Global Wafer Cutting Fluids Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Water-Soluble, and Water-Insoluble), By Application (Semiconductor, Solar Wafer, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Wafer Cutting Fluids Market Insights Forecasts to 2033

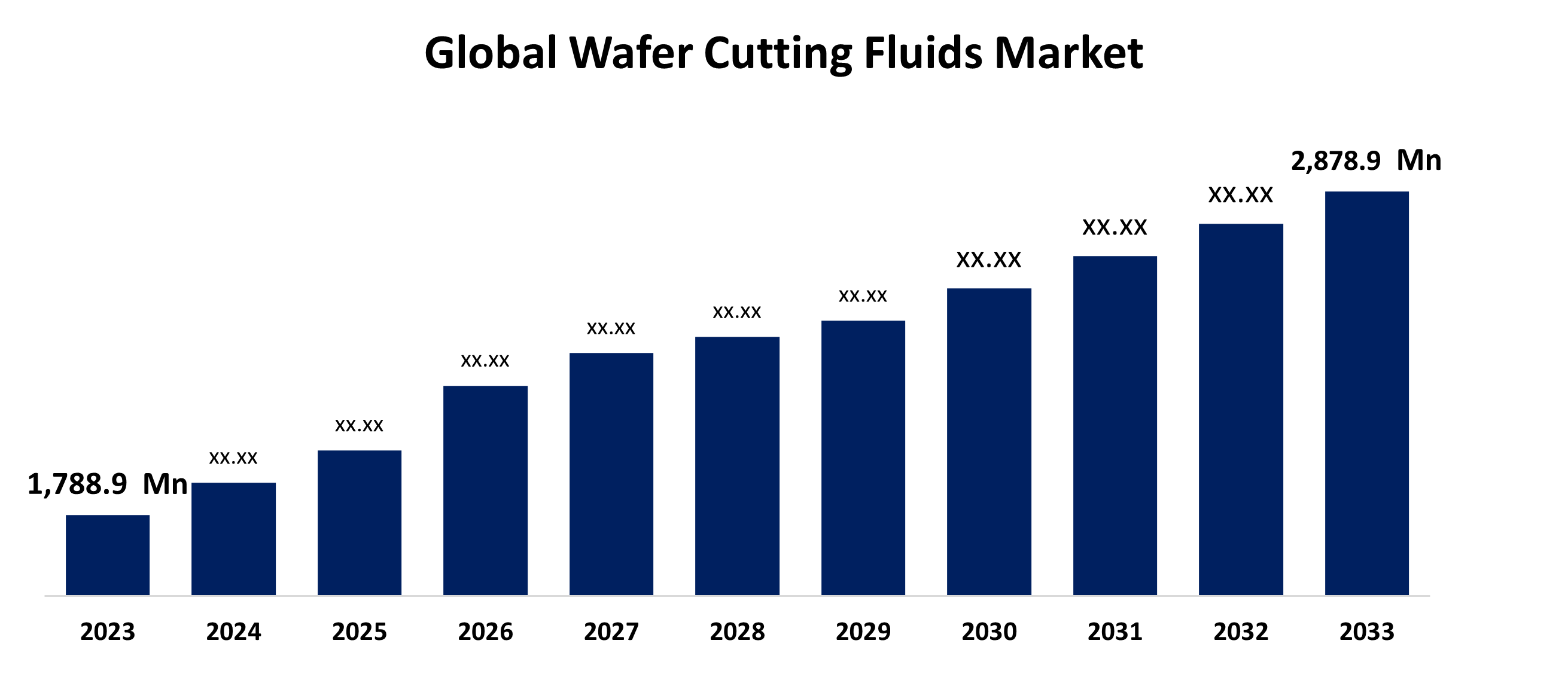

- The Global Wafer Cutting Fluids Market Size was Valued at USD 1,788.9 Million in 2023

- The Market Size is Growing at a CAGR of 4.87% from 2023 to 2033

- The Worldwide Wafer Cutting Fluids Market Size is Expected to Reach USD 2,878.9 Million by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Wafer Cutting Fluids Market Size is Anticipated to Exceed USD 2,878.9 Million by 2033, Growing at a CAGR of 4.87% from 2023 to 2033.

