Global Water Treatment System Market Size, Share, and COVID-19 Impact Analysis, By Technology (Distillation Systems, Water Softeners, Reverse Osmosis, Filtration Methods, Disinfection Methods, and Others), By Installation (Point-of-Entry, Point-of-Use), By Application (Residential, Industrial, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Water Treatment System Market Insights Forecasts to 2033

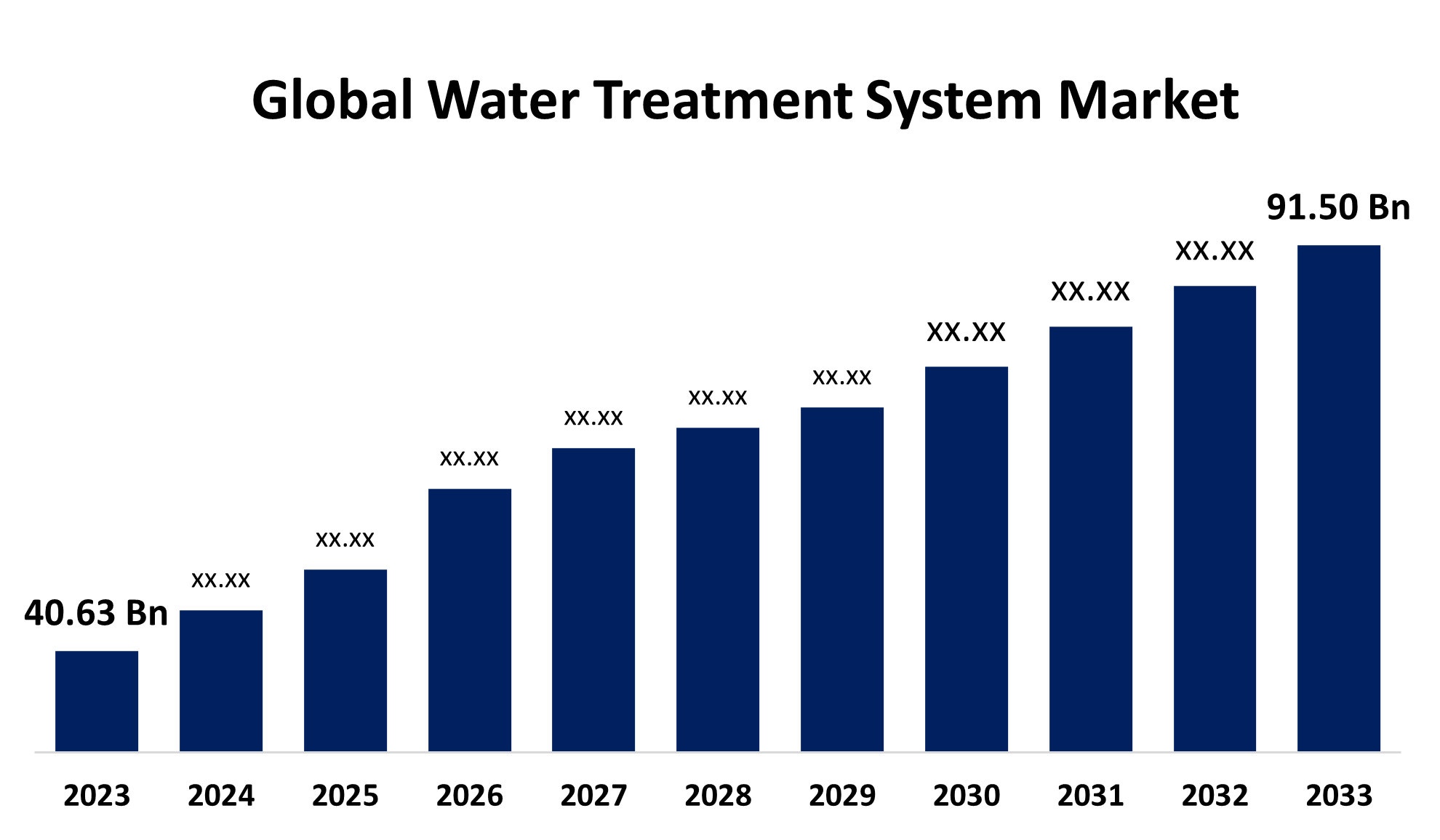

- The Global Water Treatment System Market Size was estimated at USD 40.63 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 8.46% from 2023 to 2033

- The Worldwide Water Treatment System Market Size is Expected to Reach USD 91.50 Billion by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Water Treatment System Market Size is anticipated to cross USD 91.50 Billion by 2033, Growing at a CAGR of 8.46% from 2023 to 2033.

