Global Warehouse Management Systems Market Size, Share, and COVID-19 Impact Analysis, By Offering (Software and Services), By Deployment Type (On-premise and Cloud), By Application (Labor Management System, Analytics & Optimization, Billing & Yard Management, Systems Integration & Maintenance, Consulting Services, Others), By End-Use (E-Commerce, Retail & consumer goods, Healthcare & Pharmaceuticals, Manufacturing, Food & Beverages, Transportation & Logistics, Automotive, Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Semiconductors & ElectronicsGlobal Warehouse Management Systems Market Insights Forecasts to 2032

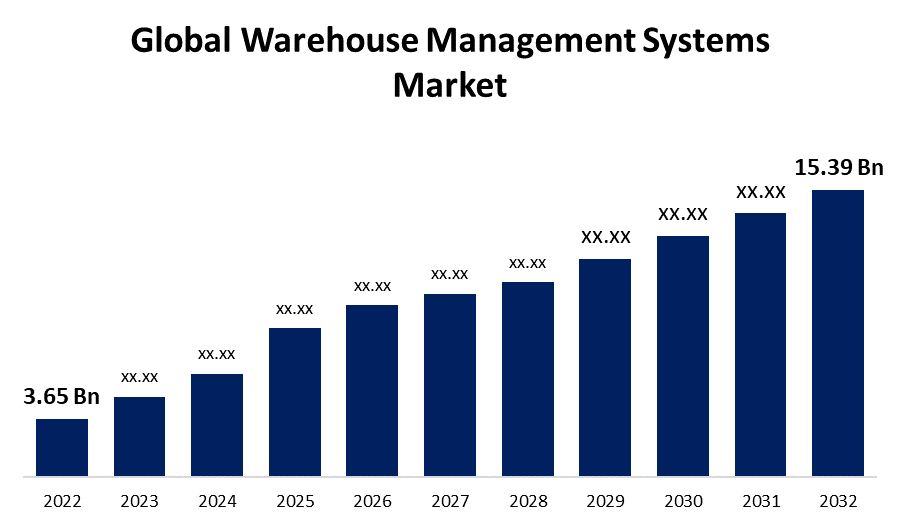

- The Global Warehouse Management Systems Market Size was valued at USD 3.65 Billion in 2022.

- The Market is Growing at a CAGR of 15.48% from 2022 to 2032

- The Worldwide Warehouse Management Systems Market Size is expected to reach USD 15.39 Billion by 2032

- Europe is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Warehouse Management Systems Market Size is expected to reach USD 15.39 billion by 2032, at a CAGR of 15.48% during the forecast period 2022 to 2032.

A warehouse management system, or WMS, is a software program that controls supply chain fulfillment activities from the shipping center to the retail location and provides access to a company's full inventory levels. Warehouse Management Systems (WMS) services also assist businesses to optimize workforce and storage utilization, as well as equipment investments, by organizing and maximizing the utilization of resources and material movements. A warehouse management system (WMS) is frequently used in conjunction with or linked with other related systems, such as ERP systems, transportation management systems (TMS), and inventory management systems.

A warehouse management system (WMS) is designed to assist in keeping track of goods and commodities moved throughout warehouses in the most effective and economical way possible. Many operations which facilitate these movements are handled by a WMS, such as tracking inventories, gathering, acquiring, and putting away. Furthermore, a Warehouse Management System (WMS) plays a crucial part in supply chain management by controlling order fulfillment procedures from the beginning of raw material receipt through the shipment of finished products. The distribution network is able to function as rapidly, precisely, and cost-effectively as warehouse processes allow.

The increasing popularity of online purchases has boosted the market for warehousing. In reaction to the pandemic, people have turned to internet shopping due to the establishment of lockdowns, social distancing, and other safety precautions. As a result, major global corporations are establishing new warehouses in a variety of nations to meet the increased demand. As such, warehouse management systems are increasingly being used in e-commerce and third-party logistics corporations. E-commerce giants like Flipkart Ltd., Amazon.com, and eBay Inc. are increasing their demand for WMS as they build additional warehouses throughout the world.

Report Coverage

This research report categorizes the market for the Global Warehouse Management Systems Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Warehouse Management Systems Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Global Warehouse Management Systems Market.

Global Warehouse Management Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.65 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 15.48% |

| 2032 Value Projection: | USD 15.39 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Offering, By Deployment Type, By Application, By End-Use, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Manhattan Associates, Inc., Oracle Corporation, EPICOR, HighJump Software, Inc. (Korber), PSI Logistics, Synergy Ltd, Made4net, 3PL Central LLC, Tecsys, Infor, Fishbowl Inventory, IBM, Softeon, Infoplus Commerce, SAP, Blue Yonder Group, Inc. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

A warehouse management system reduces turnaround time, speeds up delivering goods, and reduces distribution expenses. Furthermore, the Warehouse Management System (WMS) software is used by a variety of consumers, including third-party logistics companies, B2B distribution organizations, and other manufacturing enterprises. Furthermore, as economies throughout the world grow, numerous sectors such as pharmaceuticals, manufacturing, and e-commerce have been driven toward extremely effective operations to enable maximizing productivity and complying with consumer expectations.

