Global Utility System Construction Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Water and Sewer Line, Oil and Gas Pipeline, Power and Communication Line, Infrastructure Construction, and Others), By Type Of Contractors (Large Contractors and Small Contractors), By End Users (Private and Public), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Construction & ManufacturingGlobal Utility System Construction Market Insights Forecasts to 2033

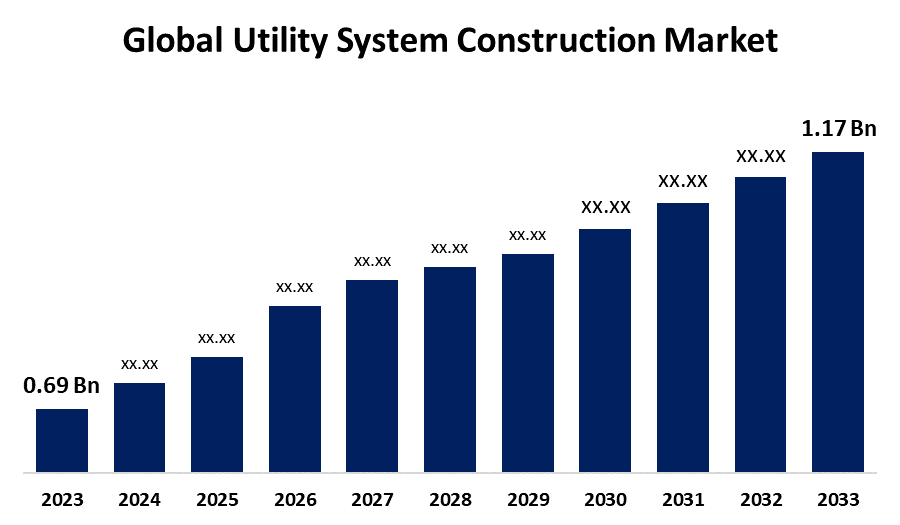

- The Global Utility System Construction Market Size was Valued at USD 0.69 Billion in 2023

- The Market Size is Growing at a CAGR of 5.42% from 2023 to 2033

- The Worldwide Utility System Construction Market Size is Expected to Reach USD 1.17 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Utility System Construction Market Size is Anticipated to Exceed USD 1.17 Billion by 2033, Growing at a CAGR of 5.42% from 2023 to 2033.

Market Overview

The process of constructing, modifying, maintaining, upgrading, or dismantling any structure that incorporates a utility system such as gas, water, or sewage using a thorough design and plan is known as utility system construction. It supports the development of numerous other utility systems. Sewer, electricity, and water line installations, together with other related infrastructure constructions, comprise most of the utility construction system. It is significant because it provides fundamental and necessary services to various end users, including homes, businesses, and industries. Because the utility system building industry has a lot of potential in the forecast period, the government and other major participants in the market are investing greater amounts in the project. It is anticipated that the development of smart grid technology will expand the utility system construction industry globally. The two main market factors boosting market expansion are urbanization and the necessary infrastructure to support expanding cities. The need for power and communication lines is increasing in commercial and industrial regions, and throughout the forecast period, there is expected to be an increase in demand for gas supplies, drive growth in the market.

Report Coverage

This research report categorizes the market for the global utility system construction market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global utility system construction market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global utility system construction market.

Global Utility System Construction Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.69 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.42% |

| 2033 Value Projection: | USD 1.17 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Type Of Contractors, By End Users, By Region |

| Companies covered:: | China Energy Engineering Group, Powerteam Services, Qwest Communications International, Inc, Michels Corporation, Paraflex, American Tower Corporation, Keene Systems, Inc., Dycom Industries Inc., Charter Oak Utility Constructors, Inc., UTILITY CONSTRUCTION COMPANY INC., Mastec, Inc., American Tower Corporation, ABM Industries Inc., InfraSource Services Inc., Quanta Services Inc., and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

There is an increasing demand for power due to the world's fast industrialization and population expansion. Advances in technology are expected to propel the expansion of the global utility system construction market in the forecast period. The market need for utility construction systems has increased due to the drone's communication technology. Drones can also be used for other purposes, such as environmental analysis, elevation mapping, calculating the volume of earthwork, and many more. Moreover accelerating development prospects in the worldwide utility system building market is the increase in people's disposable income. In nations where people have high standards for living conditions, there is a great need for utility system building to satisfy these requirements.

Restraining Factors

Construction work involves many potentially fatal tasks, such as working at heights below ground, operating near falling objects, navigating tight places, and handling dangerous products. As a result, there is always a chance of property and human loss, which might hinder the growth of the utility system construction market.

