Global Voice Commerce Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Smart Speakers, Smartphones), By Deployment Mode (On-Premises, Cloud), By Industry Vertical (Consumer Goods & Retail, Healthcare, Automotive, Travel & Tourism, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Electronics, ICT & MediaGlobal Voice Commerce Market Insights Forecasts to 2033

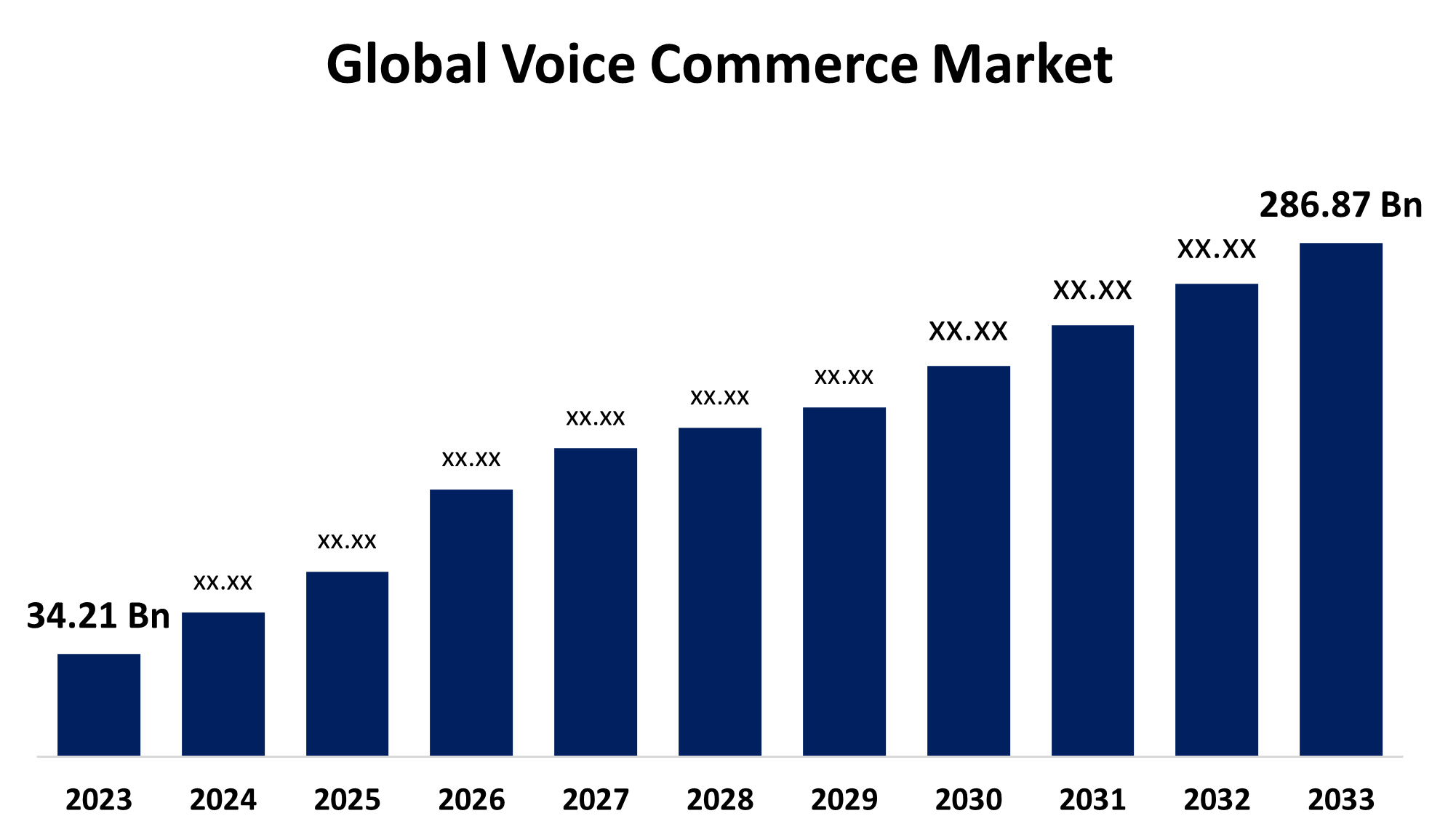

- The Global Voice Commerce Market Size Was Estimated at USD 34.21 Billion in 2023

