Global Utility Communication Market Size, Share, and COVID-19 Impact Analysis, By Technology (Wired and Wireless), By Utility Type (Public and Private), By Application (Oil & Gas, Power Generation, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Utility Communication Market Insights Forecasts to 2033

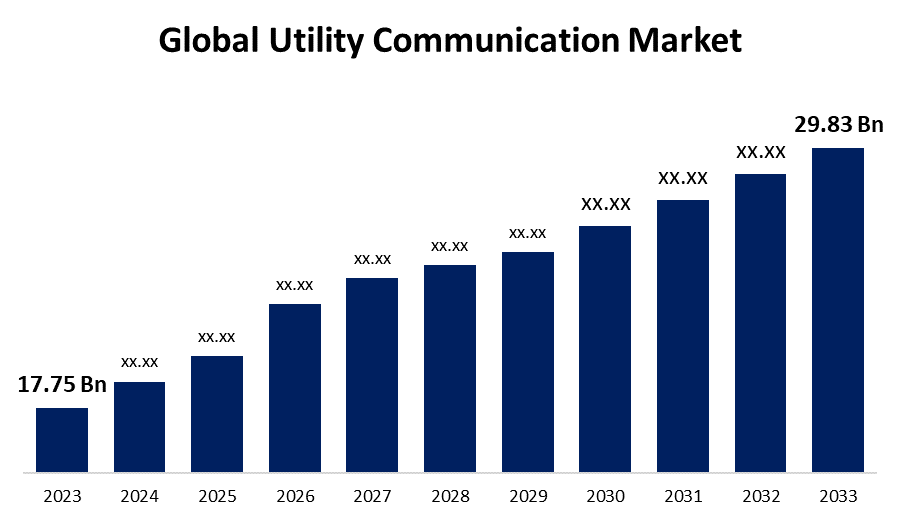

- The Global Utility Communication Market Size was Valued at USD 17.75 Billion in 2023

- The Market Size is Growing at a CAGR of 5.33% from 2023 to 2033

- The Worldwide Utility Communication Market Size is Expected to Reach USD 29.83 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Utility Communication Market Size is Anticipated to Exceed USD 29.83 Billion by 2033, Growing at a CAGR of 5.33% from 2023 to 2033.

Market Overview

The numerous parts of a complicated utility distribution system are coordinated by a set of instruments and technologies known as utility communication. In addition to monitoring and controlling grid equipment, it assesses network performance and delivers real-time information. The development of automated distribution networks for utilities like energy and electricity has made modern power systems more efficient. The utilities communication sector is expected to grow rapidly over the next several years due to the demand for automation. The efficient and well-regulated transportation of utilities like gas and electricity is made possible by this communication technology. Through the utility communications network, every data point in the utility may converse with every other data point in both ways. To avoid an ecosystem of fragmented communication networks, utilities worldwide are investing large sums of money to modernize communications infrastructure. This infrastructure is supported by distribution automation (DA), advanced metering infrastructure (AMI), and demand response (DR). It is financed by government grants, regulatory requirements, and the high cost of inefficient energy supply. In the utility industry, communication is becoming even more important as distributed power generation and the creation of smarter grids gain traction. To manage their networks that span several vendors and technologies, utilities are searching for a range of communication options.

Report Coverage

This research report categorizes the market for the global utility communication market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global utility communication market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global utility communication market.

Global Utility Communication Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 17.75 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.33% |

| 2033 Value Projection: | USD 29.83 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Utility Type, By Application, By Region |

| Companies covered:: | General Electric, Cisco Systems, Inc., Hitachi, Ltd., Schneider Electric SE., Motorola Solutions, Inc., Itron Inc., Milsoft Utility Solutions, ABB, RAD, OMICRON, Siemens, FUJITSU, Landis+Gyr, Sensus, Telefonaktiebolaget LM Ericsson, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

To increase the reliability of the electricity distribution network, utility communication technologies are needed. To increase the operational efficiency of power distribution systems, data is gathered, automated, analyzed, and optimized using sensors, processors, communication networks, and switches. The different field devices that are used to increase grid reliability and operational efficiency include automated voltage regulators, remote fault indicators, smart relays, automated feeder switches/reclosers, automated capacitors, transformer monitors, automated feeder monitors, and remote terminal units. Power utilities may improve power dependability and minimize peak demands by utilizing their existing assets more effectively with the use of automated voltage regulators. Through the effective use of utility communication technology, grid operators may also optimize operations from a distance. Utilities can reduce emissions into the environment, restore services more quickly, and maintain high levels of operational efficiency and dependability. Predictive technologies for advanced maintenance, equipment replacement, and system restoration are a few applications that increase operational efficiency. Therefore, in the upcoming years, there will probably be a greater emphasis on enhancing grid stability and operational efficiency, which will increase demand for utility communication technology.

