Global Veterinary Imaging Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Small Animal, Large Animal), By Product (MRI, X-ray, CT Imaging & Others), By Application (Orthopedics & Traumatology, Oncology, Cardiology, Dental Application & Others), By End User (Veterinary Clinics, Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Veterinary Imaging Market Insights Forecasts to 2033.

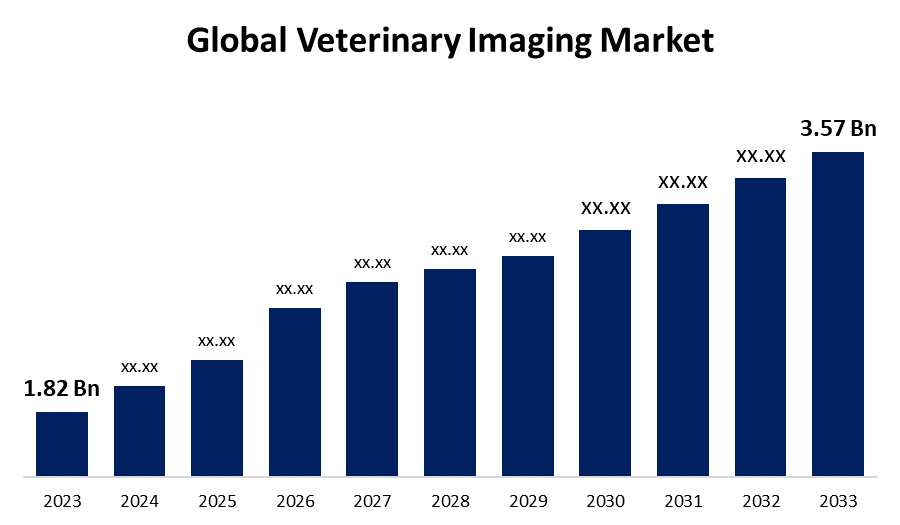

- The Global Veterinary Imaging Market Size was Valued at USD 1.82 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.97% from 2023 to 2033.

- The Worldwide Global Veterinary Imaging Market Size is Expected to Reach USD 3.57 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Veterinary Imaging Market Size is Anticipated to Exceed 3.57 Billion by 2033, Growing at a CAGR of 6.97% from 2023 to 2033.

Market Overview

Veterinary imaging, a type of test that generates precise pictures of inside organs, is imaginative. Imaging procedures make use of radio waves, high-energy radiation (X-rays), high-energy sound waves (ultrasounds), and radioactive substances. They are useful in illness diagnosis, therapy planning, or efficacy assessment. Numerous imaging technologies have been created and updated for use in animal diagnostics as well as human diagnostics. The practice of taking diagnostic images of an animal's body in order to identify chronic ailments is known as veterinary imaging. The majority of imaging modalities guarantee that the sickness process is not changed and that the pet is not in any discomfort while offering a multitude of information in a non-invasive and economical manner. However, because of the complexity and expense of the instruments and equipment, some of these treatments are performed in facilities built especially for their use. Some of the key factors propelling the market include a growth in the number of pets adopted, an increase in the number of infectious illnesses emerging, a rise in the need for various diagnostic tools, and an increase in the amount of money spent on pet care.

Report Coverage

This research report categorizes the market for the global veterinary imaging market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global veterinary imaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global veterinary imaging market.

Global Veterinary Imaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.82 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.97% |

| 2033 Value Projection: | USD 3.57 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Animal Type, By Product, By Application, By End User, By Region |

| Companies covered:: | IDEXX Laboratories, Inc., FUJIFILM Holdings America Corporation, VetZ GmbH, Hallmarq Veterinary Imaging Ltd., Shenzhen Mindray Animal Medical Technology Co., LTD., Heska Corporation, SOUND, ESAOTE SPA, Universal Medical Systems, Inc., Bruker, Hitachi Ltd., Siemens Healthcare GmbH, Epica Animal Health, MinXray Inc., DRAMIÑSKI SA., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The global veterinary imaging market is driven by various factors, including artificial intelligence in veterinary medicine across the global regions. By improving productivity, accuracy, and patient care, artificial intelligence in veterinary imaging has completely transformed the area of veterinary diagnosis and therapy. Increased demand for advanced veterinary care, increased telemedicine and remote consultations, improved diagnostic accuracy, increased efficiency and workflow optimization, research and development initiatives, and electronic health record (EHR) integration are fueling growth. Large amounts of veterinary imaging data is quickly and accurately analyzed and interpreted by AI algorithms, which can also spot subtle patterns and anomalies in pictures that are hard for human practitioners to notice. This helps vets treat patients more effectively and get better results. All things considered, AI in veterinary imaging is revolutionizing the industry, allowing improved patient outcomes, and raising the standard of veterinary care as a whole. Rising veterinary illness incidence, non-invasive diagnostic technologies, increased awareness of animal healthcare, technical improvements, and continuous research and development activities are some of the key drivers propelling the market. These developments make it possible for vets to identify illnesses early, which results in more efficient treatment regimens and a rise in the market for veterinary imaging product.

Restraining Factors

The market expansion for veterinary imaging systems is anticipated to be hampered by the high cost of veterinary imaging product and the significant maintenance requirements of emerging imaging technologies like MRI and CT systems. Adoption is challenging in growing places due to a lack of information about animal healthcare. Furthermore, a shortage of qualified veterinarians is expected to restrict the use of these instruments since they require specialized personnel to operate and assess pictures for accurate diagnosis.

Market Segmentation

The Global Veterinary Imaging Market share is classified into animal type, application and end user

- The small animal segment is expected to hold the largest share of the global veterinary imaging market during the forecast period.

