Global Vegetal Natural Fiber Market Size, Share, and COVID-19 Impact Analysis, By Products (Cotton, Bamboo, Jute, Flex), By Application (Textiles, Automotive, Construction, Packaging, Agriculture, Geotextiles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Vegetal Natural Fiber Market Size Insights Forecasts to 2033

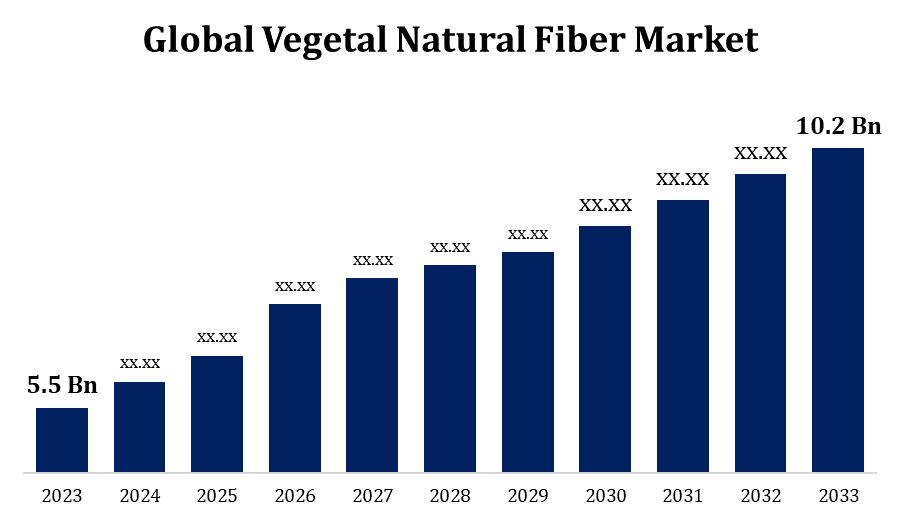

- The Global Vegetal Natural Fiber Market Size was valued at USD 5.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.37% from 2023 to 2033.

- The Worldwide Vegetal Natural Fiber Market Size is expected to reach USD 10.2 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Vegetal Natural Fiber Market Size is expected to reach USD 10.2 Billion by 2033, at a CAGR of 6.37% during the forecast period 2023 to 2033.

The vegetal natural fiber market is quickly expanding, driven by rising demand for sustainable and environmentally friendly materials in industries such as textiles, automotive, construction, and packaging. Cotton, flax, hemp, jute, sisal, and coir are common fibers used because they are biodegradable and renewable. The market benefits from increased consumer awareness of environmental issues, strong rules that encourage sustainable practices, and advances in fiber processing technologies. However, issues like as high production costs, quality unpredictability, and the need for sophisticated processing methods remain.

Vegetal Natural Fiber Market Value Chain Analysis

The vegetal natural fiber market value chain involves several interconnected stages, starting with raw material cultivation where plants like cotton, flax, hemp, jute, sisal, and coir are grown using sustainable farming practices. Following cultivation, fibers are extracted through processes such as retting, decortication, and ginning, and then cleaned and combed to remove impurities. Intermediate processing includes spinning fibers into yarn, weaving or knitting into the fabric, and applying chemical or mechanical treatments to enhance fiber properties. In the product manufacturing stage, these fibers are used to produce textiles, automotive composites, construction materials, and specialty products. Distribution and sales encompass logistics, marketing, and consumer engagement, ensuring that the products reach the market effectively through wholesale, retail, and online channels. End-use applications of these fibers span textiles and apparel, automotive interiors, construction materials, and sustainable packaging solutions. Supporting activities such as research and development, regulatory compliance, and sustainability initiatives play a crucial role in enhancing the market's growth and environmental impact. Despite challenges like high production costs and quality variability, the market is driven by a strong demand for sustainable products, regulatory support, and continuous innovation.

Vegetal Natural Fiber Market Opportunity Analysis

As environmental restrictions tighten and customer preferences move to sustainable products, natural fibers provide a renewable and biodegradable alternative to synthetic materials. This places natural fibres as an important component in the transition to a circular economy. New textile blends combining natural and synthetic fibers are being developed to improve durability and utility while being environmentally friendly. Natural fiber composites are increasingly being used in automobile interiors to reduce weight, improve fuel efficiency, and boost sustainability. This trend is fueled by the car industry's push for greener manufacturing practices. The use of natural fibers in construction materials for insulation, roofing, and reinforcement provides options to reduce buildings' carbon footprints and improve environmental performance.

