Vietnam Animal Feed Market Size, Share, and COVID-19 Impact Analysis, By Product (Antibiotics, Vitamins, Antioxidants, and Amino Acids), By Livestock (Pork/Swine, Poultry, and Cattle), and By Vietnam Animal Feed Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesVietnam Animal Feed Market Insights Forecasts to 2033

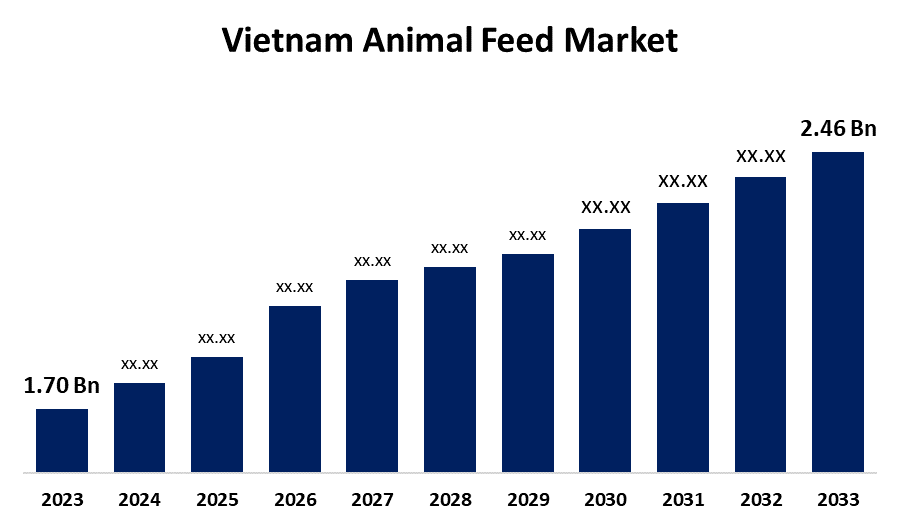

- The Vietnam Animal Feed Market Size was valued at USD 1.70 Billion in 2023.

- The Market is growing at a CAGR of 3.76% from 2023 to 2033

- The Vietnam Animal Feed Market Size is expected to reach USD 2.46 Billion by 2033

Get more details on this report -

The Vietnam Animal Feed Market is anticipated to exceed USD 2.46 Billion by 2033, growing at a CAGR of 3.76% from 2023 to 2033.

Market Overview

The Vietnam animal feed market refers to the industry engaged in producing, distributing, and selling feed for livestock, poultry, and aquaculture. It encompasses a wide range of products, including compound feed, additives, and premixes, catering to the nutritional requirements of various animal species. The market plays a crucial role in supporting the country’s livestock and aquaculture industries, which are significant contributors to the agricultural sector. Several factors are driving the growth of the Vietnam animal feed market. Rising meat consumption, driven by increasing disposable income and urbanization, has led to higher demand for quality feed products. The expansion of commercial livestock farming and aquaculture has further fueled the need for nutritionally balanced feed formulations. Additionally, advancements in feed technology, coupled with a growing preference for high-protein diets in animal nutrition, are contributing to market expansion. Government initiatives play a vital role in shaping the industry. Policies promoting sustainable livestock farming, strict regulations on feed quality and safety, and incentives for foreign investments in the feed sector are fostering industry growth. The government has also encouraged the adoption of modern feed production techniques to enhance efficiency and reduce reliance on imported raw materials, thereby strengthening the domestic supply chain.

Report Coverage

This research report categorizes the market for the Vietnam animal feed market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Vietnam animal feed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Vietnam Animal Feed market.

Vietnam Animal Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.70 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 3.76% |

| 023 – 2033 Value Projection: | USD 2.46 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Product, By Livestock |

| Companies covered:: | BASF SE, Charoen Pokphand Foods PCL, Cargill, Incorporated., dsm-firmenich, Protexin, Nutreco, Novus International, Vedan Vietnam Enterprise Corp.,Ltd, EZ, HONG HA NUTRITION JSC, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The Vietnam animal feed market is driven by multiple factors, including rising meat consumption, rapid urbanization, and increasing disposable income. The expansion of commercial livestock and aquaculture farming has heightened the demand for high-quality feed products. Advancements in feed technology, such as precision nutrition and feed additives, are enhancing productivity and efficiency. Additionally, the growing awareness of animal nutrition and the need for disease prevention are influencing the adoption of fortified feed formulations. Foreign investments and partnerships in the sector are further propelling market growth, while the shift toward sustainable and locally sourced raw materials is strengthening industry resilience.

Restraining Factors

The Vietnam animal feed market faces challenges such as high dependency on imported raw materials, fluctuating feed ingredient prices, stringent regulatory compliance, and concerns over environmental sustainability in large-scale feed production and distribution.

Market Segmentation

The Vietnam animal feed market share is classified into product and livestock.

- The amino acids segment is expected to hold the largest market share through the forecast period.

The Vietnam animal feed market is segmented by product into antibiotics, vitamins, antioxidants, and amino acids. Among these, the amino acids segment is expected to hold the largest market share through the forecast period. Amino acids play a crucial role in animal nutrition by enhancing growth, improving feed efficiency, and supporting overall health. The increasing demand for high-protein diets in livestock and aquaculture, along with the rising focus on optimizing feed formulations for better productivity, is driving the dominance of this segment.

- The poultry segment dominates the market with the largest market share over the predicted period.

The Vietnam animal feed market is segmented by livestock into pork/swine, poultry, and cattle. Among these, the poultry segment dominates the market with the largest market share over the predicted period. The growing demand for poultry meat and eggs, driven by rising consumer preferences for affordable and protein-rich food sources, is a key factor supporting this dominance. Additionally, the expansion of commercial poultry farming, coupled with advancements in feed formulations to enhance growth rates and disease resistance, is further propelling market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Vietnam animal feed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Charoen Pokphand Foods PCL

- Cargill, Incorporated.

- dsm-firmenich

- Protexin

- Nutreco

- Novus International

- Vedan Vietnam Enterprise Corp.,Ltd

- EZ

- HONG HA NUTRITION JSC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-added resellers (VARs)

Recent Developments

- In November 2023, Entobel, a manufacturer of insect protein, inaugurated the largest new black soldier fly (BSF) manufacturing facility in Asia. The production facility will have a production capacity of 10,000 metric tons of insect protein.

Market Segment

- This study forecasts revenue at Vietnam, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Vietnam animal feed market based on the below-mentioned segments

Vietnam Animal Feed Market, By Product

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

Vietnam Animal Feed Market, By Livestock

- Pork/Swine

- Poultry

- Cattle

Need help to buy this report?