Global Vegan Food Market Size, Share, Growth, and Industry Analysis, By Product (Dairy Alternatives, Meat Substitutes, and Others), By Source (Almond, Soy, Oats, Wheat, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, and Others), and Regional Insights and Forecast to 2033

Industry: Food & BeveragesGlobal Vegan Food Market Insights Forecasts to 2033

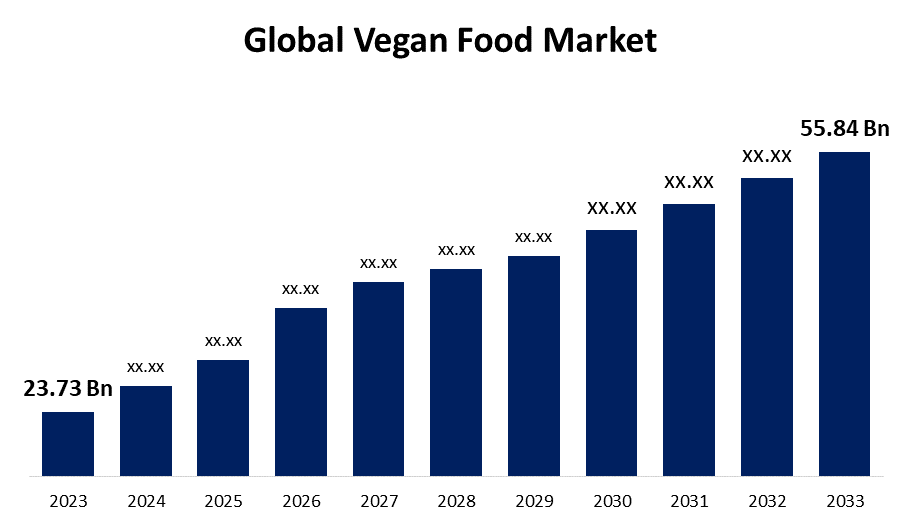

- The Global Vegan Food Market Size was Valued at USD 23.73 Billion in 2023

- The Market Size is Growing at a CAGR of 8.93% from 2023 to 2033

- The Worldwide Global Vegan Food Market Size is Expected to Reach USD 55.84 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Vegan Food Market Size is Anticipated to Exceed USD 55.84 Billion by 2033, Growing at a CAGR of 8.93% from 2023 to 2033. Growing concerns about animal health and cruelty are driving people to transition from animal-based to plant-based diets. As a result, there is an increase in the consumption of vegan foods.

Global Vegan Food MARKET REPORT OVERVIEW

Vegan food products are typically free from dairy and meat, originating from plant-based sources. Meat substitutes, designed to mimic the taste, flavor, and appearance of real meat, offer a healthier alternative and are increasingly used instead of traditional meat products. These substitutes are mainly made from ingredients like soy and wheat. Tofu, a popular meat substitute, is commonly used as an alternative to pork, chicken, beef, and other meats. Similarly, dairy-free food and beverage products are made from sources such as almond, soy, rice, and coconut. Popular dairy alternatives include milk, ice cream, cheese, and butter.

Initially, consumers began stockpiling a variety of food products, including both meat-based and meat-free items, which significantly strained the production and supply chains. This surge in demand put additional pressure on food manufacturers, leading to supply shortages. In response, companies scaled up their production efforts to address the increasing demand for vegan food products. They invested in expanding their facilities, optimizing supply chains, and enhancing distribution networks to ensure a steady supply of vegan options to the market. This adjustment was crucial in meeting the rising consumer interest in plant-based diets and stabilizing the food supply.

For instance, In April 2023, The Bel Group, a leading player in the cheese market, announced a partnership with biotech start-up Climax Foods Inc. to develop plant-based cheese. This collaboration results in the production of plant-based versions of popular brands such as Kiri, Laughing Cow, Babybel, Boursin, and Nurishh.

Report Coverage

This research report categorizes the market for the global vegan food market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global vegan food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global vegan food market.

Global Vegan Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 23.73 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.93% |

| 2033 Value Projection: | USD 55.84 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 179 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Source, By Distribution Channel |

| Companies covered:: | Allplants, Atlast Food, Amy’s Kitchen, FUTURE FARM LLC., Good Catch, Bel Group, Danone S.A, Daiya Foods Inc., Beyond Meat, LIVEKINDLY CO. INC., Puris Foods, Tofutti Brands Inc., Plamil Foods Ltd, VBites Foods Limited, Eden Foods Inc., VITASOY International Holdings Limited, SunOpta, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

DRIVING FACTORS:

“Increasing Demand for Animal Cruelty-Free Products to Drive Growth in the Vegan Food Market”

Consumers are increasingly conscious of animal welfare, leading many to adopt lifestyles and diets that seek to minimize animal cruelty and reduce environmental harm associated with meat consumption. Research published in scientific journals highlights that dairy and meat products account for approximately 60% of greenhouse gas emissions from agriculture. By transitioning to a vegan diet, individuals not only mitigate their environmental footprint but also help to prevent the exploitation of animals in the food industry. This dietary shift addresses both the ecological impact and ethical concerns related to animal agriculture, promoting a more sustainable and humane approach to food production.

RESTRAINING FACTORS:

“The High Cost of Vegan Food Products Might Hamper Market Growth”

Many manufacturers are introducing plant-based alternatives to the market; however, these products often come with higher price tags compared to traditional animal-based foods. Additionally, the taste and texture of plant-based options can differ markedly from their animal-based counterparts, which might affect their appeal. As a result, forecasts suggest that consumer adoption of vegan food products may progress more slowly.