Market Overview

Wafer-cutting fluids are liquids that are utilized in the semiconductor and solar industries. They are utilized to cut wafers, which are slim silicon sheets that are cast off to create solar cells and other electronic devices. Wafer-cutting fluids help in the formation of clean cuts without causing impairment to the wafer or the surrounding area. Furthermore, the fluid scrubs and lubricates the surfaces of a wafer as it is cut. Wafer-cutting fluids are vital because they support ensuring a clean, accurate cut while averting wafer impairment. Moreover, wafer-cutting fluid offers steady high wafer quality, high yield, less wafer breakage, low power consumption, minimized kerf loss, high recycling efficiency, neutral pH, non-corrosive properties, and suitable thermal conductivity. Wafer-cutting fluid improves the cutting process by growing productivity, lowering energy consumption, creating cleaner wafers, and refining downstream processing and facility operations in terms of materials, waste treatment, waste discharge, and logistics. In addition, cutting fluid is a kind of coolant and lubricant that is created for usage in metalworking operations like stamping and machining. Cutting fluids derive in a variety of forms, for instance, oils, oil-water emulsions, pastes, gels, aerosols (mists), air, and other gases. Cutting fluids can be formed using petroleum distillates, water, air, plant oils, animal fats, and other basic materials. Cutting fluids might be referred to as cutting fluid, cutting oil, cutting compound, coolant, or lubricant depending on the situation and the form of cutting fluid under consideration. Cutting fluids can be not only gaseous but also liquid. Cutting fluids is frequently used in metalworking operations containing machining and stamping.

Report Coverage

This research report categorizes the market for the global wafer-cutting fluids market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global wafer-cutting fluids market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global wafer-cutting fluids market.

Global Wafer Cutting Fluids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1,788.9 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.87% |

| 2033 Value Projection: | USD 2,878.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 203 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, By Region |

| Companies covered:: | Evonik Industries AG, Momentive, Exxon Mobil Corporation, Dynatex International, Keteca Singapore (Pte) Ltd., BASF SE, SINO-JAPAN CHEMICAL CO. LTD., UDM Systems, LLC, Valtech Corporation,, Dow Chemical,, Pace Technologies Corporation, SIC-Processing, Liaoning Oxiranchem, Liaoning Kelongchem, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for solar panels is witnessed to be a significant driver of the wafer-cutting fluids market. The constant growth in the demand for solar panels has resulted in an associated need for progressive and efficient wafer manufacturing processes that include wafer-cutting fluids. This surge in solar panel manufacture is primarily credited to various factors such as technological advancements, government grants, and the growing focus on renewable energy sources as a means of reducing environmental issues and endorsing sustainable practices. Moreover, the imperiousness to embrace sustainable manufacturing practices stands as an essential driver in fostering the adoption of water-soluble wafer-cutting fluids. As businesses increasingly prioritize environmental responsibility, water-soluble fluids deliver a compelling solution. These fluids deliver effective cooling and lubrication and suggestively reduce environmental impact compared to traditional oil-based complements. Furthermore, water-soluble cutting fluids can be simply filtered and treated, reducing waste generation and easing recycling. Producers are drawn to these eco-friendly fluids as they make them even healthier with stringent regulations, decrease their carbon footprint, and establish a greener production ecosystem. The swift uptake of water-soluble wafer-cutting fluids highlights their crucial role in nurturing a more sustainable and environmentally aware manufacturing landscape.

Restraining Factors

Advancements in substitute-cutting technologies create a potential challenge to the global wafer-cutting fluids market. The new substitute cutting technologies could hinder the market by delivering more efficient and cost-effective solutions for wafer cutting. Moreover, growing focus on environmental sustainability, the products in the market providing less sustainable solutions or manufacturing processes associated therein could impact the market. Furthermore, cutting fluids could pose hazards not only due to the specific constituents that are contained within the fluid but also as a result of contaminants that water-based cutting fluids might accumulate during manufacturing processes. Certain constituents present in cutting fluids might have adverse effects mutually on the environment and individual health.

Market Segmentation

The global wafer-cutting fluids market share is classified into product type, and application.

- The water-soluble segment is expected to hold the largest share of the global wafer-cutting fluids market during the forecast period.

Based on the product type, the global wafer-cutting fluids market is divided into water-soluble, and water-insoluble. Among these, the water-soluble segment is expected to hold the largest share of the global wafer-cutting fluids market during the forecast period. This is attributed to the capability of the product to simply dilute with water is experiential to be the greatest driver for the dominance and high demand for water-soluble products. Water-soluble is cost-effective as the complete product is not directly used in wafer cutting and associated processes. Water-soluble cutting fluids aid decrease waste and pollution, as they are easier to dispose of and are less harmful to the environment in comparison with other related fluids.

- The semiconductor segment is expected to hold the largest share of the global wafer-cutting fluids market during the forecast period.

Based on the application, the global wafer-cutting fluids market is divided into semiconductors, solar wafers, and others. Among these, the semiconductor segment is expected to hold the largest share of the global wafer-cutting fluids market during the forecast period. This is attributed to wafer-cutting fluids being a crucial component of the semiconductor manufacturing procedure. Wafer-cutting fluids are utilized to lubricate the cutting tools and progress the quality of the wafer surfaces after cutting. Furthermore, various types of cutting fluids are utilized depending on the precise application and necessities of the manufacturing process. Therefore, growing market demand for semiconductors has directly increased the demand and production of these fluids.

