Global Vaccine Contract Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Type (Attenuated, Inactivated, Subunit-based, Toxoid-based, and DNA-based), By Workflow (Downstream, and Upstream), By Application (Human Use, and Veterinary), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Vaccine Contract Manufacturing Market Insights Forecasts to 2033

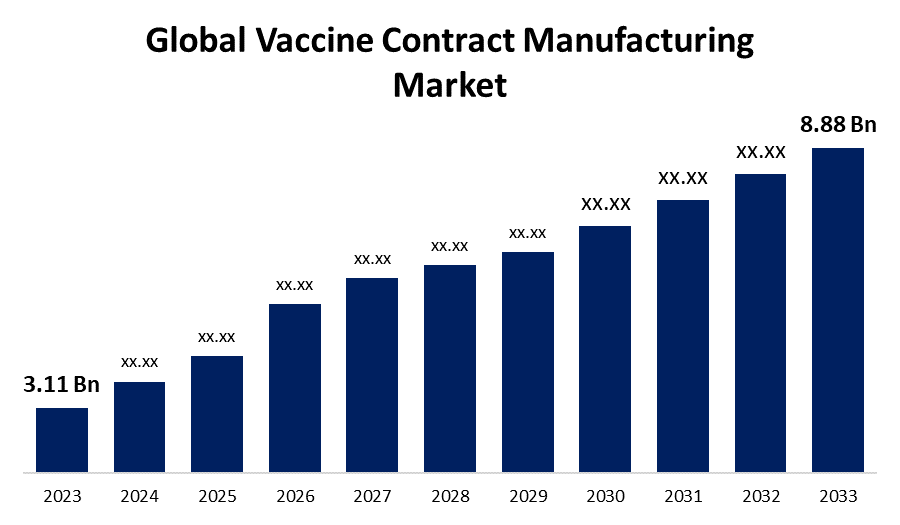

- The Global Vaccine Contract Manufacturing Market Size was Valued at USD 3.11 Billion in 2023

- The Market Size is Growing at a CAGR of 11.06% from 2023 to 2033

- The Worldwide Vaccine Contract Manufacturing Market Size is Expected to Reach USD 8.88 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Vaccine Contract Manufacturing Market Size is Anticipated to Exceed USD 8.88 Billion by 2033, Growing at a CAGR of 11.06% from 2023 to 2033.

Market Overview

Vaccine is a preparation that is used to stimulate the body’s immune response against diseases. Vaccines are usually administered through needle injections, but some can be administered by mouth or sprayed into the nose. Vaccine contract manufacturing is when a third party is hired to make vaccines for a company or organization. The third party, or contract manufacturing organization (CMO), is responsible for the production, packaging, and labeling of the vaccines. CMOs have the infrastructure, expertise, and facilities to make vaccines. They can help vaccine manufacturers meet production needs while still adhering to quality standards and regulations. This can be especially helpful during global health emergencies, like the COVID-19 pandemic, when demand for vaccines is high. The vaccine manufacturing process involves many steps, including, Selecting target pathogens or antigens, Cultivation, Purification, Formulation, Testing, and Release.

According to World Health Organization, while immunization is one of the most successful public health interventions, coverage has plateaued over the last decade. The COVID-19 pandemic, associated disruptions and COVID-19 vaccination efforts strained health systems, resulting in setbacks. In 2023, DTP (diphtheria, tetanus toxoid and pertussis-containing vaccine) immunization coverage had not yet recovered to preveous levels. DTP3 (third dose of DTP containing vaccine) immunization coverage among one-year-olds worldwide dropped from 86% to 81% in 2021 and recovered to 84% in 2023. Still 14.5 million infants did not receive an initial dose of DTP vaccine, pointing to a lack of access to immunization and other health services, and an additional 6.5 million are partially vaccinated. Measles, because of its high transmissibility, acts as a “canary in the coalmine”, quickly exposing any immunity gaps in the population. Still 22.2 million children missed their routine first dose of measles, far from previous levels with 19.3 million.