Based on the animal type, the global veterinary imaging market is divided into large animals, small animals. Among these, the small animal segment is expected to hold the largest share of the global veterinary imaging market during the forecast period. The increasing prevalence of acute and chronic illnesses, the expanding number of companion animals, the rising cost of pet care, the increasing use of pet insurance, and technical advancements in small animal imaging modalities are all factors driving the growth of this market.

- The MRI segment is expected to grow at the fastest pace in the global veterinary imaging market during the forecast period.

Based on the product the global veterinary imaging market is divided into MRI, X-ray, CT Imaging & others. Among these, the veterinary MRI segment is expected to hold the largest share of the global veterinary imaging market during the forecast period. X-rays are one of the most regularly utilized diagnostic methods in veterinary clinics due to an increase in the incidence of orthopedic issues in animals. The several concepts of radiographic diagnostics and teleradiology are also covered by pet insurance. Hence, some of the factors driving the segment's growth are increased adoption of pet insurance and increased awareness of the variety of radiography imaging choices available to dogs.

- The orthopedics and traumatology segment are expected to grow at the fastest pace in the global veterinary imaging market during the forecast period.

Based on the application, the global veterinary imaging market is divided into orthopedics & traumatology, oncology, cardiology, dental applications, and others. Among these, the orthopedics and traumatology segment is expected to grow at the fastest pace in the global veterinary imaging market during the forecast period. The majority of revenue came from veterinary imaging applications in orthopedics and traumatology. The dominance of this market is attributed to an increase in animal injuries, a rise in the need for accurate diagnostic tools, and the accessibility of animal care facilities. Veterinary diagnostic imaging technology has several applications in the field of cancer. According to the American Veterinary Medical Association's statistics, neoplasia will occur in one out of every four dogs over their lifetime. About half of all dogs over the age of 10 suffer from cancer. Dogs are affected by cancer at a rate comparable to that of humans, although information on cat cancer prevalence is scarcer. Every year, 412 out of 100,000 cats and roughly 4.2 million canines in the US receive a cancer diagnosis.

- The veterinary clinics segment is expected to grow at the fastest pace in the global veterinary imaging market during the forecast period.

Based on the end users, the global veterinary imaging market is divided into veterinary clinics and others. Among these, the veterinary clinics segment is expected to hold the largest share of the global veterinary imaging market during the forecast period. The development of imaging technologies is driven by the need for fast, easy, and reliable diagnostic tools in the field of veterinary medicine. In a nationwide survey of pet owners conducted by the financial website Lend EDU, over half of all Americans said they spend as much or more on their dogs' medical care as they do for themselves.

Regional Segment Analysis of the Global Veterinary Imaging Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global veterinary imaging market over the predicted timeframe.

North America is anticipated to hold the largest share of the global veterinary imaging market over the predicted timeframe. Numerous factors, including the widespread adoption of companion animals by Americans and Canadians, high pet care expenditures, growing employment opportunities in the veterinary industry, and alluring reimbursement options, have contributed significantly to the region's supremacy. Moreover, because the region places a great deal of emphasis on introducing novel products, there is a greater uptake of technologically sophisticated tomography items. It is anticipated that is supporting regional market expansion.

Asia Pacific is expected to grow at the fastest pace in the global veterinary imaging market during the forecast period. Increased awareness of this tomography, the rising adoption of companion animals, and the Asia-Pacific region present profitable opportunities for major players in the veterinary imaging market, all of which support the industry's expansion. In addition, growing disposable income, better animal health spending, the significance of livestock animals rising, the need for animal food high in protein, the consumption of meat and dairy products rising, and the number of veterinary hospitals with cutting-edge tomography equipment all support market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global veterinary imaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IDEXX Laboratories, Inc.

- FUJIFILM Holdings America Corporation

- VetZ GmbH

- Hallmarq Veterinary Imaging Ltd.

- Shenzhen Mindray Animal Medical Technology Co., LTD.

- Heska Corporation

- SOUND

- ESAOTE SPA

- Universal Medical Systems, Inc.

- Bruker

- Hitachi Ltd.

- Siemens Healthcare GmbH

- Epica Animal Health

- MinXray Inc.

- DRAMIÑSKI SA.

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, IDXX Laboratories has introduced its first veterinary diagnostic test, IDEXX Cystatin B, for detecting kidney injury in cats and dogs.

- In February 2022, Fujifilm introduces the VXR Veterinary X-Ray Room, a comprehensive digital radiography system designed to streamline veterinarian workflows, ensure pet health, and provide peace of mind for owners.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Veterinary Imaging Market based on the below-mentioned segments:

Global Veterinary Imaging Market, By Animal

- Small Animal

- Large Animal

Global Veterinary Imaging Market, By Product

- MRI

- X-ray

- CT Imaging

- Others

Global Veterinary Imaging Market, By Application

- Orthopedics And Traumatology

- Oncology

- Cardiology

- Dental Application

- Others

Global Veterinary Imaging Market, By End User

- Veterinary Clinics

- Others

Global Veterinary Imaging Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which is the leading region in the veterinary imaging market?North America is leading the veterinary diagnostic imaging market.

-

2. What is the key driving factor of global veterinary imaging market?The key factors driving the market growth include the rising need for timely diagnosis of chronic conditions, increased adoption of imaging technologies in veterinary orthopedics, dentistry, and several other indications, and increased pet adoption & ownership rates.

-

3. How much is global veterinary imaging market worth in 2033?The Global Veterinary Imaging Market Size is anticipated to Exceed 3.57 Billion by 2033, growing at a CAGR of 6.97% from 2023 to 2033.

Need help to buy this report?