Market Overview

The global water treatment system market is a hub of technologies and processes to purify water for drinking and industrial applications or proper management of wastewater. Processes such as filtration, desalination, chemical treatments, and advanced methods such as reverse osmosis and UV disinfection feature in this market. As the scarcity of water, pollution, and demand for clean water increase due to industrialization, urbanization, and population growth, the market keeps increasing. Furthermore, many countries have in place regulations demanding that businesses and institutions supply safe and clean drinking water. These regulations differ from country to country, but they all have the same aim of protecting public health. Increasingly rigorous government regulations will continue to support the growth of the water treatment systems market Industry over the coming years. For instance, The US Department of Energy's (DOE) Industrial Efficiency and Decarbonization Office (IEDO) has announced $28 million in funding for 10 projects aimed at driving innovation to decarbonize the full life cycle of Water Resource Recovery Facilities (WRRFs). These facilities, which treat wastewater from public water systems, are among the country's largest industrial electricity users, with full lifecycle greenhouse gas (GHG) emissions comparable to direct emissions from the entire food and beverage industry, one of the largest GHG emitters in the United States.

Report Coverage

This research report categorizes the water treatment system market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the water treatment system market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the water treatment system market.

Global Water Treatment System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 40.63 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 8.46% |

| 023 – 2033 Value Projection: | USD 91.50 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 139 |

| Segments covered: | By Technology, By Installation, By Application, By Regional Analysis |

| Companies covered:: | FilterSmart, Pure Aqua, Inc., DuPont, EcoWater Systems LLC, Honeywell International Inc., Aquasana, Inc., 3M, BWT Aktiengesellschaft, Pentair plc, Panasonic, Calgon Carbon Corp., Watts Water Technologies Inc., Aquaphor, Culligan, WCC (Water Control Corp.), and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for water treatment systems is accelerating due to numerous critical factors like growing water scarcity, rising water pollution levels, and the globally increasing population. As industrialization and urbanization are on a roll, increased demand for clean, safe potable water supply and efficient use of wastewater exists. Environmental and government regulations strictly enforcing quality-based water standards increase the demand for advanced water treatment technologies. The growing population, solid economic growth, an increase in construction projects, and cheap mortgage rates are predicted to be the primary drivers of market expansion in the residential construction sector. The Environment Protection Agency (EPA) established drinking water quality standards under the Safe Drinking Water Act of 1974, and the agency, in collaboration with its partners, implements a variety of financial and technical programs to protect drinking water quality. In addition, with increasing technology breakthroughs and R&D operations, there have been numerous new product introductions that drive market growth. For instance, Amway, an entrepreneur-led health and wellness brand, has announced the launch of the New eSpring Water Purifier, which is powered by Crystal IS' breakthrough UV-C LED technology. The introduction represents the first comprehensive eSpring product redesign in over 20 years. eSpring is the world's best-selling brand of home water purification systems.

Restraining Factors

The global water treatment system market confronts a number of constraints, including high initial investment and operational expenses, which might limit accessibility, particularly in developing countries. Inadequate infrastructure, a lack of technical experience, and limited financial resources in specific places all contribute to the slow adoption of water treatment technologies. Furthermore, regulatory complications and varied standards across countries make compliance difficult, while environmental concerns about waste disposal and sludge management complicate matters.

Market Segmentation

The water treatment system market share is classified into technology, installation, and application.

