Global Utility Asset Management Market Size, Share, and COVID-19 Impact Analysis, By Type (Public Utility, and Private Utility), By Component (Software, Hardware, and Services), By Application (Electric, Gas, and Water), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Utility Asset Management Market Insights Forecasts to 2033

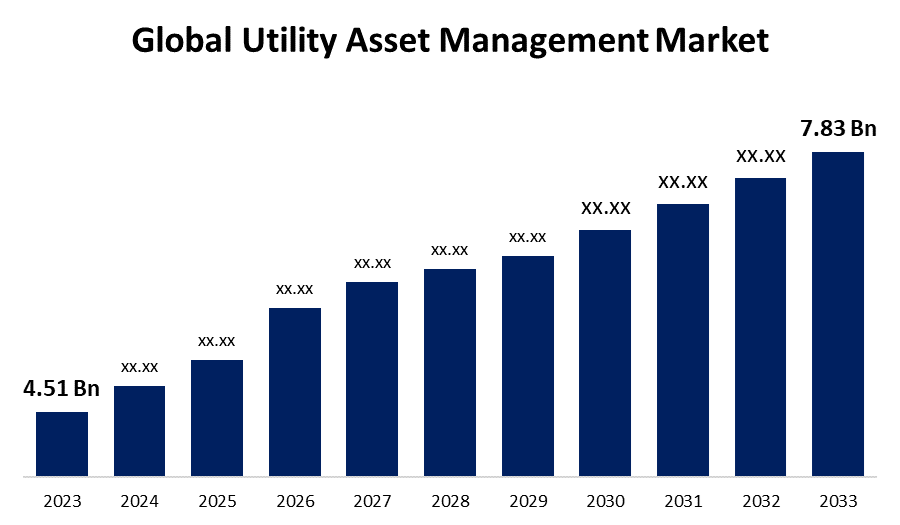

- The Global Utility Asset Management Market Size was Valued at USD 4.51 Billion in 2023

- The Market Size is Growing at a CAGR of 5.67% from 2023 to 2033

- The Worldwide Utility Asset Management Market Size is Expected to Reach USD 7.83 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Utility Asset Management Market Size is Anticipated to Exceed USD 7.83 Billion by 2033, Growing at a CAGR of 5.67% from 2023 to 2033.

Market Overview

The strategic process of managing the infrastructure and physical assets needed to provide utility services is known as utility asset management. It makes sure that all phases of the equipment lifecycle purchase, installation, upgrades, maintenance, and disposal are managed in an economical and organized manner. Strong utility asset management guarantees higher service quality, enhanced equipment and worker safety, and environmental, health, and safety regulations. The utility asset management market is driven by factors such as growing energy consumption, aging infrastructure, dispersed energy supplies, and the requirement for dependable and efficient energy. The transmission and distribution cables, transformers, grid networks, and substations needed to transport energy in residential and commercial buildings make up an electric utility. The resources used in wastewater operations in municipalities and industries are referred to as water utilities. Gas utilities are the equipment such as power plants, turbines, steam generators, and others that are necessary to generate electricity from natural gas. Utility asset management is a data-driven, integrated ecosystem that collects and evaluates data for better asset efficiency and decision-making.

Report Coverage

This research report categorizes the market for the global utility asset management market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global utility asset management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global utility asset management market.

Global Utility Asset Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.51 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.67% |

| 2033 Value Projection: | USD 7.83 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Component, By Application, By Region |

| Companies covered:: | General Electric, ABB, Eaton, Getac, Fujitsu, Lindsey Manufacturing, Siemens, DNV GL, Aclara Technologies, Sentient Energy, Schneider Electric, IFS, IBM, Hitachi Energy, Black & Veatch, ABS Group, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The utility asset management sector is expected to grow as a result of the rising number of unexpected power outages occurring worldwide due to a variety of causes, including weather-related issues, disasters, faults in transmission and distribution lines, and abrupt grid difficulties. Utility asset management is being viewed by many governments in rising nations throughout the world as a strategic investment in infrastructure upgrades that will assist minimize losses resulting from irregular maintenance and servicing and preserving the long-term electricity grid. Furthermore, unplanned power outages have had a substantial impact on various commercial, industrial, and residential activities. As a result, there is a strong need to modernize transmission and distribution lines as well as other electrical power grid infrastructures with more robust technologies. The introduction of significant electrification targets for rural regions by several administrations have created enormous prospects for the utility asset management market size. It is expected that ongoing efforts to provide power to remote locations would result in a multiplication of the installation of new transmission and distribution lines as well as the integration of modern electrical technologies for effective grid connections.