- The Market Size is expected to grow at a CAGR of around 23.70% from 2023 to 2033

- The Worldwide Voice Commerce Market Size is Expected to Reach USD 286.87 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The global voice commerce market size was valued at USD 34.21 billion in 2023 and is expected to reach USD 286.87 billion by 2033, growing at a CAGR of 23.70% from 2023 to 2033. The global market of voice commerce is driven by the rising popularity of voice-activated smart gadgets. With the help of voice assistants such as Apple Siri, Google Assistant, Microsoft’s Cortana, and Amazon Alexa, consumers can buy conveniently without using their hands. Voice commerce has been incorporated by major e-commerce companies like Flipkart, Amazon, and others, which has simplified the shopping experience. Voice recognition accuracy has increased dramatically due to advancements in AI and NLP, which have increased confidence in voice commerce. Consequently, this has strengthened the vital role that voice commerce plays in the development and expansion of the e-commerce industry.

Market Overview

The voice commerce industry is the sector in which consumers use voice commands via virtual assistants such as Microsoft’s Cortana, Siri, Amazon Alexa, or Google Assistant to find and buy products online, enabling them to shop hands-free by speaking rather than typing; it is a segment of e-commerce that depends on voice recognition technology and natural language processing to comprehend customer queries and finalize transactions.

The growing adoption of smart devices such as smartphones, laptops, smart electronic devices, and IoT-enabled gadgets has resulted in enhanced consumer ease in utilizing voice commands for everyday activities, including shopping, entertainment, financial transactions, and more. In 2023, the worldwide worth of e-commerce transactions involving voice assistants was projected to approach nearly $20 billion. It occurs due to the increasing adoption of smart devices and voice assistants like Amazon Alexa, and others these are significantly contributing to the industry growth, especially, Amazon Alexa, which has a substantial impact on Amazon’s overall revenue.

Moreover, hectic routines increase the need for convenient shopping, prepared meals, and streamlined transaction methods. This demand for multitasking drives consumers to seek out technologies that provide convenience. Moreover, there is an increasing desire for easy and hands-free shopping experiences featuring quick transactions and swifter purchases. Voice commerce addresses these demands, becoming an essential component of the contemporary consumer's shopping journey.

Report Coverage

This research report categorizes the global voice commerce market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global voice commerce market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global voice commerce market.

Global Voice Commerce Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 34.21 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 23.70% |

| 2033 Value Projection: | USD 286.87 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Device Type, By Deployment Mode, By Industry Vertical, By Region |

| Companies covered:: | Amazon, Apple, Tencent, Panasonic Corporation, LG Electronics, Alibaba, Google, Baidu, Samsung, IBM, Nuance Communications, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing availability of the internet with technological awareness and smartphone adoption as well as the growing appeal of smart home appliances. Customers are growing more familiar with utilizing voice commands for a variety of tasks, including purchasing, as more of them embrace these technologies. The demands of busy lifestyles are met by voice assistants built into smartphones and smart home appliances, which offer a smooth and hands-free purchasing experience. Voice commerce's effectiveness and ease draw customers looking for speedy transactions and multitasking features. The market for voice commerce is growing as a result of this tendency, which makes it a crucial component of the contemporary retail environment.

Moreover, the increasing use of smart speakers and voice assistants is driving the growth of voice commerce, allowing consumers to place orders through smart speakers while engaged in other tasks like cooking, traveling, and working on priorities. This voice process for placing orders eliminates the necessity for complex navigation or manual entry, which is especially beneficial for the elderly or individuals with disabilities, as they may find conventional online shopping platforms more difficult to use.