Global Vegetal Natural Fiber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.37% |

| 2033 Value Projection: | USD 10.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Products, By Application, By Region |

| Companies covered:: | Aditya Birla Group, Lenzing AG, Shandong Ruyi Textile Group Co., Ltd., Nufarm Ltd., Kelheim Fibres GmbH, Golden Peacock Group, Shanghai Chemical Industries Co., Ltd., Sateri Holdings Ltd., Antex, Ltd., Shenglong Group Co., Ltd., Suominen Oyj, Thai Rayon PCL, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Market Dynamics

Vegetal Natural Fiber Market Dynamics

Rising Demand for Sustainable Materials

Growing awareness of environmental challenges such as plastic waste, carbon emissions, and natural resource depletion is driving a shift towards more sustainable materials. Consumers are increasingly more concerned about the environmental impact of their purchases, resulting in a preference for products created from natural fibers. Many businesses are making sustainability a major aspect of their strategy. This involves using less synthetic fibers and more natural fibers in their products. Corporate sustainability programs are about more than just complying with legislation; they also aim to address the growing customer demand for environmentally friendly products. Consumer tastes for organic, natural, and sustainable products have shifted significantly.

Restraints & Challenges

Natural fiber cultivation and processing can be more expensive than synthetic fiber production. The cost of sustainable farming practices, labor-intensive harvesting methods, and the necessity for specialised processing equipment all contribute to greater overall costs. Natural fibers frequently vary in quality due to variances in growing circumstances, harvesting practices, and processing methods. This unpredictability can have an impact on the fibers' performance and reliability, making them less appealing to producers who demand consistent raw materials. Natural fiber processing necessitates specialised methods that may be less advanced than those used for synthetic fibers. Innovation is required to improve fiber extraction, retting, decortication, and spinning processes. Current processing technology restrictions may have an impact on production scalability.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Vegetal Natural Fiber Market from 2023 to 2033. Growing environmental concerns and a push towards sustainable practices are important drivers. Consumers and industry are increasingly looking for biodegradable and sustainable alternatives to synthetic fibers, driving up demand for natural fibers. Innovations in fiber processing and manufacturing technologies improve natural fiber qualities and applications, making them more competitive with synthetic alternatives. Improved processing technologies improve the efficiency and scalability of natural fiber manufacturing. Organic, natural, and environmentally friendly items are becoming increasingly popular among customers. This tendency is especially noticeable in the textile and garment industries, where natural fibres are being used in sustainable fashion.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region is rich in natural resources and has ideal weather conditions for growing various vegetal fibers. For example, India and Bangladesh are the major jute producers, whereas the Philippines is the leader in abaca output. Governments in the region are encouraging the use of natural fibers through regulations and incentives. For example, the Indian government promotes jute cultivation and use in packaging materials through a variety of initiatives. Many Asia-Pacific countries have lower labour and production costs, allowing them to compete in the global market. This economic advantage enables large-scale manufacture and export of natural fibers.

Segmentation Analysis

Insights by Product

The cotton segment accounted for the largest market share over the forecast period 2023 to 2033. Cotton has long been popular among customers because of its natural characteristics and comfort. Organic and sustainably sourced cotton goods are gaining popularity as customers become more aware of sustainability and environmental impact, propelling market growth even further. Cotton fibres have a wide range of applications, including garments, household textiles, medical textiles, and industrial textiles. Cotton's adaptability allows it to be combined with different fibers to improve performance properties such as strength, durability, and moisture control. Cotton breeding, farming practices, and processing technology innovations have resulted in higher cotton yields, quality, and sustainability. Biotechnological improvements, such as genetically engineered cotton cultivars, have also helped to boost yield and insect resistance.

Insights by Application

The textile segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Consumers and companies are placing a greater emphasis on sustainable and eco-friendly products as environmental awareness grows. Natural fibers, such as cotton, linen, hemp, and bamboo, are renewable and biodegradable, making them an appealing alternative to synthetic fibers. Natural fibers have distinct features such as breathability, moisture absorption, and comfort, making them desirable materials for textiles and clothing. Consumers value the natural feel and hypoallergenic properties of natural fiber textiles, which drives demand for these items. Advances in textile processing and manufacturing technology have increased the capabilities of natural fibers, allowing for the development of a diverse range of textiles with improved performance qualities. Textile developments such as mixed textiles, multifunction finishes, and eco-friendly dyeing techniques have accelerated industry growth.

Recent Market Developments

- In July 2023, Safilens launched biodegradable linen yarns: The European company introduced a new line of linen yarns that disintegrate organically, providing a sustainable option for a variety of uses.

Competitive Landscape

Major players in the market

- Aditya Birla Group

- Lenzing AG

- Shandong Ruyi Textile Group Co., Ltd.

- Nufarm Ltd.

- Kelheim Fibres GmbH

- Golden Peacock Group

- Shanghai Chemical Industries Co., Ltd.

- Sateri Holdings Ltd.

- Antex, Ltd.

- Shenglong Group Co., Ltd.

- Suominen Oyj

- Thai Rayon PCL

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Vegetal Natural Fiber Market, Product Analysis

- Cotton

- Bamboo

- Jute

- Flex

Vegetal Natural Fiber Market, Application Analysis

- Textiles

- Automotive

- Construction

- Packaging

- Agriculture

- Geotextiles

Vegetal Natural Fiber Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?