Global Wastewater Treatment Services Market Size, Share, and COVID-19 Impact Analysis, Service Type (Design & Engineering Consulting, Building & Installation Service, Operation & Process Control, Maintenance & Repair, and Others), By End-User (Municipal and Industrial), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032).

Industry: Chemicals & MaterialsGlobal Wastewater Treatment Services Market Insights Forecasts to 2032

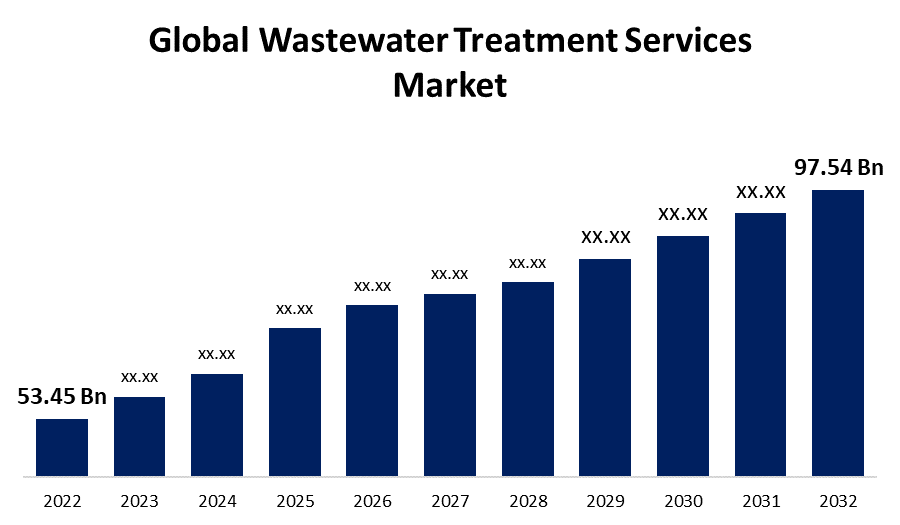

- The Wastewater treatment services market was valued at USD 53.45 Billion in 2022.

- The Market is growing at a CAGR of 6.2% from 2022 to 2032.

- The Global wastewater treatment services market is expected to reach USD 97.54 Billion by 2032.

- Asia-Pacific is expected to grow higher during the forecast period.

Get more details on this report -

The Global wastewater treatment services market is expected to reach USD 97.54 Billion by 2032, at a CAGR of 6.2% during the forecast period 2022 to 2032.

Market Overview

Wastewater treatment services involve the process of treating and purifying wastewater to remove contaminants and pollutants before it is discharged or reused. This vital service ensures the protection of public health and the environment by preventing the contamination of water bodies and groundwater sources. The wastewater treatment process typically includes several stages, such as primary treatment to remove larger solids, secondary treatment to break down organic matter, and tertiary treatment for advanced removal of remaining impurities. Various methods and technologies are employed, including physical, chemical, and biological processes, to effectively treat the wastewater. Additionally, wastewater treatment facilities often incorporate measures to recover valuable resources, such as energy generation from biogas produced during treatment or nutrient-rich biosolids for agricultural use. Wastewater treatment services play a crucial role in maintaining clean and sustainable water systems for communities and ecosystems.

Report Coverage

This research report categorizes the market for wastewater treatment services market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the wastewater treatment services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the wastewater treatment services market.

Global Wastewater Treatment Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 53.45 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 6.2% |

| 022 – 2032 Value Projection: | USD 97.54 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Service Type, By End-User, By Region. |

| Companies covered:: | SUEZ, Veolia Water Technologies, Thermax, Evoqua Water Technologies, Xylem, Ecolab, GE Water, Acciona, Hydro International, Trojan Technologies, American Water, Pentair, SWA Water Australia, Orenco Systems, Aquatech International, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The wastewater treatment services market is influenced by several key drivers. First and foremost, stringent environmental regulations and water quality standards imposed by governments and regulatory bodies drive the demand for wastewater treatment services. The increasing awareness of the need to protect water resources and prevent water pollution further fuels the market growth. Rapid industrialization and urbanization contribute to the rising volume of wastewater generated, necessitating efficient treatment services. Moreover, growing concerns about water scarcity and the need for water reuse propel the demand for advanced treatment technologies. Technological advancements, such as membrane filtration, biological nutrient removal, and energy recovery systems, are also driving market growth by enhancing treatment efficiency and reducing operational costs. Furthermore, government initiatives and funding support for infrastructure development in emerging economies create opportunities for market expansion. Overall, the drivers of the wastewater treatment services market reflect the increasing focus on sustainability, regulatory compliance, and resource optimization.

Restraining Factors

The wastewater treatment services market faces certain restraints that impact its growth potential. One significant restraint is the high initial investment required for setting up and operating wastewater treatment plants. The complex infrastructure and advanced technologies involved often result in substantial capital costs, making it a barrier for small-scale operators. Additionally, the lack of proper maintenance and skilled personnel can hinder the efficiency of treatment facilities. Limited awareness and understanding of the importance of wastewater treatment, especially in certain regions or industries, can also restrict market growth. Moreover, the absence of clear policies and regulations, particularly in developing countries, may impede the adoption of wastewater treatment services. These restraints highlight the need for increased awareness, financial support, and regulatory frameworks to overcome challenges in the wastewater treatment services market.