Restraining Factors

The market expansion might be hampered by the need for unpredictable expensive, and risky installation processes in combination with extended equipment maintenance across a range of technologies, including predictive, corrective, and condition-based maintenance. The system's efficiency might be severely impacted by faults in prioritizing the functional layouts and the lack of accurate technical expertise while installing the tools and connecting the hardware, which can result in limited repair times and over-maintenance potentials.

Market Segmentation

The global utility asset management market share is classified into type, component, and application.

- The private utility segment is expected to hold the largest share of the global utility asset management market during the forecast period.

Based on the type, the global utility asset management market is divided into public utility and private utility. Among these, the private utility segment is expected to hold the largest share of the global utility asset management market during the forecast period. Large-scale non-governmental energy networks and rising grid modernization investments are expected to improve the sector prospects by reducing power interruption issues.

- The software segment is expected to hold the largest share of the global utility asset management market during the forecast period.

Based on the component, the global utility asset management market is divided into software, hardware, and services. Among these, the software segment is expected to hold the largest share of the global utility asset management market during the forecast period. Due to mobile and remote tools for diagnosis, inspection, and detection are becoming more and more necessary in huge networks. Major players in the sector have launched asset management software. Through AI-powered predictive maintenance, inspection, and monitoring systems, it offers greater dependability.

- The electric segment is expected to hold the largest share of the global utility asset management market during the forecast period.

Based on the application, the global utility asset management market is divided into electric, gas, and water. Among these, the electric segment is expected to hold the largest share of the global utility asset management market during the forecast period. An essential component of the electricity transmission network is the transformer. The system to evaluate and optimize operating conditions, life expectancy, and failure reduction has been greatly integrated into management solutions. Some of the primary drivers of the market growth for the electric sector are the growing worry about maintaining dependable operations at reduced costs and the rising use of resource lifecycle planning, prediction, and condition-based maintenance activities.

Regional Segment Analysis of the Global Utility Asset Management Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global utility asset management market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global utility asset management market over the predicted timeframe. The market in the region is probably going to be driven by the deregulation of the electric sector. Many commercial companies have been able to accomplish their strategic goals of lowering the cost of energy for end users and minimizing losses by routinely monitoring and tracking their networks due to the deregulation of the power industry in various countries. The market in the region will most likely be driven by the deregulation of the power industry. Due to the deregulation of the power sector in several countries, numerous commercial organizations have been able to accomplish their strategic objectives of minimizing losses and lowering the cost of energy to end users by continually monitoring and tracking their networks.

Asia Pacific is expected to grow at the fastest pace in the global utility asset management market during the forecast period. The installation of automated monitoring and tracking systems in the power distribution and transmission infrastructure is one of the elements driving the market's expansion. The region's steadily expanding fertilizer, automobile, petrochemical, and chemical industries have raised demand for energy and necessitated maintenance of several system components. The region's continuously growing industrial sectors such as the chemical, petrochemical, automotive, and fertilizer industries have increased energy demand and called for the proper maintenance of the grid's many components. India's utility asset management market was growing at the quickest rate in the Asia-Pacific region, while China's utility asset management market had the largest market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global utility asset management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Electric

- ABB

- Eaton

- Getac

- Fujitsu

- Lindsey Manufacturing

- Siemens

- DNV GL

- Aclara Technologies

- Sentient Energy

- Schneider Electric

- IFS

- IBM

- Hitachi Energy

- Black & Veatch

- ABS Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, SB Energy USA Corp. (SB Energy), one of the largest owner-operators and developers of renewable energy in the United States, partnered with Stem, a leading provider of AI-driven clean energy solutions and services, on a multi-year technical and commercial basis.

- In October 2022, Adani Power Limited (APL) engaged Black & Veatch to streamline operations and improve the reliability and efficiency of its power assets in India in an effort to lower CO2 emissions overall. By decreasing unplanned shutdowns and raising operational efficiency, the adoption will assist India's over 12 GW of thermal power-producing equipment in operating reliably, efficiently, and sustainably.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global utility asset management market based on the below-mentioned segments:

Global Utility Asset Management Market, By Type

- Private Utility

- Public Utility

Global Utility Asset Management Market, By Component

- Software

- Hardware

- Services

Global Utility Asset Management Market, By Application

- Electric

- Gas

- Water

Global Utility Asset Management Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?General Electric, ABB, Eaton, Getac, Fujitsu, Lindsey Manufacturing, Siemens, DNV GL, Aclara Technologies, Sentient Energy, Schneider Electric, IFS, IBM, Hitachi Energy, Black & Veatch, ABS Group, and Others.

-

2.What is the size of the global utility asset management market?The global utility asset management market is expected to grow from USD 4.51 Billion in 2023 to USD 7.83 Billion by 2033, at a CAGR of 5.67% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global utility asset management market over the predicted timeframe.

Need help to buy this report?