United States Warehouse Racking Market Size, Share, and COVID-19 Impact Analysis, By Racking Type (Selective Pallet Racking, Drive-In/Drive-Thru Racking, Push Back Racking, Pallet Flow Racking, Cantilever Racking, Mobile Racking, and Mezzanine Racking), By End-User Industry (Retail, Food & Beverage, Automotive, Pharmaceutical, E-commerce, Manufacturing, Logistics & Distribution, and others), By Distribution Channel (Direct Sales, Online, and Distributors), and United States Warehouse Racking Market Insights, Industry Trend, Forecasts to 2033

Industry: Construction & ManufacturingUnited States Warehouse Racking Market Insights Forecasts to 2033

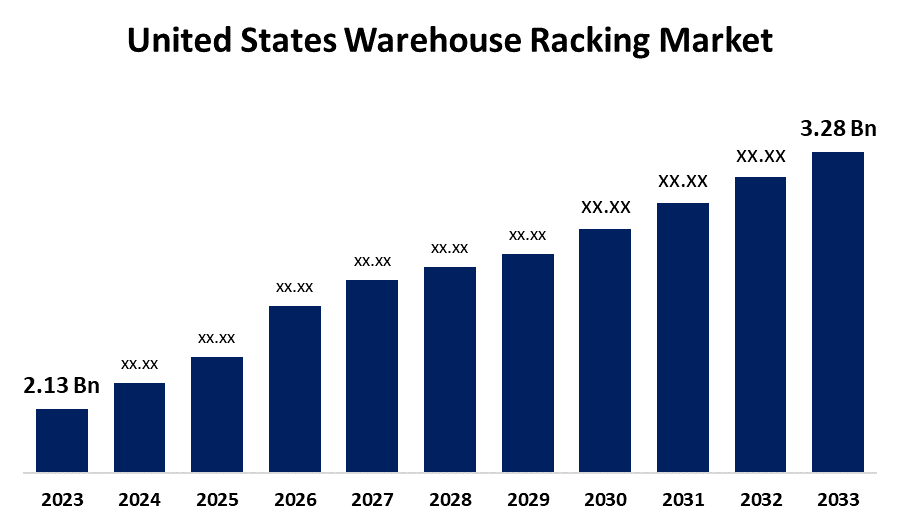

- The US Warehouse Racking Market Size was valued at USD 2.13 Billion in 2023.

- The Market is Growing at a CAGR of 4.41% from 2023 to 2033

- The U.S. Warehouse Racking Market Size is Expected to Reach USD 3.28 Billion by 2033

Get more details on this report -

The US Warehouse Racking Market Size is Anticipated to Reach USD 3.28 Billion by 2033, Growing at a CAGR of 4.41% from 2023 to 2033.

Market Overview

A material handling solution that works well for bulk storage of items organized on pallets or skids is warehouse racking. It makes effective use of available space and makes stocked items easily accessible for improved inventory management. Warehouse racking systems, sometimes referred to as pallet racks or materials handling systems, come in a variety of designs. Pallets, also known as skids, can be made of wood, metal, or plastic. They are paired with bigger racking systems that have shelves arranged at different levels. To support items put on the storage racks, decking bases come in a variety of widths. Forklifts are frequently needed to load warehouse racking, which is often several feet high. A range of layouts for warehouse racking systems are available, such as drive-through racks, push-back racks, flow racks, and selected racks. Additionally, the effectiveness of the warehouse's administration, accuracy of orders, order fulfillment rapidity, and security for employees are all directly impacted by warehouse racking systems.

Report Coverage

This research report categorizes the market for United States warehouse racking market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. warehouse racking market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US warehouse racking market.