Market Segmentation

- In 2022, the operation & process control segment accounted for around 34.2% market share

On the basis of service type, the global wastewater treatment services market is segmented into design & engineering consulting, building & installation service, operation & process control, maintenance & repair, and others. The operation and process control segment has emerged as the dominant player, holding the largest market share in the wastewater treatment services industry. This segment encompasses the various technologies and systems that enable efficient and effective operation and control of wastewater treatment processes. One of the key factors contributing to the dominance of the operation and process control segment is the increasing emphasis on operational efficiency and cost optimization in wastewater treatment plants. Advanced process control systems, including supervisory control and data acquisition (SCADA), distributed control systems (DCS), and programmable logic controllers (PLC), are widely adopted to monitor and control various aspects of the treatment process. These systems provide real-time data, enable remote monitoring, and facilitate the automation of key operations, enhancing overall plant performance. Furthermore, the operation and process control segment plays a crucial role in meeting stringent regulatory requirements and compliance standards. The implementation of precise monitoring and control systems ensures that treatment processes are operating within prescribed limits, enabling compliance with water quality standards and environmental regulations. Additionally, the adoption of advanced analytics and optimization techniques in process control further strengthens the market position of this segment. Data-driven decision-making and predictive analytics help optimize process parameters, reduce energy consumption, minimize chemical usage, and improve overall operational efficiency. Moreover, the increasing focus on sustainability and resource recovery in wastewater treatment has propelled the demand for sophisticated operation and process control systems. These systems facilitate the extraction of valuable resources, such as energy generation from biogas or nutrient recovery from wastewater, maximizing the efficiency and sustainability of the treatment process. Overall, the operation and process control segment's dominance is driven by the need for efficient operations, regulatory compliance, sustainability goals, and the integration of advanced technologies to optimize wastewater treatment processes.

- In 2022, the municipal segment dominated with more than 71.6% market share

Based on the end-user, the global wastewater treatment services market is segmented into municipal and industrial. The municipal segment has emerged as the dominant force, holding the largest market share in the wastewater treatment services industry. This segment primarily focuses on providing wastewater treatment solutions for municipal or urban areas. One of the key factors contributing to the dominance of the municipal segment is the rapid urbanization and population growth in various regions. As cities and urban areas expand, there is a corresponding increase in wastewater generation, necessitating efficient treatment solutions to maintain public health and environmental sustainability. Government regulations and initiatives also play a significant role in driving the dominance of the municipal segment. Regulatory bodies often impose stringent standards for wastewater treatment in urban areas to prevent water pollution and protect water resources. Governments worldwide are increasingly investing in wastewater treatment infrastructure, allocating budgets for the development and maintenance of municipal wastewater treatment plants. Moreover, the municipal segment benefits from economies of scale. Serving a larger population allows for the implementation of larger treatment plants and more advanced technologies, resulting in improved efficiency and cost-effectiveness. Additionally, the municipal segment is characterized by long-term contracts and partnerships between service providers and municipalities. These agreements often involve the design, construction, operation, and maintenance of wastewater treatment facilities, ensuring a steady and reliable revenue stream for service providers. Overall, the dominance of the municipal segment in the wastewater treatment services market is driven by urbanization, government regulations, economies of scale, and long-term partnerships, highlighting the critical role of effective wastewater treatment in urban areas.

Regional Segment Analysis of the Wastewater Treatment Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific dominated the market with more than 55.8% revenue share in 2022.

Get more details on this report -

Based on region, the Asia-Pacific region has emerged as the dominant market for wastewater treatment services, holding the largest market share. Rapid industrialization and urbanization in countries like China and India have led to increased wastewater generation, creating a significant demand for treatment services. Furthermore, stringent environmental regulations imposed by governments to tackle water pollution have further propelled market growth. The region also witnesses a growing awareness of the importance of clean water resources and sustainable practices, driving the adoption of wastewater treatment services. Additionally, government initiatives promoting infrastructure development and investments in wastewater treatment facilities have bolstered the market. The presence of a large population and rising disposable income levels in the region further drive the need for effective wastewater treatment to ensure public health and environmental sustainability.

Recent Developments

- In October 2022, Xylem Water Systems Singapore Pte Ltd and Gross-Wen Technologies Inc. have entered into a partnership for a joint research and development (R&D) project. The collaboration aims to advance ecologically friendly wastewater treatment systems. By combining their expertise, the two companies seek to drive innovation and develop sustainable solutions for the wastewater treatment industry.

- In April 2023, Veolia, a leading environmental services company, has secured the contract to operate and maintain Turkey's inaugural waste-to-energy plant located in Istanbul. This facility is not only Turkey's first but also the largest waste-to-energy plant in Europe. The partnership with Veolia signifies a significant step towards sustainable waste management and energy production in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global wastewater treatment services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- SUEZ

- Veolia Water Technologies

- Thermax

- Evoqua Water Technologies

- Xylem

- Ecolab

- GE Water

- Acciona

- Hydro International

- Trojan Technologies

- American Water

- Pentair

- SWA Water Australia

- Orenco Systems

- Aquatech International

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global wastewater treatment services market based on the below-mentioned segments:

Wastewater Treatment Services Market, By Service Type

- Design & Engineering Consulting

- Building & Installation Service

- Operation & Process Control

- Maintenance & Repair

- Others

Wastewater Treatment Services Market, By End-User

- Municipal

- Industrial

Wastewater Treatment Services Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?