- The reverse osmosis segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the water treatment system market is divided into distillation systems, water softeners, reverse osmosis, filtration methods, disinfection methods, and others. Among these, the reverse osmosis segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The remarkable effectiveness with which it removes a wide range of impurities, including salts, bacteria, and heavy metals, has contributed to its rapid rise. This makes it suitable for both household and industrial uses, including desalination, food & beverage, and pharmaceuticals. The growing demand for clean, potable water, combined with increased awareness of water quality issues, has fueled the widespread use of RO systems. Furthermore, developments in RO membrane technology have enhanced performance and lowered energy costs, strengthening its market position.

- The point-of-use segment accounted for the majority of the share in 2023 and is estimated to grow at the fastest CAGR during the projected timeframe.

Based on the installation, the water treatment system market is divided into point-of-entry and point-of-use. Among these, the point-of-use segment accounted for the majority of the share in 2023 and is estimated to grow at the fastest CAGR during the projected timeframe. The point-of-use installation is critical for treating water in developing countries because of its simplicity, cost, low maintenance, and independence from electricity grids. PoU systems are extremely valuable in medical settings, especially for individuals with compromised immune systems. As water contamination increases, populations grow, knowledge of water treatment benefits grows, and technological improvements in water treatment occur, the market for PoU water treatment systems is likely to grow dramatically in the future years.

- The residential segment held the largest share in 2023 and is estimated to grow at the fastest CAGR during the predicted timeframe.

Based on the application, the water treatment system market is divided into residential, industrial, and others. Among these, the residential segment held the largest share in 2023 and is estimated to grow at the fastest CAGR during the predicted timeframe. The growing concerns about new pollutants and a need for high-quality drinking water. It is also expected to grow because of the increasing demand for drinking water that has been treated to remove biodegradable organics, harmful microorganisms, bad odor, taste, and discoloration. Residential applications represent a sizable consumer segment in the industry.

Regional Segment Analysis of the Water Treatment System Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the water treatment system market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the water treatment system market over the predicted timeframe. Countries such as China and India are experiencing high demand for clean water due to rising pollution levels and limited freshwater resources. The region's growing industrial sector and strict environmental restrictions have prompted investments in modern water treatment technology and infrastructure. The industry is being driven by increased awareness of water scarcity challenges and the necessity for sustainable water management methods. Asia-Pacific is a significant hub for the business due to its broad water treatment applications in the residential, commercial, and industrial sectors.

North America is expected to grow at the fastest CAGR growth of the water treatment system market during the forecast period. North America is characterized by the presence of large market participants with robust distribution channels, including 3M, Honeywell International Inc., DuPont, and Panasonic. Consumer spending power and increased emphasis on water treatment in the region is projected to drive market expansion over the forecast period. The water treatment systems market in Canada is expected to develop as the country's population grows and construction projects expand. Over the predicted period, Canada's population increase is expected to greatly boost the residential sector. Residential building is likely to be bolstered further by the Canadian government's increasing expenditures in affordable housing for low-income families through the Affordable Housing Initiative (AHI) and Canada Mortgage and Housing Corporation (CMHC) programs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the water treatment system market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- FilterSmart

- Pure Aqua, Inc.

- DuPont

- EcoWater Systems LLC

- Honeywell International Inc.

- Aquasana, Inc.

- 3M

- BWT Aktiengesellschaft

- Pentair plc

- Panasonic

- Calgon Carbon Corp.

- Watts Water Technologies Inc.

- Aquaphor

- Culligan

- WCC (Water Control Corp.)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, Rainmaker Worldwide Inc. has announced its acquisition of Miranda Water Treatment Systems. This acquisition is expected to lead to a horizontal integration of its resources, providing Miranda with expanded worldwide service capabilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the water treatment system market based on the below-mentioned segments:

Global Water Treatment System Market, By Technology

- Distillation Systems

- Water Softeners

- Reverse Osmosis

- Filtration Methods

- Disinfection Methods

- Others

Global Water Treatment System Market, By Installation

- Point-of-Entry

- Point-of-Use

Global Water Treatment System Market, By Application

- Residential

- Industrial

- Others

Global Water Treatment System Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?