Restraining Factors

Among the main obstacles to the widespread deployment of diverse devices are the absence of communication standards and the incompatibility of various IT protocols and communication system components. As the grid becomes increasingly interconnected, utilities are also facing challenges with cybersecurity. Persuading customers to embrace smart meters and other connected devices can pose challenges. Challenges from regulations and lack of clarity in data privacy laws also hinder progress and creativity. Transitioning to renewable energy sources increases the challenge of ensuring consistent service during severe weather or other disruptions.

Market Segmentation

- The wired segment is anticipated to hold the largest share of the market during the forecast period.

Based on the technology, the global utility communication market is divided into wired and wireless. Among these, the wired segment is anticipated to hold the largest share of the market during the forecast period. Reliable, fast communication is provided via wired systems, which is necessary for utility operations and increasing customer access. Upgrades to wired networks are prioritized by governments to power grids and other vital services. In the case of extreme occurrences, this guarantees network resilience. To do preventative maintenance, utilities also rely on wired networks to monitor remote assets.

- The public segment is anticipated to dominate the market during the forecast period.

Based on the utility type, the global utility communication market is divided into public and private. Among these, the public segment is anticipated to dominate the market during the forecast period. When compared to private utilities, public utilities service larger populations and geographic areas. To monitor substations across sites that are challenging to access through wired networks, public utilities also use wireless technologies. As a result, operational visibility is preserved.

- The power generation segment is anticipated to hold the largest share of the market during the forecast period.

Based on the application, the global utility communication market is divided into oil & gas, power generation, and others. Among these, the power generation segment is anticipated to hold the largest share of the market during the forecast period. Wireless connection is necessary for generators to automate plant operations remotely. Condition-based maintenance of generation assets dispersed over wide areas is made easier by wireless networks.

Regional Segment Analysis of the Global Utility Communication Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to dominate the global utility communication market over the predicted timeframe.

Get more details on this report -

North America is anticipated to dominate the global utility communication market over the predicted timeframe. Some of the biggest utility companies in the world with sophisticated transmission and distribution networks are based in the region. North American utilities have been modernizing their operations for decades, embracing new technology considerably sooner than other regions of the world. To increase network visibility, efficiency, and reliability, they have made significant investments in smart grid technologies, sophisticated metering solutions, distribution automation systems, and communication networks. In recent years, there has been a notable growth in communication investment in the utility industry, driven by the need to maintain reliability standards, repair outdated infrastructure, and improve consumer experiences. The region has embraced a wide range of field area networks, wireless technology, cloud-based apps, and Internet of Things solutions.

Asia Pacific is expected to grow at the fastest pace in the global utility communication market during the forecast period. Growth has been fueled by forces such as rapid urbanization, the expansion of transmission and distribution networks, government initiatives towards smart grid rollouts, and the influx of new technologies. Hotspots such as China and India, with their large populations and rising energy demands, have resulted in billions of dollars being allocated by Chinese utility firms, both state-owned and private, towards smart infrastructure to modernize their grid systems and meet renewable energy targets. In India, meanwhile, a major focus on rural electrification and strengthening transmission infrastructure has created opportunities for communication providers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global utility communication market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Electric

- Cisco Systems, Inc.

- Hitachi, Ltd.

- Schneider Electric SE.

- Motorola Solutions, Inc.

- Itron Inc.

- Milsoft Utility Solutions

- ABB

- RAD

- OMICRON

- Siemens

- FUJITSU

- Landis+Gyr

- Sensus

- Telefonaktiebolaget LM Ericsson

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2022, Barrett Communications, a worldwide supplier of specialist radio communications, was purchased by Motorola Solutions, a communications solutions provider.

- In April 2021, for the German market, Itron, a developer of IoT solutions, introduced the eHZ-B, a new household smart electricity meter. Via Transport Layer Security encryption, it interacts with the Smart Meter Gateway with ease.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global utility communication market based on the below-mentioned segments:

Global Utility Communication Market, By Technology

- Wired

- Wireless

Global Utility Communication Market, By Utility Type

- Public

- Private

Global Utility Communication Market, By Application

- Oil & Gas

- Power Generation

- Others

Global Utility Communication Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?The key companies that are currently operating within the market are General Electric, Cisco Systems, Inc., Hitachi, Ltd., Schneider Electric SE., Motorola Solutions, Inc., Itron Inc., Milsoft Utility Solutions, ABB, RAD, OMICRON, Siemens, FUJITSU, Landis+Gyr, Sensus, Telefonaktiebolaget LM Ericsson, and others.

-

2. What is the size of the global utility communication market?The Global Utility Communication Market Size is Expected to Grow from USD 17.75 Billion in 2023 to USD 29.83 Billion by 2033, at a CAGR of 5.33% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global utility communication market over the predicted timeframe.

Need help to buy this report?