US Travel Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Coverage (Single-trip Travel Insurance and Annual Multi-trip Travel Insurance), By Distribution Channel (Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers, and Others), and US Travel Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUS Travel Insurance Market Insights Forecasts to 2033

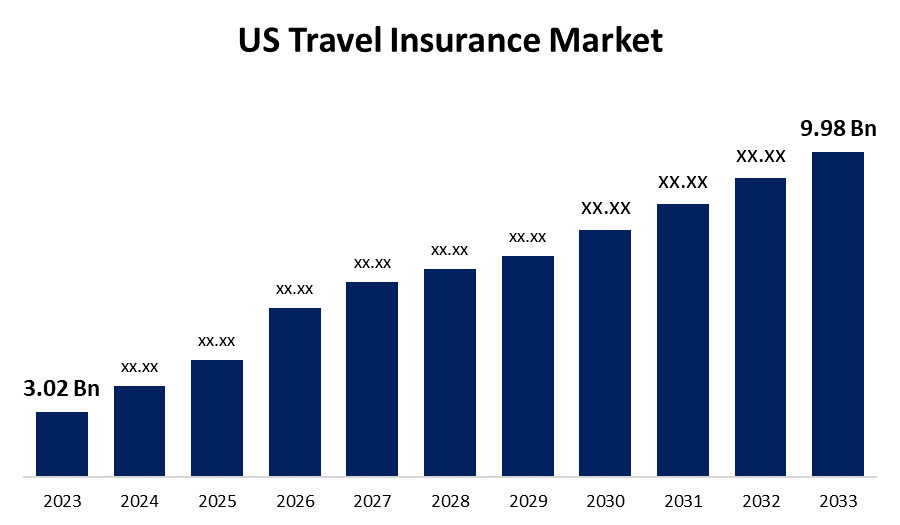

- The US Travel Insurance Market Size was valued at USD 3.02 Billion in 2023.

- The Market Size is Growing at a CAGR of 12.70% from 2023 to 2033

- The US Travel Insurance Market Size is Expected to Reach USD 9.98 Billion by 2033

Get more details on this report -

The US Travel Insurance Market is Anticipated to exceed USD 9.98 Billion by 2033, growing at a CAGR of 12.70% from 2023 to 2033. Rising business trips the simple availability of online travel bookings and inexpensive package vacations.

Market Overview

Travel insurance offers financial security for expenses or damage suffered due to unforeseen incidents while domestic or overseas travel. It usually covers the costs of lost or stolen possessions, critical medical care, accidental passing away, and travel cancellation and delay. It takes into consequence from the day of travel until the insured gets to back home. Nowadays, multiple companies are offering travel insurance with 24/7 emergency products and services, such as substituting lost passports, cash wire support, and re-booking abandoned flights. They are also providing modification options depending on the geographical location and as per the requirements of the insured people in general. Additionally, the immediate digital payment for approved profits for the all-too-common travel inconveniences such as a missed connection, delayed baggage, delayed flight, or last-minute flight cancellation by an airline, is one of the growing trends in travel insurance technology that appeals to younger travellers. It is no longer necessary to submit a claim with receipts when an insured party's flights can be tracked, a covered delay or cancellation can be identified, and the covered limit can be automatically deposited into an account or debit card. One of the main reasons why travel insurance is becoming more popular in the US is technology.

Report Coverage

This research report categorizes the market for the US travel insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US travel insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US travel insurance market.

US Travel Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 3.02 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 12.70% |

| 023 – 2033 Value Projection: | USD 9.98 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Insurance Coverage, By Distribution Channel |

| Companies covered:: | Allianz Partners Sas, Seven Corners Inc.., Travel Safe Insurance, American International Group Inc., USI Insurance Services, LLC, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

Incorporating AI techniques to update insurance pricing models and boost business efficiency has been a major emphasis for US travel insurance carriers. Due to consumer preference for accessing insurance products and services across several devices—including laptops, cellphones, and personal computers companies are making significant investments in developing omnichannel platforms. The U.S. market now has multiple potentials due to the insurance industry's rapid rise, which offers a far better and more efficient client experience. Established insurers in the country, as well as venture capital firms, have increased their presence in this market, hence promoting the growth of the travel insurance industry. The United States has witnessed a steady rise in the popularity of travel insurance. According to data from the U.S. Travel Insurance Association (UStiA) 2020–2022 study, American individuals spent approximately USD 4.27 billion on various forms of travel protection.

Restraining Factors

The travel insurance industry faces a variety of complex laws that are enforced by various state and federal authorities. Ensuring compliance with legislation about licensing, consumer protection, sales tactics, and policy terms presents a considerable administrative burden and cost for insurance carriers operating worldwide. Establishing local businesses, securing permits, designating legal counsel, and modifying goods and marketing tactics to comply with regional regulations are all necessary steps in fulfilling regulatory obligations.

Market Segmentation

The US travel insurance market share is classified into insurance coverage and distribution channel.

- The single-trip travel insurance segment is expected to hold the largest market share through the forecast period.

The US travel insurance market is segmented by insurance coverage into single-trip travel insurance and annual multi-trip travel insurance. Among these, the single-trip travel insurance segment is expected to hold the largest market share through the forecast period. Due to their comprehensive coverage of a short trip or one-time holiday plan, single-trip travel insurance policies are very popular due to their protection against unanticipated events such as cancelled vacations or accommodations, lost luggage, passports, money, documents, delayed departures, personal accidents, and medical and hospital costs.

- The insurance companies segment is expected to hold a significant share of the US travel insurance market during the forecast period.

Based on the distribution channel, the US travel insurance market is divided into insurance intermediaries, insurance companies, banks, insurance brokers, and others. Among these, the insurance companies segment is expected to hold a significant share of the US travel insurance market during the forecast period. They operate by pooling risk across multiple policyholders, and premiums are determined by the possibility of a certain incident occurring and the financial damages that may result. Insurance firms offer a variety of products that cover situations such as flooding, fire, theft, breakage, travel, death, and financial loss.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US travel insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allianz Partners Sas

- Seven Corners Inc..

- Travel Safe Insurance

- American International Group Inc.

- USI Insurance Services, LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2022, USI Affinity announced the debut of a unique travel insurance plan, road trip insures, provided through its travel insurance solutions subsidiary.

Market Segment

This study forecasts revenue at the US, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US Travel Insurance Market based on the below-mentioned segments:

US Travel Insurance Market, By Insurance Coverage

- Single-trip Travel Insurance

- Annual Multi-trip Travel Insurance

US Travel Insurance Market, By Distribution Channel

- Insurance Intermediaries

- Insurance Companies

- Banks

- Insurance Brokers

- Others

Need help to buy this report?