Global Wedding Gown Market Size, By Product (Gown, Traditional Wear), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Consumer GoodsGlobal Wedding Gown Market Insights Forecasts to 2033

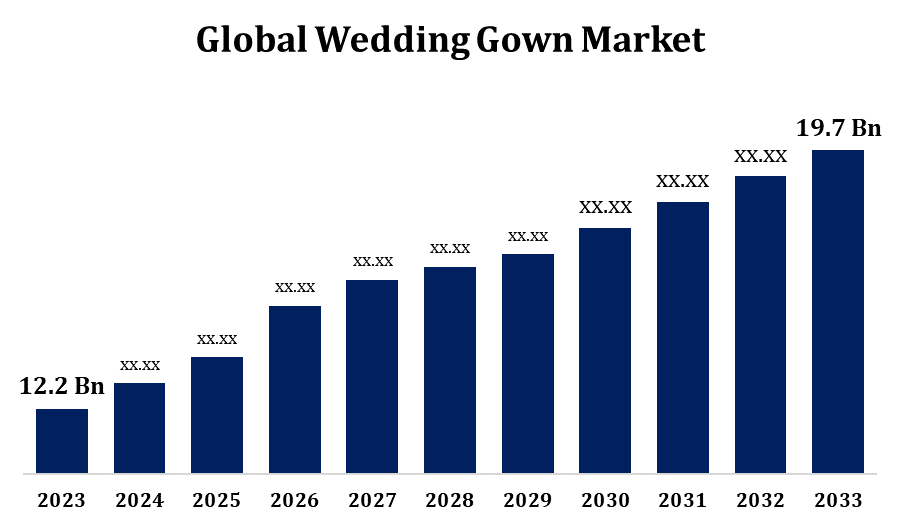

- The Global Wedding Gown Market Size was valued at USD 12.2 Billion in 2023.

- The Market is Growing at a CAGR of 4.90% from 2023 to 2033

- The Worldwide Wedding Gown Market Size is Expected to reach USD 19.7 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Wedding Gown Market Size is Expected to reach USD 19.7 Billion by 2033, at a CAGR of 4.90% during the forecast period 2023 to 2033.

The wedding gown market is an important component of the larger bridal industry, which includes the design, manufacture, and retail of wedding dresses. The market is vast, ranging from conventional white gowns to more contemporary and avant-garde styles that cater to a wide range of tastes, cultures, and budgets. Different cultures have their own traditions and customs for wedding dress, which influence the sorts of gowns worn in different places. Traditional Western white gowns, for example, may be less common in countries where red or other colours are the norm. Wedding gown trends, like those in any other fashion business, evolve throughout time. Designers are continually innovating to develop new styles, fabrics, and silhouettes that appeal to modern brides. Brides have varying preferences when it comes to wedding clothes.

Wedding Gown Market Value Chain Analysis

A value chain analysis of the wedding gown market entails examining the essential activities and processes involved in taking a wedding gown from concept to consumer purchase. Designers and fashion businesses create new wedding gown designs depending on current fashion trends, cultural influences, and consumer preferences. Suppliers provide raw materials like fabrics, lace, beads, and accessories. Wedding gowns are manufactured in factories or workshops in accordance with design criteria. Wedding gowns are sold through a variety of venues, including bridal boutiques, department stores, online retailers, and designers' showrooms. Marketing strategies include advertising in bridal periodicals, internet platforms, social media, and attending bridal exhibitions and events. A pleasant experience for customers is critical in the wedding gown market. Personalised fittings, changes, and style sessions improve brides' overall experience.

Wedding Gown Market Opportunity Analysis

Several factors make the wedding gown market a compelling possibility for businesses and individuals. For starters, the wedding sector is intrinsically resilient, as weddings remain culturally significant occasions around the world. Furthermore, developing cultural trends and changing consumer tastes open up opportunities for innovation and new goods in the market. With the rise of online retail and social media, connecting and engaging with potential customers has become easier than ever, allowing for tailored marketing and personalised experiences. Furthermore, the increased awareness of sustainability and ethical practices allows businesses to cater to eco-conscious brides by providing ecologically friendly and ethically sourced gown options. Fashion's globalisation and improved access to international markets open up new prospects for expansion beyond local bounds.

Global Wedding Gown Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.90% |

| 2033 Value Projection: | USD 19.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Distribution Channel, By Region. |

| Companies covered:: | Elie Saab, JLM Couture Inc., Justin Alexander Inc., Louis Vuitton, V.E.W. Ltd., Kleinfeld Bridal Corp., Harrods Limited, Moonlight Bridal Design, Inc., Maggie Sottero Designs L.L.C., Pronovias Fashion Group, Rosa Clara, De La Cierva Y Nicolas, CUT S.r.l, Pronuptia de Paris SA., Yumi Katsura International Co., Ltd., Zuhair Murad, Alfred Angelo, Inc., Watters, Madeline Gardner, Sincerity Bridal, Sophia Tolli, Temperley London, Helen Rodrigues, Macy's, Inc., Monique Lhuillier, Naeem Khan, Paloma Blanca, Theia Couture, Vera Wang, David's Bridal Inc., Winnie Couture, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Wedding Gown Market Dynamics

Increased urbanization and fashion upgrades

Increased urbanisation and fashion upgrades are key drivers of growth in the wedding gown market. As more people move to cities, there is a commensurate increase in demand for sophisticated, attractive wedding wear that represents current trends and tastes. Urbanisation frequently causes cultural upheavals, which influence wedding rituals and preferences, opening up potential for novel designs and trends in wedding gowns. Fashion upgrades, driven by advances in design, materials, and technology, help to shape the aesthetics of wedding gowns. Designers are always pushing boundaries, creating new designs, embellishments, and fabrics to cater to the tastes of fashion-forward brides. This ongoing innovation not only draws brides looking for the latest styles, but also pushes them to invest more in their wedding gowns.

