Global Varactor Diode Market Size, Share, and COVID-19 Impact Analysis, By Breakdown Voltage (5V - 30V, 31V - 65V, and 65V & Above), By Application (Mobile Devices, Satellite Communication, Defense, Aviation, and Marine), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Semiconductors & ElectronicsGlobal Varactor Diode Market Insights Forecasts to 2033

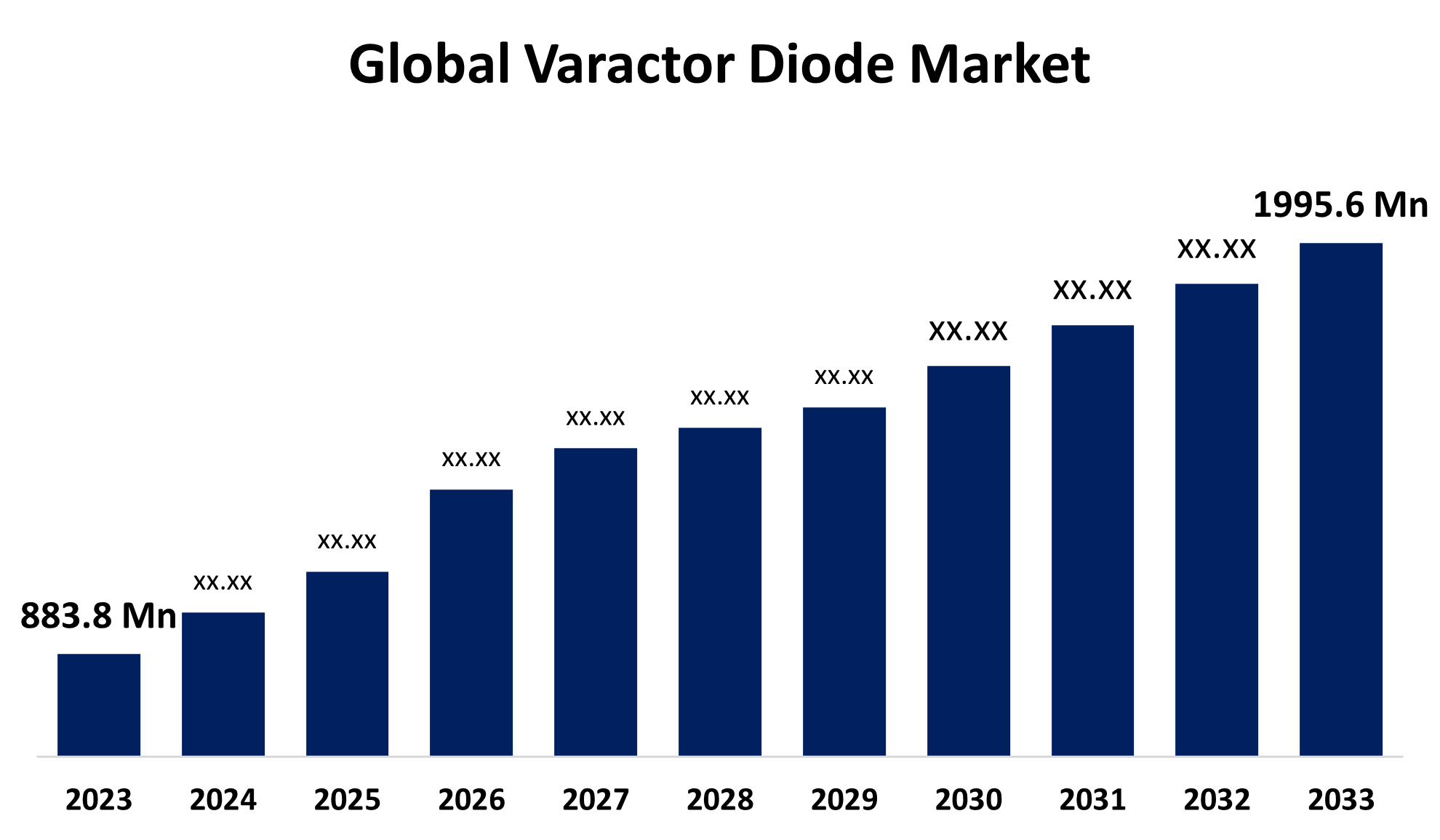

- The Global Varactor Diode Market Size was estimated at USD 883.8 Million in 2023

- The Market Size is Expected to Grow at a CAGR of around 8.49% from 2023 to 2033

- The Worldwide Varactor Diode Market Size is Expected to Reach USD 1995.6 Million by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Varactor Diode market size was worth around USD 883.8 Million in 2023 and is predicted to grow to around USD 1995.6 Million by 2033 with a compound annual growth rate (CAGR) of around 8.49% between 2023 and 2033. The significant driving factors for the growth of the varactor diode market include increase in demand for consumer electronics.

Market Overview

The global varactor diode market refers to the industry involved in the production and supply of varactor diodes, which are specialized semiconductor devices that change their capacitance with applied voltage. These diodes are widely used in various applications such as mobile phones, TV sets, satellite communication, and defense systems. The varactor diode is designed in a manner that exhibits better transition capacitance characteristics than the regular diodes. It finds applications in frequency multipliers, parametric amplifiers, and voltage-controlled oscillators. Additionally, the proliferation of smart devices has necessitated the need for smarter components, leading to increased demand for varactor diodes. However, the adoption of 5G technology is expected to further boost the market, as these diodes play a significant role in providing the desired capacitance changes required for advanced wireless communication systems.

Report Coverage

This research report categorizes the global varactor diode market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global varactor diode market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global varactor diode market.