Market Segmentation

The global utility system construction market share is classified into product type, type of contractors, and end-users.

- The water and sewer line segment dominates the market with the largest market share through the forecast period.

Based on the product type, the global utility system construction market is categorized into water and sewer lines, oil and gas pipelines, power and communication lines, infrastructure construction, and others. Among these, the water and sewer line segment dominates the market with the largest market share through the forecast period. Water pipes are installed to guarantee a steady and secure supply of clean water for homes, places of work, and public spaces. This lowers the danger of diseases caused by water and is crucial for clean drinking water and sanitation. Sewage can be disposed of safely due to the building of sewers. To safeguard public health and avoid contaminating water supplies and the environment, this is imperative.

- The large contractors segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the type of contractors, the global utility system construction market is categorized into large contractors and small contractors. Among these, the large contractors segment is anticipated to grow at the fastest CAGR growth through the forecast period. Due to the necessity of heavy utility system delivery, large contractors are the only ones able to provide the necessities of gas, oil, electricity, and other amenities. The large contractors are equipped with sufficient manpower and equipment to efficiently handle and control the bulk delivery.

- The public segment accounted for the largest revenue share through the forecast period.

Based on the end-users, the global utility system construction market is categorized as private and public. Among these, the public segment accounted for the largest revenue share through the forecast period. The greatest income was produced by the public sector. Utilities provide clean water, electricity, natural gas, sewage, and trash disposal among other necessities to residences, commercial buildings, and public spaces. These services are necessary for daily existence, healthcare, and business endeavors. Reliable public services lower the danger of diseases caused by water, enhance public health, and guarantee access to clean drinking water and sanitary facilities.

Regional Segment Analysis of the Global Utility System Construction Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global utility system construction market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global utility system construction market over the predicted timeframe. The utility infrastructure in much of North America has aged and requires replacement or repair. The building of new energy networks and infrastructure is being driven by the shift from conventional fossil fuels to renewable energy sources like solar and wind power, which will accelerate market expansion in this region. Although the utility infrastructure in North America is well-developed, it requires ongoing improvements. The market is well-funded through public and private channels and is built around the various needs of different countries about the building of utility systems.

Asia Pacific is expected to grow at the fastest CAGR growth of the global utility system construction market during the forecast period. Millions of people are relocating to cities in the Asia-Pacific region as a result of substantial urbanization. The Asia Pacific region is seeing significant investments in the expansion of its infrastructure, especially utilities. Projects to provide access to electricity, clean water, and contemporary sewage systems are funded by both public and private investors. In addition, India's utility system construction market was the fastest-growing in the region of Asia-Pacific, while China's utility system construction industry held the most market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global utility system construction market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- China Energy Engineering Group

- Powerteam Services

- Qwest Communications International, Inc

- Michels Corporation

- Paraflex, American Tower Corporation

- Keene Systems, Inc.

- Dycom Industries Inc.

- Charter Oak Utility Constructors, Inc.

- UTILITY CONSTRUCTION COMPANY INC.

- Mastec, Inc.

- American Tower Corporation

- ABM Industries Inc.

- InfraSource Services Inc.

- Quanta Services Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2021, Blattner Holding Company (Blattner), one of the biggest and most reputable suppliers of utility-scale renewable energy infrastructure solutions in North America, was acquired by Quanta Services, Inc. according to a definitive agreement that was signed.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global utility system construction market based on the below-mentioned segments:

Global Utility System Construction Market, By Product Type

- Water and Sewer Line

- Oil and Gas Pipeline

- Power and Communication Line

- Infrastructure Construction

- Others

Utility System Construction Market, By Type of Contractors

- Large Contractors

- Small Contractors

Global Utility System Construction Market, By End Users

- Private

- Public

Global Utility System Construction Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?China Energy Engineering Group, Powerteam Services, Qwest Communications International, Inc, Michels Corporation, Paraflex, American Tower Corporation, Keene Systems, Inc., Dycom Industries Inc., Charter Oak Utility Constructors, Inc., UTILITY CONSTRUCTION COMPANY INC., Mastec, Inc., American Tower Corporation, ABM Industries Inc., InfraSource Services Inc., Quanta Services Inc., and Others

-

2. What is the size of the global utility system construction market?The Global Utility System Construction Market Size is Expected to Grow from USD 0.69 Billion in 2023 to USD 1.17 Billion by 2033, at a CAGR of 5.42% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global utility system construction market over the predicted timeframe.

Need help to buy this report?