluff Pulp

- Others

Need help to buy this report?