Report Coverage

This research report categorizes the market for vaccine contract manufacturing based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the vaccine contract manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the vaccine contract manufacturing market.

Global Vaccine Contract Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.11 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.06% |

| 2033 Value Projection: | USD 8.88 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Workflow, By Application, By Region |

| Companies covered:: | Fujifilm Diosynth Biotechnologies, AGC Biologics, Catalent, Inc., Charles River Laboratories, Emergent BioSolutions, Samsung Biologics, IDT Biologika GmbH, KBI Biopharma, Lonza Group, WuXi Biologics, Merck KGaA, Recipharm AB, Richter-Helm BioLogics GmbH & Co. KG, Seqirus (CSL Limited), and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing demand for vaccines serves as a crucial driver propelling the expansion of the vaccine contract manufacturing market. As the global population continues to prioritize preventive healthcare measures, the need for proficient vaccine production escalates. Vaccine Contract Manufacturing offers pharmaceutical companies the flexibility to extent up production swiftly to meet this rising demand. Additionally, outsourcing manufacturing to specialized facilities enables companies to focus on research and development, accelerating vaccine innovation. In addition, partnerships with contract manufacturers streamline the production process, ensuring timely delivery of vaccines to the market. Innovations in manufacturing and biotechnology revolutionize the vaccine contract manufacturing sector by boosting productivity and adaptability. New vaccinations that are more scalable and effective can be made possible by current biotech advancements, which raise the need for specialist manufacturing expertise. Examples of progressive manufacturing technologies that abridge production and save costs and time without sacrificing quality are automation and single-use systems.

Restraining Factors

In the vaccine contract manufacturing market, strict quality control and regulatory acquiescence are significant barriers. To guarantee product safety and efficacy, strict adherence to quality standards, such as Good Manufacturing Practices (GMP), necessitates large expenditures in infrastructure and procedures. Complying with a range of regulatory requirements across different locations increases manufacturing operations' density and expenses. Any departure from these guidelines runs the danger of a product recall or regulatory penalties, which might damage the reliability of the industry and limit future growth projection.

Market Segmentation

The vaccine contract manufacturing market share is classified into vaccine type, workflow, and application.

- The attenuated segment is estimated to hold the highest market revenue share through the projected period.

Based on the vaccine type, the vaccine contract manufacturing market is classified into attenuated, inactivated, subunit-based, toxoid-based, and DNA-based. Among these, the attenuated segment is estimated to hold the highest market revenue share through the projected period. This due to several factors, Attenuated vaccines, which contain weaken forms of pathogens, require specialized expertise and facilities for safe and effective production. Contract manufacturing organizations (CMOs) with experience in handling live, attenuated strains are in high demand. Moreover, attenuated vaccines often have a long history of efficacy, making them essential for preventing various diseases. The conventional market for these vaccines drives constant demand for manufacturing services, contributing to the segment's extensive share in the contract manufacturing market.

- The downstream segment is anticipated to hold the largest market share through the forecast period.

Based on the workflow, the vaccine contract manufacturing market is divided into downstream, and upstream. Among these, the downstream segment is anticipated to hold the largest market share through the forecast period. This is because it encompasses significant processes like formulation, fill-and-finish, packaging, and distribution. These stages are critical for ensuring vaccine safety, efficacy, and accessibility. Vaccine developers often rely on contract manufacturing organizations (CMOs) to handle these complex downstream tasks, as they require dedicated equipment, expertise, and regulatory compliance. By outsourcing these crucial steps to CMOs, vaccine developers can streamline their operations, reduce costs, and expedite vaccine production, making the downstream segment a crucial and leading constituent of the vaccine contract manufacturing market.

- The human use segment dominates the market with the largest market share through the forecast period.

Based on the application, the vaccine contract manufacturing market market is categorized into human use, and veterinary. Among these, the human use segment dominates the market with the largest market share through the forecast period. This is due to the important and constant demand for human vaccines. Vaccination is a keystone of public health programs globally, addressing various infectious diseases and preventing their spread. As a result, pharmaceutical companies and governments regularly require contract manufacturing services to meet the production needs of human vaccines. This constant demand, along with the need for dedicated expertise in human vaccine manufacturing, drives the dominance of the human-use segment within the vaccine contract manufacturing market.