Regional Segment Analysis of the Global Wafer-Cutting Fluids Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

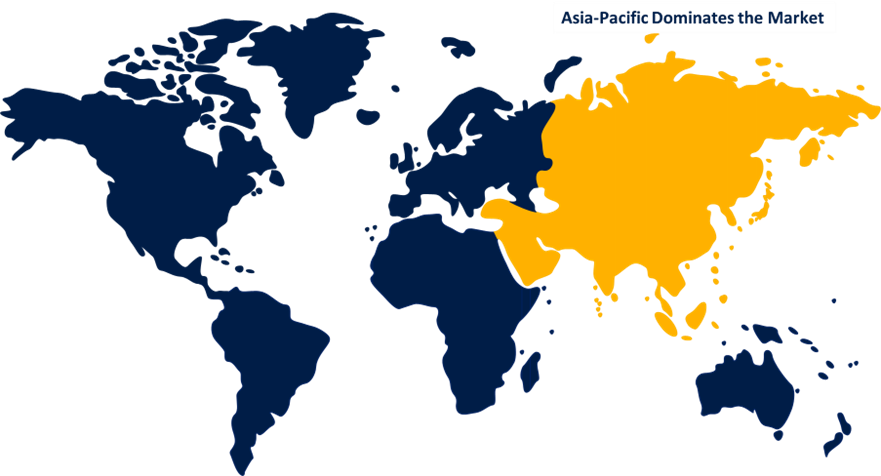

Asia Pacific is anticipated to hold the largest share of the global wafer-cutting fluids market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global wafer-cutting fluids market over the predicted timeframe. This is attributed to the swift development of end-use industries such as semiconductors, solar energy, and others. Furthermore, it is anticipated that increasing foreign investments and supportive government policies will propel manufacturing development in this region. Moreover, the presence of these producers in Taiwan and China along with the growing demand for semiconductors is observed to be the driving factor for the wafer-cutting fluid market. Asia Pacific region is one of the foremost solar wafer-cutting fluid producers, with China and India being the crucial consumers and providers of solar wafer-cutting fluid. The solar wafer cutting fluid is utilized in the electrical and electronics industry, to be applied in semiconductor, chips, photovoltaic, and other products’ cutting, cooling, and manufacturing purposes. The increasing growth of electrical and electronics manufacturing has raised the development of the wafer-cutting fluid market.

North America is expected to grow at the fastest pace in the global wafer-cutting fluids market during the forecast period. This is attributed to the U.S. being the protruding country having the maximum established market. Increasing the end-user industry in North America is the main factor driving its growth. Furthermore, metalworking fluids can be utilized on ferrous metals and alloys such as cast iron, steel, and stainless steel, as well as non-ferrous metals and alloys such as aluminum, nickel, copper, and magnesium. The flourishing semiconductor industry in the nation owing to high dependency on semiconductor chips across diverse application areas is driving the market growth in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global wafer-cutting fluids market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Evonik Industries AG

- Momentive

- Exxon Mobil Corporation

- Dynatex International

- Keteca Singapore (Pte) Ltd.

- BASF SE

- SINO-JAPAN CHEMICAL CO. LTD.

- UDM Systems, LLC

- Valtech Corporation,

- Dow Chemical,

- Pace Technologies Corporation

- SIC-Processing

- Liaoning Oxiranchem

- Liaoning Kelongchem

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, Evonik Industries AG, the German chemicals producer, revealed cutting-edge dampening and defoaming solutions, enhancing wafer cutting despite manufacturing shifts to harder materials. Tego Surten E products deliver innovative cutting fluids for high-speed diamond and multi-wire sawing in PV wafer cutting. These solutions facilitate faster, better cutting with thinner wires and augmented draw speeds. Low-foaming formulas with ultra-low surface tension improve cut quality, speed, and dosing efficiency, producing higher-quality wafers.

- In May 2022, the introduction of the TEGO Surten E-portfolio by Evonik in China is a development strategy, which emphasizes evolving high-value products. The company proposes to remain at the head of the wafer-cutting fluid market, pouring innovation and offering important value to the global solar energy sector.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global wafer-cutting fluids market based on the below-mentioned segments:

Global Wafer Cutting Fluids Market, By Product Type

- Water-Soluble

- Water-Insoluble

Global Wafer Cutting Fluids Market, By Application

- Semiconductor

- Solar Wafer

- Others

Global Wafer Cutting Fluids Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Evonik Industries AG, Momentive, Exxon Mobil Corporation, Dynatex International, Keteca Singapore (Pte) Ltd., BASF SE, SINO-JAPAN CHEMICAL CO. LTD., UDM Systems, LLC, Valtech Corporation, Dow Chemical,, Pace Technologies Corporation, SIC-Processing, Liaoning Oxiranchem, Liaoning Kelongchem, and others.

-

2.What is the size of the global wafer-cutting fluids market?The Global Wafer Cutting Fluids Market is expected to grow from USD 1,788.9 Million in 2023 to USD 2,878.9 Million by 2033, at a CAGR of 4.87% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global wafer-cutting fluids market over the predicted timeframe.

Need help to buy this report?