Global Varactor Diode Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 883.8 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.49% |

| 2033 Value Projection: | USD 883.8 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Breakdown Voltage, By Application, By Region |

| Companies covered:: | NXP Semiconductors, STMicroelectronics, Arrow Electronics, Inc., Infineon Technologies AG, ON Semiconductor, MACOM, Vishay Intertechnology, Inc., Microsemi, Analog Devices, Inc., Integrated Device Technology, Inc., Toshiba, Skyworks Solutions, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The major driving forces for the growth of the varactor diode market are the rise in demand for consumer electronics, the rise in the number of mobile phone subscribers, and the increase in adoption of varactor diode in radio frequency design space. Moreover, the varactor diode is less noisy than other diodes and is extremely lighter in weight and smaller in size, which drives the manufacturers towards its acceptance and contributes to the growth of the varactor diode market.

Restraining Factors

The market is confronted with issues like the narrow field of application by the reverse bias mode of varactor diodes, which limits their application in some industries. Despite this, the market is set to grow, with prospects coming from the aerospace and defense sectors, which are rapidly embracing varactor diodes for their sophisticated systems.

Market Segmentation

The global varactor diode market share is classified into breakdown voltage and application.

- The 5V - 30V segment accounted for the largest share in 2023 and is projected to grow at a remarkable CAGR during the forecast period.

In the terms of breakdown voltage, the global varactor diode market is divided into 5V - 30V, 31V - 65V, and 65V & above. Among these, the 5V - 30V segment accounted for the largest share in 2023 and is projected to grow at a remarkable CAGR during the forecast period. The segment growth is fueled by growing demand for consumer electronics, growth in mobile devices, and increased use of varactor diodes in radio frequency design applications.

- The mobile devices segment accounted for the highest revenue share in 2023 and is anticipated to grow at a substantial CAGR during the forecast period.

In the terms of application, the global varactor diode market is divided into mobile devices, satellite communication, defense, aviation, and marine. Among these, the mobile devices segment accounted for the highest revenue share in 2023 and is anticipated to grow at a substantial CAGR during the forecast period. The expansion is attributed to the huge demand for varactor diodes in consumer electronics, smartphones, and tablets. Varactor diodes are essential in such devices for tuning circuits in mobile communication systems as well as frequency modulation.

Regional Segment Analysis of the Global Varactor Diode Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

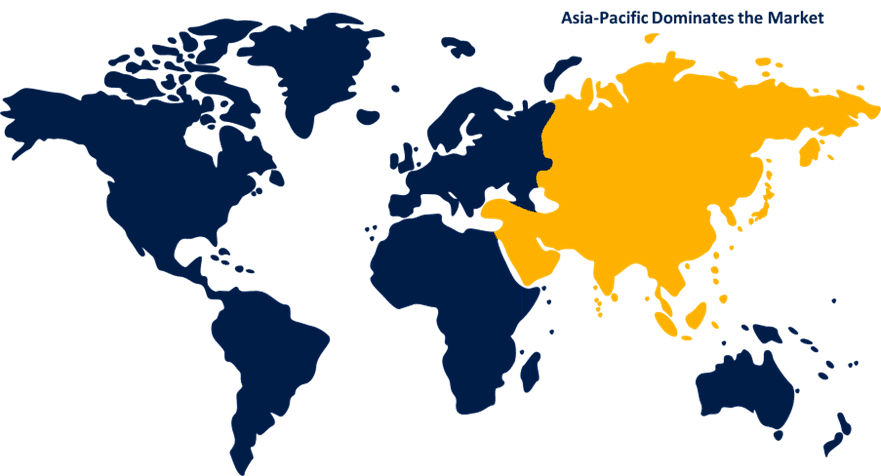

Asia Pacific is anticipated to hold the largest share of the global varactor diode market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global varactor diode market over the predicted timeframe. The growth in the region is due to a massive customer base employing smartphones and tablets and the fast development of 5G technology in the region. Huge customer base utilizing smartphones and tablets, due to the high population in India and China. The demand for mobile devices will rise due to high disposable income and the increasing development of 5G technology in the region.

North America is expected to grow at the fastest CAGR in the global varactor diode market during the forecast period. The growth in the region is due to the demand for varactor diodes used in different applications, including communication systems, consumer products, and automotive. Moreover, the development of 5G infrastructure and other high-frequency applications in the region may drive the demand for these diodes, which find application in frequency control, tuning circuits, and signal modulation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global varactor diode market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NXP Semiconductors

- STMicroelectronics

- Arrow Electronics, Inc.

- Infineon Technologies AG

- ON Semiconductor

- MACOM

- Vishay Intertechnology, Inc.

- Microsemi

- Analog Devices, Inc.

- Integrated Device Technology, Inc.

- Toshiba

- Skyworks Solutions

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2022, Toshiba and Premier Farnell Ltd announced a collaboration to strengthen the supply chain for new and innovative products. This partnership aims to broaden the range of innovative discrete devices and power semiconductors offered by Premier Farnell Ltd.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global varactor diode market based on the below-mentioned segments:

Global Varactor Diode Market, By Breakdown Voltage

- 5V - 30V

- 31V - 65V

- 65V & Above

Global Varactor Diode Market, By Application

- Mobile Devices

- Satellite Communication

- Defense

- Aviation

- Marine

Global Varactor Diode Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the expected market size of the global varactor diode market in 2033?The global varactor diode market is expected to reach USD 1995.6 million by 2033.

-

What is the primary factor contributing to the growth of the market?The significant driving factors for the growth of the varactor diode market include increase in demand for consumer electronics.

-

Based on application which segment held the largest market share in 2023?The mobile devices segment accounted for the highest revenue share in 2023.

Need help to buy this report?