The rising trend of smart devices such as smartphones, laptops, tablets, and smart home gadgets, along with the surge in smartphone usage, is driving the voice commerce sector. Partnerships between tech suppliers and retail businesses are fueling market expansion as retailers allocate resources to voice commerce platforms to improve customer interaction. Collaborations between e-commerce leaders and voice assistant creators develop tailored voice shopping experiences, enhancing convenience for consumers and enabling retailers to collect important consumer insights for targeted marketing. Progress in AI and NLP has enhanced the precision of voice recognition, building confidence in voice commerce. As a result, voice commerce is emerging as a key element of the e-commerce landscape, with further expansion anticipated.

Restraints and challenges

Increasing incidences of consumer data privacy and risk so, a significant amount of personal data is frequently associated with the accounts connected to these devices, including payment information, which makes it a potential target for cybercriminals. Consumers might feel apprehensive about the possibility of unauthorized third parties accessing their data, which could potentially lead to identity theft or fraud.

Market Segmentation

The global voice commerce market share is classified into device type, deployment mode, and industry vertical.

- The smart speakers segment secured a dominant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the device type, the global voice commerce market is classified into smart speakers and smartphones. Among these, the smart speakers segment secured a dominant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance is due to the increasing use of smart speakers in households globally. This increased internet penetration and the demand for hands-free ordering and entertainment, smart speakers such as Apple HomePod, Xiaomi Sound, Google Nest Mini, Amazon Echo Studio, and Marshall Stanmore II Wireless Smart Speaker, with integrated voice assistance, have become popular household devices.

- The cloud segment held a significant share of the market in 2023 and is expected to grow at a notable CAGR during the forecast period.

Based on the deployment mode, the global voice commerce market is categorized into on-premises and cloud. Among these, the cloud segment held a significant share of the market in 2023 and is expected to grow at a notable CAGR during the forecast period. This is due to, their advantages such as scalability, flexibility, and cost-effectiveness, that help to serve efficiently. Also, businesses can effortlessly expand their voice commerce platforms to meet growing demand without requiring substantial initial investment in hardware and infrastructure. Additionally, Cloud-based solutions offer access to advanced AI and analytical tools, allowing businesses to enhance their voice commerce strategies and boost customer engagement.

- The consumer goods & retail segment accounted for the highest share in 2023 and is anticipated to grow at a prominent CAGR during the forecast period.

Based on the industry vertical, the global voice commerce market is divided into consumer goods & retail, healthcare, automotive, travel & tourism, and others. Among these, the consumer goods & retail segment accounted for the highest share in 2023 and is anticipated to grow at a prominent CAGR during the forecast period. This segmental growth is driven by, the continuous adoption of digitalization in businesses including retailers, wholesalers, and others, that helps to be connected with consumers efficiently. Additionally, Improvements in voice recognition technology have allowed retailers to provide a more interactive and user-friendly shopping experience. Shoppers can now communicate with virtual assistants to look for particular items, compare costs, and even monitor orders, all without having to physically touch their devices.

Regional Segment Analysis of the Global Voice Commerce Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