Regional Segment Analysis of the Vaccine Contract Manufacturing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the vaccine contract manufacturing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the vaccine contract manufacturing market over the predicted timeframe. North America boasts a well-developed pharmaceutical industry with numerous established pharmaceutical and biotech companies that specialize in vaccine research, development, and manufacturing, driving growth of the region. The U.S. boasts a robust pharmaceutical industry with numerous leading pharmaceutical and biotech companies that specialize in vaccine research, development, and manufacturing. Furthermore, FDA's rigorous oversight and expertise in vaccine regulation provide assurance to global markets, elevating the desirability of vaccines manufactured in the U.S. The region has one of the highest healthcare expenditures globally, reflecting significant investments in healthcare infrastructure, research, and development. The region's strong healthcare spending supports vaccine development and manufacturing activities, fostering a conducive environment for contract manufacturing partnerships and investments. Moreover, the U.S. is a global leader in vaccine development and distribution, with several vaccines developed within its borders achieving widespread international use. This leadership status, coupled with the country's reputation for innovation and quality, enhances the competitiveness of U.S.-based vaccine manufacturers in the global market.

Asia Pacific is expected to grow at the fastest CAGR growth of the vaccine contract manufacturing market during the forecast period. Primarily, it boasts a large and growing population, leading to increased demand for vaccines. Asia-Pacific has a robust pharmaceutical and biotechnology industry, attracting global vaccine developers who seek cost-effective manufacturing solutions. Moreover, the region benefits from a skilled workforce and advanced manufacturing capabilities. Furthermore, favorable regulatory environments and lower labor costs make it an attractive destination for vaccine contract manufacturing. As a result, Asia-Pacific continues to be a major contributor to the global vaccine contract manufacturing market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the vaccine contract manufacturing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fujifilm Diosynth Biotechnologies

- AGC Biologics

- Catalent, Inc.

- Charles River Laboratories

- Emergent BioSolutions

- Samsung Biologics

- IDT Biologika GmbH

- KBI Biopharma

- Lonza Group

- WuXi Biologics

- Merck KGaA

- Recipharm AB

- Richter-Helm BioLogics GmbH & Co. KG

- Seqirus (CSL Limited)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, The Duke Human Vaccine Institute received funding from the National Institute of Allergy and Infectious Diseases (NIAID), a branch of the National Institutes of Health, to manufacture H5N1 avian flu vaccines for use in clinical trials.

- In June 2024, South Korean biotech firm SK Bioscience is to acquire the German CDMO-specializing company IDT Biologika at 339 billion won ($244 million) to further sharpen and diversify its pipeline for global markets.

- In February 2024, Danish drugmaker Bavarian Nordic inked a $270 million agreement to buy numerous vaccine assets and a manufacturing competence in Bern, Switzerland from contract development and manufacturing organization (CDMO) Emergent Biosolutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the vaccine contract manufacturing market based on the below-mentioned segments:

Global Vaccine Contract Manufacturing Market, By Vaccine Type

- Attenuated

- Inactivated

- Subunit-based

- Toxoid-based

- DNA-based

Global Vaccine Contract Manufacturing Market, By Workflow

- Downstream

- Upstream

Global Vaccine Contract Manufacturing Market, By Application

- Human Use

- Veterinary

Global Vaccine Contract Manufacturing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the vaccine contract manufacturing market over the forecast period?The vaccine contract manufacturing market is projected to expand at a CAGR of 11.06% during the forecast period.

-

2. What is the market size of the vaccine contract manufacturing market?The Global Vaccine Contract Manufacturing Market Size is Expected to Grow from USD 3.11 Billion in 2023 to USD 8.88 Billion by 2033, at a CAGR of 11.06% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the vaccine contract manufacturing market?North America is anticipated to hold the largest share of the vaccine contract manufacturing market over the predicted timeframe.

Need help to buy this report?