Global Vegan Tuna Market Size, Share, and COVID-19 Impact Analysis, By Product (Frozen, Canned, and Others), By End-User (Household and Foodservice), By Distribution Channel (Supermarkets/Hypermarkets, Online, Convenience Stores, Specialty Stores, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Vegan Tuna Market Insights Forecasts to 2033

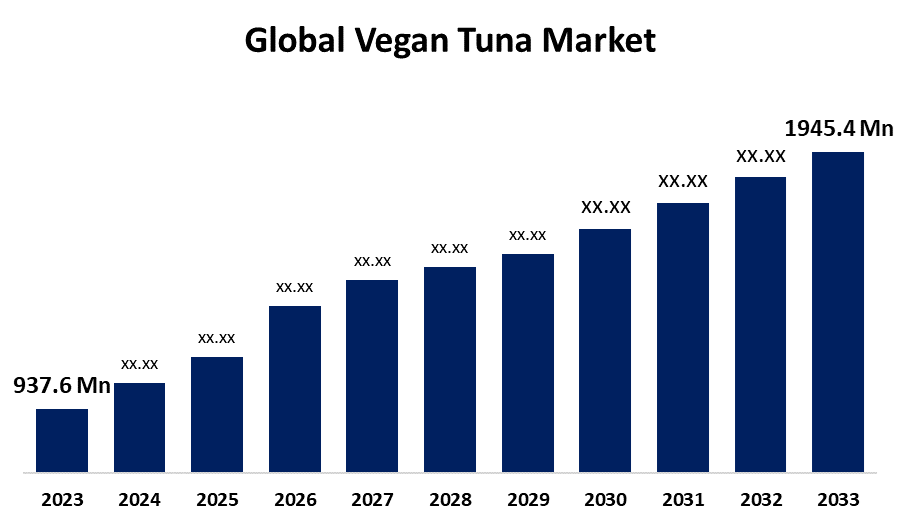

- The Global Vegan Tuna Market Size was Valued at USD 937.6 Million in 2023

- The Market Size is Growing at a CAGR of 7.57% from 2023 to 2033

- The Worldwide Vegan Tuna Market Size is Expected to Reach USD 1945.4 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Vegan Tuna Market Size is Anticipated to Exceed USD 1945.4 Million by 2033, Growing at a CAGR of 7.57% from 2023 to 2033.

Market Overview

Vegan tuna is the term for tuna substitutes made from plants intended to resemble real tuna in terms of texture, flavour, and nutritional makeup. The growing popularity of these plant-based substitutes, which contain substances, including soy, yeast, seaweed, and pea protein, can be attributed to the increasing trend of vegan and flexitarian diets and health and environmental sustainability concerns. Vegan tuna can be used in a variety of recipes, including salads, casseroles, and sandwiches. It often has spices to resemble authentic tuna. Growing consumer awareness of the adverse health impacts of eating animal products and the ethical issues associated with animal husbandry is progressively causing vegetarianism to gain popularity in society, which is fuelling the market's growth. Health-conscious consumers are major market driver. Vegan tuna products frequently feature significant levels of plant-based proteins, fiber, omega-3 fatty acids (produced from algae), and important minerals, but lack the cholesterol and saturated fat found in animal-based fish. The plant-based food business's wave of new product developments and technological advancements is another significant driver of the market. Modern culinary technology is being used by businesses to produce plant-based tuna products that taste, feel, and texture very similar to that of real tuna. The market for vegan tuna has a lot of opportunities to grow in the form of investments and new product launches to meet the growing demand from consumers for plant-based seafood substitutes.

Report Coverage

This research report categorizes the market for the vegan tuna market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the vegan tuna market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the vegan tuna market.

Global Vegan Tuna Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 937.6 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.57% |

| 2033 Value Projection: | USD 1945.4 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product, By End-User, By Distribution Channel, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Thai Union, Jinka Vegan Tuna Spread, Good Catch, Loma Linda TUNO, Ocean Hugger Foods, Inc., Atlantic Natural Foods, May Wah Vegan Delicious Tuna, Garden Gourmet Vuna, Sophie’s Kitchen, Prime Roots, OmniTuna, Hooked, Vgarden Ltd., Endori, and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing number of individuals adopting vegetarian and vegan diets, the growing awareness of the adverse impact of the fishing industry on the environment, and the health advantages of plant-based diets are some of the major factors driving the vegan tuna market. The increasing prevalence of e-commerce and direct-to-consumer sales channels offers vegan tuna producers a chance to broaden their customer base and grow their market share.