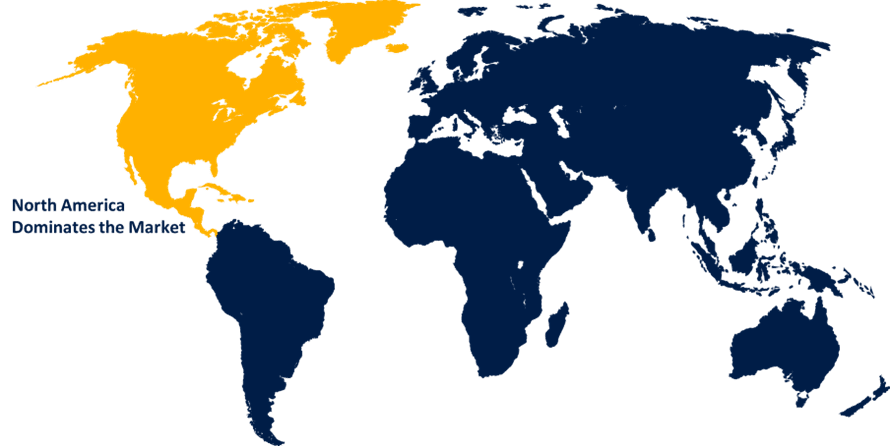

North America is expected to hold the dominant share of the global voice commerce market over the predicted timeframe.

Get more details on this report -

North America is expected to hold the dominant share of the global voice commerce market over the predicted timeframe. This regional dominance is attributed to the high adoption rate of advanced technologies. Thus, Improvements in voice recognition technology have allowed retailers to provide a more interactive and user-friendly shopping experience. Shoppers can now communicate with virtual assistants to look for particular items, compare costs, and even monitor orders, all without having to physically touch their devices.

Moreover, the emergence of major e-commerce companies such as Walmart, eBay, Amazon, Apple, Target, and others has greatly embraced voice commerce as the path for boosting their business and market reach by engaging with consumers. Also, the increasing demand for voice-enabled products and services keeps rising as these businesses add more voice-activated shopping features. Additionally, the presence of major companies in the region is fuelling the industry growth by collaborating with each other, making new innovations and new product launches. In June 2023, IBM launched Watson, an AI-powered voice commerce platform, to provide enterprises with a sophisticated voice-driven shopping experience across multiple channels. These kinds of innovations are improving consumer interest in businesses and driving industry growth across the region.

The Asia-Pacific voice commerce market is expected to grow with the fastest CAGR during the forecasting period. This regional growth is significantly influenced by the increasing penetration of smartphones, rising disposable incomes, and growing consumer awareness about smart technologies. China, India, and Japan are the major contributors to the growth of the voice commerce market in Asia Pacific, with significant investment in smart technologies and the growing popularity of voice-activated devices. Also, Voice assistance is revolutionizing e-commerce platforms by offering intuitive, hands-free shopping experiences. According to the Indian Brand Equity Foundation (IBEF), India's e-commerce market achieved a Gross Merchandise Value (GMV) of US$ 60 billion in FY 2023, reflecting a 22% growth from the previous year. This significant increase highlights the powerful impact of voice-driven interactions in enhancing consumer engagement and driving market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global voice commerce market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amazon

- Apple

- Tencent

- Panasonic Corporation

- LG Electronics

- Alibaba

- Baidu

- Samsung

- IBM

- Nuance Communications

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2024, Samsung enhanced its AI voice control for Bespoke appliances, making it easier for users to manage their appliances through improved voice commands. The advanced AI technology provides more precise and intuitive control, simplifying the operation and customization of Samsung's smart home appliances, and improving home life.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global voice commerce market based on the below-mentioned segments:

Global Voice Commerce Market, By Device Type

- Smart Speakers

- Smartphones

Global Voice Commerce Market, By Deployment Mode

- On-Premises

- Cloud

Global Voice Commerce Market, By Industry Vertical

- Consumer Goods & Retail

- Healthcare

- Automotive

- Travel & Tourism

- Others

Global Voice Commerce Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the global voice commerce market over the forecast period?The global voice commerce market size was valued at USD 34.21 billion in 2023 and is expected to reach USD 286.87 billion by 2033, growing at a CAGR of 23.70% from 2023 to 2033

-

Which region holds the largest share of the global voice commerce market?North America is estimated to hold the largest share of the global voice commerce market over the predicted timeframe.

-

Who are the top key players in the global voice commerce market?Amazon, Apple, Tencent, Panasonic Corporation, LG Electronics, Alibaba, Google, Baidu, Samsung, IBM, Nuance Communications, and Others.

Need help to buy this report?