Market Segmentation

The global vegan food market share is classified into product, source, and distribution channel.

Which segment is expected to hold the largest share of the global vegan food market during the forecast period?

“The dairy alternatives segment dominates the market with the highest market share over the forecast period”

Based on the product, the global vegan food market is categorized into dairy alternatives, meat substitutes, and others. Many people avoid dairy due to spiritual practices, lactose intolerance, or personal dietary choices. For these individuals, dairy alternatives offer a fitting replacement while respecting their cultural or dietary needs, which is driving their growing popularity. Additionally, increasing awareness of the health risks linked to excessive dairy consumption is prompting people to seek healthier options. Dairy alternatives, free from animal-based saturated fats and cholesterol, are emerging as a preferable choice. Their availability has expanded significantly across globe, with supermarkets, health food stores, and online retailers now offering a diverse range of dairy-free products, such as soy, almond, coconut, and oat milk, as well as dairy-free yogurt, cheese substitutes, and vegan butter. This broader accessibility is making it easier for consumers to include dairy alternatives in their diets.

Why Soy is Preferred over Almond, Oats, Wheat, and Others?

“Soy protein isolates create versatile, affordable vegan options”

Soy protein isolates are utilized to produce vegan meat alternatives, such as soy-based sausages, patties, and nuggets. This adaptability enables soy to meet various culinary tastes and offers a basis for creating novel vegan food items. Additionally, soy-derived products like soy milk, tofu, soy protein, and soy-based meat substitutes are abundantly available in the Indian market. They are frequently priced competitively in comparison to other plant-based options, ensuring they are both accessible and affordable for a broad spectrum of consumers.

Which segment is anticipated to dominate the global vegan food market during the forecast period?

“The supermarkets and hypermarkets segment dominates the market with the highest market share over the forecast period”

Based on the distribution channel, the global vegan food market is categorized into supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others. Supermarkets and hypermarkets offer an extensive selection of products, including vegan alternatives. They feature a range of plant-based items such as vegan meat substitutes, dairy-free milk, plant-based cheeses, vegan desserts, and pre-packaged vegan meals. This wide variety allows consumers to explore and choose from numerous vegan options. Additionally, these stores are conveniently located in urban and suburban areas, with extended operating hours and a user-friendly shopping experience, making it easier for people to find and buy vegan products. Furthermore, supermarkets and hypermarkets serve as a prominent platform for brands to present their vegan offerings to a broader audience, investing in marketing and promotional efforts to boost the visibility and appeal of vegan products.

Regional Segment Analysis of the Global Vegan Food Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Which region is expected to hold the largest share of the global vegan food market over the forecast period?

“North America is anticipated to hold the largest share of the global vegan food market over the forecast period”

Get more details on this report -

North America market is largely driven by growing concerns over animal cruelty within the food industry and the associated environmental damage. As consumers become more aware of these issues, they are increasingly seeking alternatives to traditional animal-based products. Additionally, the high prevalence of lactose intolerance in the U.S. contributes significantly to the demand for dairy alternatives. Many individuals with lactose intolerance are looking for suitable replacements that allow them to enjoy dairy-like products without experiencing discomfort. This combination of ethical and health considerations is driving the surge in popularity of plant-based and alternative dairy products, reflecting a broader shift towards more sustainable and inclusive dietary choices.

Why Asia Pacific is growing at the fastest CAGR in the global vegan food market?

“Health awareness drives market growth in Asia Pacific”

The regional market is primarily driven by increasing health awareness among consumers. As more people become conscious of their health and well-being, they are turning to products that align with healthier lifestyles. This trend is prompting major manufacturers to concentrate their efforts on expanding their operations in the Asia Pacific region, which presents significant growth potential. The burgeoning health-conscious consumer base in Asia Pacific offers ample opportunities for market expansion, leading companies to strategically invest in this area to capitalize on the rising demand for health-oriented products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global vegan food market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allplants

- Atlast Food

- Amy's Kitchen

- FUTURE FARM LLC.

- Good Catch

- Bel Group

- Danone S.A

- Daiya Foods Inc.

- Beyond Meat

- LIVEKINDLY CO. INC.

- Puris Foods

- Tofutti Brands Inc.

- Plamil Foods Ltd

- VBites Foods Limited

- Eden Foods Inc.

- VITASOY International Holdings Limited

- SunOpta

- Others

Recent Developments

- In June 2022, Starbucks Corporation and Imagine Meats signed a definitive agreement allowing Starbucks to offer vegan products created by Imagine Meats at its locations in India. Starbucks has introduced vegan hummus kebab wraps, vegan sausage croissant rolls, and vegan croissant buns in its outlets across cities including Delhi, Kolkata, Mumbai, Bangalore, Hyderabad, Jaipur, Gurugram, Goa, Noida, and Pune.

- In May 2021, U.S. retail giant Target unveiled a new sub-brand called Good & Gather Plant-Based. The company plans to introduce 30 new plant-based products under this brand.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global vegan food market based on the below-mentioned segments:

Global Vegan Food Market, By Product

- Dairy Alternatives

- Meat Substitutes

- Others

Global Vegan Food Market, By Source

- Almond

- Soy

- Oats

- Wheat

- Others

Global Vegan Food Market, by Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Global Vegan Food Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?