Restraining Factors

Growing numbers of consumers are allergic to peas and soy, which is restricting the industry's expansion and making it more difficult for manufacturers to produce vegan tuna free of allergens. The high cost of production and restricted availability of vegan tuna products in certain areas are two significant issues.

Market Segmentation

The vegan tuna market share is classified into product, end-user, and distribution channel.

- The frozen segment is expected to hold the largest market share through the forecast period.

Based on the product, the vegan tuna market is categorized into frozen, canned, and others. Among these, the frozen segment is expected to hold the largest market share through the forecast period. The fact that frozen products may hold onto their texture, flavour, and nutritional content longer than canned or fresh equivalents is one of the main factors contributing to their dominance. Retailers and customers both consider frozen vegan tuna to be a more attractive alternative because of this exceptional preservation.

- The household segment is estimated to grow at the highest CAGR during the forecast period.

Based on the end-user, the vegan tuna market is categorized into household and foodservice. Among these, the household segment is estimated to grow at the highest CAGR during the forecast period. Due to growing public acceptance of plant-based diets driven by ethical, natural, and health concerns, vegan tuna was used in households. Vegan tuna is mainly purchased by customers who prepare meals at home, with households accounting for the largest end-user in the market.

- The supermarkets/hypermarkets segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the vegan tuna market is categorized into supermarkets/hypermarkets, online, convenience stores, specialty stores, and others. Among these, the supermarkets/hypermarkets segment accounted for the largest revenue share over the forecast period. These stores serve a broad range of customers and make vegan products easily accessible for consumers who regularly buy groceries. Due to their extensive selection of vegan products in several categories, supermarkets are frequently the initial choice for consumers searching for plant-based substitutes.

Regional Segment Analysis of the Vegan Tuna Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the vegan tuna market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the vegan tuna market over the forecast period. This dominance is due to the significant presence of industry leaders in the region and the high level of consumer awareness. Pioneering concepts from brands that introduced plant-based seafood options initially have been observed in the region. In response to the growing flexibility consumer base, several prevalent grocery chains and restaurants in the United States and Canada offer vegan tuna options on their menus. Furthermore, the need for sustainable and environmentally friendly alternative protein sources has increased due to North America's sizable health and wellness sector.

Asia Pacific is expected to grow at the fastest CAGR growth in the vegan tuna market during the forecast period. The vegan tuna market in Asia Pacific is driven by a growing awareness regarding plant-based diets, increased disposable incomes, and evolving eating patterns. Urbanization in the region is accelerating, and as middle-class populations grow in nations like China, Japan, and Australia, consumer expectations are changing to include more sustainably produced and healthier food options. Plant-based seafood substitutes like vegan tuna are becoming increasingly prevalent as worries about overfishing and environmental sustainability in the region increase.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the vegan tuna market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thai Union

- Jinka Vegan Tuna Spread

- Good Catch

- Loma Linda TUNO

- Ocean Hugger Foods, Inc.

- Atlantic Natural Foods

- May Wah Vegan Delicious Tuna

- Garden Gourmet Vuna

- Sophie’s Kitchen

- Prime Roots

- OmniTuna

- Hooked

- Vgarden Ltd.

- Endori

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Vgarden, an Israeli plant-based startup, launched vegan canned tuna made from pea protein, sunflower oil, and nutritious fibers in response to the growing number of environmentally concerned consumers.

- In September 2023, Endori, a German plant-based food firm, launched Thuna, a new vegan tuna product derived from pea protein.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the vegan tuna market based on the below-mentioned segments:

Global Vegan Tuna Market, By Product

- Frozen

- Canned

- Others

Global Vegan Tuna Market, By End-User

- Household

- Foodservice

Global Vegan Tuna Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Online

- Convenience Stores

- Specialty Stores

- Others

Global Vegan Tuna Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global vegan tuna market over the forecast period?The global vegan tuna market is to expand at 7.57% during the forecast period.

-

2. Which region is expected to hold the highest share of the global vegan tuna market?The North America region is expected to hold the largest share of the global vegan tuna market.

-

3. Who are the top key players in the vegan tuna market?The key players in the global vegan tuna market are Thai Union, Jinka Vegan Tuna Spread, Good Catch, Loma Linda TUNO, Ocean Hugger Foods, Inc., Atlantic Natural Foods, May Wah Vegan Delicious Tuna, Garden Gourmet Vuna, Sophie’s Kitchen, Prime Roots, OmniTuna, Hooked, Vgarden Ltd., Endori, and others.

Need help to buy this report?