U.S Warehouse Racking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.13 Billio |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.41% |

| 2033 Value Projection: | USD 3.28 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 208 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Racking Type, By End-User Industry, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | Advance Storage Products, Elite Storage Solutions, EQUIPTO (Consolidated Storage Companies Inc.), Frazier Industrial Company, Hannibal Industries, Interlake Mecalux, Ridg-U-Rak, Speedrack Products Group, Steel King Industries Inc., UNARCO Material Handling Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Warehouse racking is practical for more reasons than just optimizing storage capacity. The financial worth or savings from renting extra storage space, requiring less labor from the workforce, and achieving greater output can be used to quantify these advantages. Warehouse racking makes advantage of vertical space to increase storage capacity. Warehouse racking solutions enable it to be simpler for staff to find and retrieve products, which reduces the packing and picking time. Additionally, as of 2023, the US Bureau of Labor Statistics reports that there are more than 21,000 warehouse establishments in the country. From over 19,000 in 2020, that is a rise. The increase in warehouse numbers represents the industry's growing demand for warehouse racking as well as storage solutions. Furthermore, warehousing in the United States has risen as a result of the explosive growth in e-commerce sales. As more customers shop online, firms must expand their warehouse space to accommodate the rising demand.

Restraining Factors

High initial costs are anticipated to limit the expansion of the warehouse-racking market and hamper the prospects for the industry.

Market Segmentation

The US warehouse racking market share is classified into racking type, end-user industry, and distribution channel.

- The selective pallet racking segment is anticipated to hold a significant share of the U.S. warehouse racking market during the forecast period.

Based on the racking type, the United States warehouse racking market is divided into selective pallet racking, drive-in/drive-thru racking, push back racking, pallet flow racking, cantilever racking, mobile racking, and mezzanine racking. Among these, the selective pallet racking segment is anticipated to hold a significant share of the U.S. warehouse racking market during the forecast period. One of the most adaptable and affordable storage solutions for distribution centers is selective pallet racking. Selective pallet racks are perfect for large-capacity operations with a variety of product kinds or variants because they provide quick access to every pallet and good visibility. Furthermore, selective pallet racking makes the most of vertical space, which enhances rack management.

- The e-commerce segment is anticipated to hold a significant share of the United States warehouse racking market during the forecast period.

Based on the end-user industry, the US warehouse racking market is divided into retail, food & beverage, automotive, pharmaceutical, e-commerce, manufacturing, logistics & distribution, and others. Among these, the e-commerce segment is anticipated to hold a significant share of the United States warehouse racking market during the forecast period. Due in large part to the ease and increasing acceptance of online buying, e-commerce has expanded rapidly in the past few years. The need for effective warehousing systems to facilitate the shipping and safekeeping of e-commerce goods has consequently risen.

- The distributors segment is anticipated to hold a significant share of the United States warehouse racking market during the forecast period.

Based on the distribution channel, the US warehouse racking market is divided into direct sales, online, and distributors. Among these, the distributors segment is anticipated to hold a significant share of the United States warehouse racking market during the forecast period. Distributors are essential due to they provide a large selection of racking solutions, post-purchase assistance, and access to more clients in a variety of industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US warehouse racking market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Advance Storage Products

- Elite Storage Solutions

- EQUIPTO (Consolidated Storage Companies Inc.)

- Frazier Industrial Company

- Hannibal Industries

- Interlake Mecalux

- Ridg-U-Rak

- Speedrack Products Group

- Steel King Industries Inc.

- UNARCO Material Handling Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2022, Nucor Corporation announced that it has paid $75 million to purchase Elite Storage Solutions, a producer of steel racking. Building on the business's acquisition of Hannibal Industries the previous year, this acquisition increases Nucor's capacity for steel racking.

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Warehouse Racking Market based on the below-mentioned segments:

United States Warehouse Racking Market, By Racking Type

- Selective Pallet Racking

- Drive-In/Drive-Thru Racking

- Push Back Racking

- Pallet Flow Racking

- Cantilever Racking

- Mobile Racking

- Mezzanine Racking

United States Warehouse Racking Market, By End-User Industry

- Retail

- Food & Beverage

- Automotive

- Pharmaceutical

- E-commerce

- Manufacturing

- Logistics & Distribution

- others

United States Warehouse Racking Market, By Distribution Channel

- Direct Sales

- Online

- Distributors

Need help to buy this report?