Global VVT & Start-Stop System Market Size, Share, and COVID-19 Impact Analysis, By Technology (Cam-phasing, Cam-phasing Plus Changing, BAS, Enhanced Starter, Direct Starter, ISG), By Valvetrain (SOHC, DOHC), By Vehicle (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal VVT & Start-Stop System Market Insights Forecasts to 2033

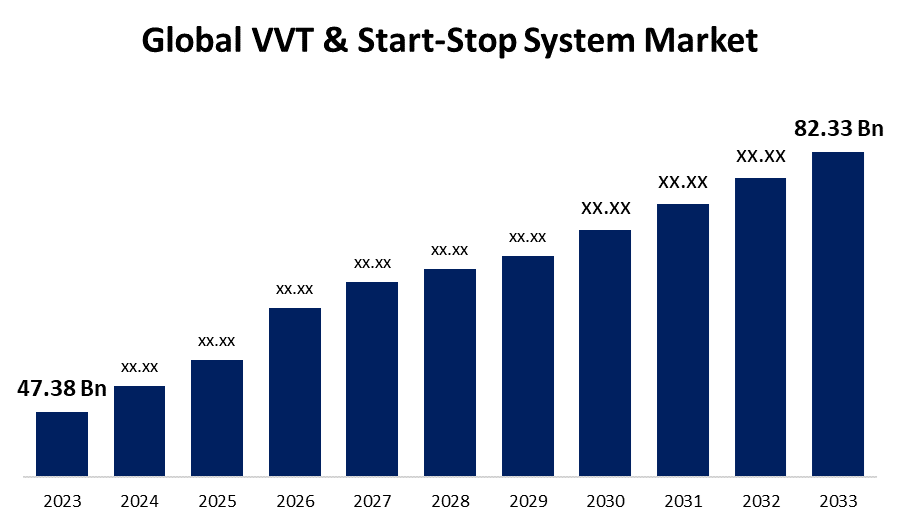

- The Global VVT & Start-Stop System Market Size was Valued at USD 47.38 Billion in 2023

- The Market Size is Growing at a CAGR of 5.68% from 2023 to 2033

- The Worldwide VVT & Start-Stop System Market Size is Expected to Reach USD 82.33 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global VVT & Start-Stop System Market Size is Anticipated to Exceed USD 82.33 Billion by 2033, Growing at a CAGR of 5.68% from 2023 to 2033.

Market Overview

Variable valve timing (VVT) is an automotive engine technology that adjusts the timing of the engine's intake and exhaust valves as they open and close. This adjustment is made continually and variably to maximize engine performance at different RPMs, improving fuel efficiency, cutting emissions, and increasing overall engine power and responsiveness. A startup system is an automotive technology that automatically shuts down and restarts the internal combustion engine when the vehicle comes to a stop, such as at traffic lights or while idling. This technique decreases fuel consumption and emissions by eliminating unnecessary engine use while the vehicle is stationary, resulting in improved fuel efficiency and environmental sustainability. The increase in hybrid car production, government incentives to encourage hybrid vehicle purchases, and hybrid vehicle adoption have all increased demand for start-stop systems. OEMs are currently focused on employing ultracapacitors for engine start-stop. For example, Continental Automotive Systems' Maxwell Technologies offered the voltage stabilization system (VSS) as a standard feature in the 2016 Cadillac ATS, CTS sedans, and ATS coupes (except the ATS-V, CT6 variants). Despite the rapid expansion of electric vehicles, the VVT & start-stop system market is expected to increase steadily because of rising demand for hybrid and other alternative fuel ICE vehicles. As a result, the increased demand for hybrid cars will likely increase the production of VVT and start-stop systems.

Report Coverage

This research report categorizes the market for the global VVT & start-stop system market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global VVT & start-stop system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global VVT & start-stop system market.

Global VVT & Start-Stop System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 47.38 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.68% |

| 2033 Value Projection: | USD 82.33 Billion |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 219 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Valvetrain, By Vehicle, By Region |

| Companies covered:: | BorgWarner Inc, Robert Bosch GmbH, Aptiv PLC, Continental AG, Mitsubishi Electric Corporation, Hitachi, Ltd. (Hitachi Automotive Systems, Ltd., Johnson Controls International Plc, DENSO Corporation, Valeo S.A, Aisin Seiki Co., Ltd, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Petrol, diesel, and other fuel prices are rising at an exponential rate, making it difficult for the majority of consumers to afford automotive fuel. Because of the increase in petrol prices, the demand for fuel-efficient vehicles is increasing, forcing automobile manufacturers to produce vehicles with great fuel efficiency. VVT and start-stop systems in automobiles halt the engine when the car comes to a stop, such as at a red light, then restart when the driver releases the brake to press the gas pedal. The operation of the VVT and start-stop system avoids wasteful fuel consumption when the vehicle is idle, hence increasing fuel efficiency and vehicle mileage. Thus, there is an increase in demand for fuel-efficient vehicles.

Restraining Factors

The high cost of the start-stop system, as well as engine wear owing to increased start-stop cycles, are two main concerns that may limit the growth of the VVT & start-stop system market.

Market Segmentation

The global VVT & start-stop system market share is classified into technology, valvetrain, and end user.

- The cam-phasing segment is expected to hold the largest share of the global VVT & start-stop system market during the forecast period.