The WMS market is expected to grow promptly because of the shifting supply chain strategies of product manufacturers and significantly increasing demand from consumers, particularly in the transportation and logistics, and consumer goods industries. Furthermore, warehouse management systems are becoming more important in connected technologies such as automated processes, the Internet of Things (IoT), and artificial intelligence (AI)-powered systems due to benefits such as highly effective operating procedures and more precise results. Furthermore, strong expansion in the e-commerce industry and increasing requirements for cloud WMS systems are propelling the warehouse management systems market forward.

Furthermore, IoT is well-suited to automation, which can help to speed up workloads and provide better insight into warehouse activities. The Internet of Things is made up of interconnected devices that have built-in sensor networks designed to transmit and gather data in real time. Furthermore, a number of major and small firms are using and creating IoT-enabled sophisticated technologies. As a result of the increased use of automation technologies such as IoT, AI, and cloud, the warehouse management systems market is growing. The increasing digital transformation of warehouse management systems by a variety of enterprises across several industries is driving end-user penetration. Furthermore, government funding for the increasing construction of a smart warehouse management system is fueling the growth of the warehouse management systems market. Various companies and government bodies are collaborating to strengthen R&D in different industries with evolving productive alliances that lead to indigenous design, development, manufacturing, and deployment of cost-effective warehouse management products and solutions.

Restraining Factors

However, the significant investment necessary for establishing on-premises WMS for small and midsize enterprises as well as worries about the confidentiality of data as well as information integrity, hinder the warehouse management systems market growth. Small and medium-sized enterprises (SMEs) contribute to a significant portion of the worldwide economy. Small and medium enterprises often do not have a large amount of money to dedicate to on-premises WMS systems, which limits the growth of the overall market for on-premises WMS. Furthermore, a general lack of understanding regarding the positive aspects of WMS among small-scale enterprises presents a hurdle to The Warehouse Management System market players.

Market Segmentation

By End-Use Insights

The e-commerce segment accounted the largest market share of more than 38.7% over the forecast period.

On the basis of end-use, the global warehouse management systems market is segmented into e-commerce, retail & consumer goods, healthcare & pharmaceuticals, manufacturing, food & beverages, transportation & logistics, automotive, and others. Among these, e-commerce is dominating the market with the largest market share of 38.7% over the forecast period. The rising popularity of electronic payment methods, social media advertising, internet-based transaction processing, and data exchange via the internet can be ascribed to the rise of the e-commerce sector. E-commerce has revolutionized a traditional retailing perception for businesses, retailers, and end-users by lowering costs, improving quality, and expediting the distribution of goods. The demand for automated distribution facilities has risen as a result of rapidly shifting customer demands, growing interest in online shopping, an increase in the demand for faster delivery intervals, and strong competition among internet-based retail companies. This has led to an increase in the need for flexible and focused warehouse management systems solutions in the e-commerce sector. One of the most rapidly developing end-user industries for the warehouse management systems market is e-commerce. Furthermore, with the increased usage of internet access and internet-enabled devices including computers, tablets, and smartphones, the e-commerce business is witnessing tremendous development.

By Application Insights

The analytics & optimization segment is witnessing significant CAGR growth over the forecast period.

On the basis of application, the global warehouse management systems market is segmented into labor management system, analytics & optimization, billing & yard management, systems integration & maintenance, consulting services, and others. Among these, the analytics & optimization is witnessing significant CAGR growth over the forecast period. Warehouse operations have become more complex as a result of rapid technological improvements and the rising need for more effective storage solutions. As a result, modern warehouse management operations necessitate greater transparency and access to information during all processes so that the data gathered can be used to effectively decrease costs, maximize revenue, and optimize workflows. Furthermore, data insights can be used to discover crucial challenges that might otherwise require a long time to recognize. Businesses can install automation systems to handle these vital duties, as automation aids in the generation of more relevant data, which can eventually boost comprehensive warehouse operations.

By Offering Insights

The services segment is dominating the market with the largest market share over the forecast period.