Based on the technology, the global VVT & start-stop system market is categorized into cam-phasing, cam-phasing plus changing, bas, enhanced starter, direct starter, and ISG. Among these, the cam-phasing segment is expected to hold the largest share of the global VVT & start-stop system market during the forecast period. The acceptance of cam-phasing VVT technology is heavily affected by its use in passenger vehicles. Furthermore, the inexpensive cost of cam-phasing VVT systems is a major factor behind their popularity in the Asia-Pacific area. Cam-phasing requires only one hydraulic phasing actuator, unlike other systems that use separate mechanisms for each cylinder. This simple application encourages OEMs to use cam-phasing technology.

- The SOHC segment is expected to grow at the fastest CAGR during the forecast period.

Based on the valvetrain, the global VVT & start-stop system market is categorized into SOHC and DOHC. Among these, the SOHC segment is expected to grow at the fastest CAGR during the forecast period. A SOHC design normally allows for two or three valves per cylinder, with one valve allowing air in and the other allowing gases to exit. However, a manufacturer's engineering prowess can allow for four valves per cylinder arrangement employing SOHC. Because the bulk of the valvetrain is reduced in this form, a SOHC 4-valve engine will have more torque in the low end. In comparison, because of the increased mass of the valvetrain.

- The passenger car segment is expected to hold a significant share of the global VVT & start-stop system market during the forecast period.

Based on the end user, the global VVT & start-stop system market is categorized into passenger car, light commercial vehicle, and heavy commercial vehicle. Among these, the passenger car segment is expected to hold a significant share of the global VVT & start-stop system market during the forecast period. The adoption of VVT and start-stop technologies is likely to be faster in passenger vehicles than in LCVs and HCVs. Another element driving the expansion of the passenger automobile category is rising purchasing power in developing countries. Initially, VVT and start-stop technologies are intended to be integrated into mild-hybrid and premium passenger vehicles. Due to intense rivalry in the premium car category, luxury carmakers such as Audi, BMW, Mercedes-Benz, and others have shifted their focus to fuel efficiency and modern technology supported by electric cam phasers and start-stop systems. Existing rules in Europe governing VVT and start-stop system systems would be a significant element in the region's industry growth.

Regional Segment Analysis of the Global VVT & Start-Stop System Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the global VVT & start-stop system market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global VVT & start-stop system market over the forecast period. Automotive production is expanding in Japan, China, and India. Because of increased car production with VVT systems, the area has the highest global share of VVT systems. India is growing rapidly due to an increased preference for diesel-powered vehicles, which has resulted in a need for VVT systems for diesel engines in the country. Furthermore, increasing socioeconomic situations in Asian countries such as India, Thailand, and Indonesia have led to an increase in the number of premium passenger automobiles. This has pushed the demand for VVT and start-stop systems in these countries. Many automotive manufacturers are focusing on the Asia Pacific region due to various benefits such as the simple supply of affordable labour, access to innovative machines, and forgiving environmental rules.

North America is expected to grow at the fastest CAGR growth of the global VVT & start-stop system market during the forecast period. The significant developments in the development of VVT and start-stop technologies. The United States is a leader in the adoption of cutting-edge automotive technologies. The established vehicle manufacturing industry in the United States, including Michigan, Ohio, and Indiana, can provide significant market growth opportunities. The region's large number of global market players will help it maintain a significant market share. Many VVT technology providers in the United States supply low-cost VVT solutions, increasing their acceptability in a wide range of automotive vehicles. Furthermore, increasing demand for electromobility solutions is likely to drive market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global VVT & start-stop system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BorgWarner Inc

- Robert Bosch GmbH

- Aptiv PLC

- Continental AG

- Mitsubishi Electric Corporation

- Hitachi, Ltd. (Hitachi Automotive Systems, Ltd.

- Johnson Controls International Plc

- DENSO Corporation

- Valeo S.A

- Aisin Seiki Co., Ltd

- Others

Key Market Developments

- In April 2021, Robert Bosch GmbH launched a joint venture with Qingling Motors to establish Bosch Hydrogen Powertrain Systems (Chongqing) Co., Ltd. in China. The joint venture's goal is to deliver fuel cells to all automobile manufacturers in China.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global VVT & start-stop system market based on the below-mentioned segments:

Global VVT & Start-Stop System Market, By Technology

- Cam-phasing

- Cam-phasing Plus Changing

- BAS

- Enhanced Starte

- Direct Starter

- ISG

Global VVT & Start-Stop System Market, By Valvetrain

- SOHC

- DOHC

Global VVT & Start-Stop System Market, By Vehicle

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Global VVT & Start-Stop System Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global VVT & start-stop system market over the forecast period?The Global VVT & Start-Stop System Market Size is Expected to Grow from USD 47.38 Billion in 2023 to USD 82.33 Billion by 2033, at a CAGR of 5.68% during the forecast period 2023-2033.

-

2.Which region is expected to hold the highest share in the global VVT & start-stop system market?Asia Pacific is projected to hold the largest share of the global VVT & start-stop system market over the forecast period.

-

3.Who are the top key players in the VVT & start-stop system market?BorgWarner Inc, Robert Bosch GmbH, Aptiv PLC, Continental AG, Mitsubishi Electric Corporation, Hitachi, Ltd. (Hitachi Automotive Systems, Ltd., Johnson Controls International Plc, DENSO Corporation, Valeo S.A, Aisin Seiki Co., Ltd, and others.

Need help to buy this report?