On the basis of offering, the global warehouse management systems market is segmented into the software and services. Among these, the services segment is dominating the market with the largest market share of 78.32% over the forecast period. The services segment includes consulting, system integration, operation, and maintenance services. Warehouse operations can be contracted by WMS providers to external vendors as a service. Vendors either sell their software to the customer without the service, allowing them to concentrate on their primary line of operations, or they sell the program directly to the customer. Additionally, elements like increased demand in both the manufacturing and retail industries and high consumer financial freedom are important aspects anticipated to promote warehouse management systems market growth in the forecasted period.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 35.7% market share over the forecast period. The ongoing presence of growing countries such as China, Japan, India, and South Korea in the Asia Pacific region is contributing to the growth of the Warehouse Management System market in this specific region. With rising consumer spending power, emerging economies are experiencing an increase in demand for end-use items. This has a beneficial impact on the need for WMS to ensure an uninterrupted supply of items to users. Furthermore, the Indian government's Make in India policy has enabled the opportunity for manufacturing industries and warehousing facilities in India. India is also pushing toward digital transformation, innovative technology, and industrialization. All of these trends have led to compelling demand potential for the Asia Pacific warehouse management systems market.

Europe, on the contrary, is expected to grow the fastest during the forecast period. The innovation of warehouse management systems and the growing recognition of cloud-based warehouse management systems are the key factors propelling the current expansion of the warehouse management systems market in Europe. The existence of vast networks of 3PL (third-party logistics) organizations along with major corporations with worldwide distribution services and storage facilities, as well as continued growth in the e-commerce sector, are fueling the warehouse management systems market growth in Europe.

North America is expected to register a rapid revenue growth rate for the warehouse management systems market during the forecast period. Emerging technological trends such as the incorporation of Internet of Things-enabled devices into goods and components, along with the adoption of business processes management software, such as Oracle's Fusion Middleware, as well Comindware Tracker, and several others, are among the main variables driving revenue growth in this regional warehouse management systems market. Furthermore, as the e-commerce business expands, consumer preferences for higher-quality, better-performing products change, adding to the increase in revenue in the warehouse management systems market in North America.

List of Key Market Players

- Manhattan Associates, Inc.

- Oracle Corporation

- EPICOR

- HighJump Software, Inc. (Korber)

- PSI Logistics

- Synergy Ltd

- Made4net

- 3PL Central LLC

- Tecsys

- Infor

- Fishbowl Inventory

- IBM

- Softeon

- Infoplus Commerce

- SAP

- Blue Yonder Group, Inc.

Key Market Developments

- On February 2023, PSI Logistics GmbH has been appointed for the delivery of the Warehouse Management System PSIwms 2023 by LGI Logistics Group International GmbH. Following the initial implementations at two warehouse locations, the standard product will be rolled out at more logistics hubs. PSIwms will be utilized at these sites to ramp up new customers and, later, to migrate current WMS systems.

- On February 2023, REWE International AG selected Korber's Warehouse Management System (WMS) for deployment in approximately 40 European locations. K.Motion WMS was selected to optimize a complex process landscape while providing maximum flexibility to suit the multi-layered demands of the food and drugstore retail industry. The rollout will occur in two parts. Korber will pilot the WMS at five locations for dry and fresh assortments, as well as cross docking, until mid-2025. Simultaneously, the connection to REWE's existing ERP system will be made. The further 35 properties will be converted with the assistance of Korber via REWE International. The implementation is scheduled for 2028.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Warehouse Management Systems Market based on the below-mentioned segments:

Warehouse Management Systems Market, Offering Analysis

- Software

- Services

Warehouse Management Systems Market, Deployment Type Analysis

- On-premise

- Cloud

Warehouse Management Systems Market, Deployment Type Analysis

- Labor Management System

- Analytics & Optimization

- Billing & Yard Management

- Systems Integration & Maintenance

- Consulting Services

- Others

Warehouse Management Systems Market, End-Use Analysis

- E-Commerce

- Retail & consumer goods

- Healthcare & Pharmaceuticals

- Manufacturing

- Food & Beverages

- Transportation & logistics

- Automotive

- Others

Warehouse Management Systems Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Warehouse Management Systems market?The Global Warehouse Management Systems Market is expected to grow from USD 3.65 billion in 2022 to USD 15.39 billion by 2032, at a CAGR of 15.48% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?PSI Logistics, Synergy Ltd, Made4net, 3PL Central LLC, Tecsys, Infor, Fishbowl Inventory, IBM, Softeon, Infoplus Commerce, SAP

-

3. Which segment dominated the Warehouse Management Systems market share?The e-commerce segment in end-use type dominated the Warehouse Management Systems market in 2022 and accounted for a revenue share of over 38.7%.

-

4. What are the elements driving the growth of the Warehouse Management Systems market?The changing supply chain models of product producers, as well as quickly expanding consumer demand, are significant factors driving the warehouse management system market growth, particularly in the transportation and logistics, and retail sectors.

-

5. Which region is dominating the Warehouse Management Systems market?Asia Pacific is dominating the Warehouse Management Systems market with more than 35.7% market share.

-

6. Which segment holds the largest market share of the Warehouse Management Systems market?The services segment based on offering type holds the maximum market share of the Warehouse Management Systems market.

Need help to buy this report?