Restraints & Challenges

The conventional wedding gown market faces challenges from shifting demographics, such as decreased marriage rates and changing family arrangements. Furthermore, changing societal conventions and cultural shifts may influence wedding clothing preferences, forcing industry players to adapt to a wide range of customer expectations. Economic downturns and swings can affect consumer expenditure on weddings, including wedding clothes. During times of economic instability, couples may prioritise cost-cutting measures, affecting sales of high-end gowns and designer brands. The rise of fast fashion has hastened trend development and raised customer expectations for price, convenience, and variety. Brides may anticipate the same amount of immediacy and variety while shopping for wedding gowns, disrupting traditional retail structures and business methods.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Wedding Gown Market from 2023 to 2033. North America has a diverse spectrum of wedding gown designers, from well-known luxury labels to new independent designers. This diversity provides brides with a wide range of alternatives, from classic and conventional patterns to contemporary and avant-garde forms. The rise of e-commerce has revolutionised North America's wedding gown market, with online shops providing a diverse assortment of dresses, quick shopping experiences, and competitive prices. Many brides choose to buy their dresses online, whether through specific wedding websites or general fashion outlets. The cost of wedding gowns in North America varies greatly, catering to brides with various budgets. While luxury designer dresses are expensive, there are more cheap options available through mass-market merchants and online platforms.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Asia-Pacific is home to a wide diversity of cultures, each having their own wedding traditions and dress preferences. Wedding gown styles vary greatly between countries and regions, reflecting cultural history and local customs. With rising income and urbanisation in many Asian countries, there is a greater desire for luxury wedding clothing and designer gowns. This has resulted in the formation of a robust wedding fashion business, with both local and international designers catering to the needs of discerning brides. While traditional wedding apparel is still popular in many Asian countries, Western wedding traditions, such as the fondness for white bridal gowns, are becoming more prevalent. This trend is especially noticeable among younger generations and in metropolitan regions.

Segmentation Analysis

Insights by Product

The gown segment accounted for the largest market share over the forecast period 2023 to 2033. The constant evolution of bridal fashion and gown styles drives desire for new designs and trends. Brides choose gowns that reflect their unique style, resulting in a varied selection of options in the gown market. Brides are increasingly choosing custom gowns to create a one-of-a-kind and personalised look on their wedding day. This tendency towards customisation fuels growth in the gown category, as designers and retailers provide bespoke services to meet these desires. The advent of online retail platforms has made bridal gown purchasing more accessible to brides, resulting in increased growth in the gown market. Online merchants attract more customers by offering a diverse assortment of dresses, convenient shopping experiences, and competitive pricing.

Insights by Distribution Channel

The offline segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Brick-and-mortar bridal stores provide brides with a personalised and immersive shopping experience. Experienced bridal advisors provide one-on-one advice to brides in finding the ideal gown for their style, body type, and wedding theme. Offline businesses frequently offer expert fitting services and in-house alterations to ensure the proper fit of the bridal gown. This attention to detail and customisation improves brides' overall satisfaction and drives growth in the offline segment. The offline category targets the high-end and luxury markets, providing designer labels, couture gowns, and premium bridal services. Brides seeking exclusive and opulent experiences gravitate towards offline businesses that specialise in high-end bridal wear.

Recent Market Developments

- On May 2023, Elie Saab has established a new flagship store in Via Riyadh Mall, the Saudi capital's premier experience luxury and architectural destination.

Competitive Landscape

Major players in the market

- Elie Saab

- JLM Couture Inc.

- Justin Alexander Inc.

- Louis Vuitton

- V.E.W. Ltd.

- Kleinfeld Bridal Corp.

- Harrods Limited

- Moonlight Bridal Design, Inc.

- Maggie Sottero Designs L.L.C.

- Pronovias Fashion Group

- Rosa Clara

- De La Cierva Y Nicolas

- CUT S.r.l

- Pronuptia de Paris SA.

- Yumi Katsura International Co., Ltd.

- Zuhair Murad

- Alfred Angelo, Inc.

- Watters

- Madeline Gardner

- Sincerity Bridal

- Sophia Tolli

- Temperley London

- Helen Rodrigues

- Macy's, Inc.

- Monique Lhuillier

- Naeem Khan

- Paloma Blanca

- Theia Couture

- Vera Wang

- David's Bridal Inc.

- Winnie Couture

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Wedding Gown Market, Product Analysis

- Gown

- Traditional Wear

Wedding Gown Market, Distribution Channel Analysis

- Online

- Offline

Wedding Gown Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Wedding Gown Market?The global Wedding Gown Market is expected to grow from USD 12.2 billion in 2023 to USD 19.7 billion by 2033, at a CAGR of 4.90% during the forecast period 2023-2033.

-

2. Who are the key market players of the Wedding Gown Market?Some of the key market players of the market are Elie Saab, JLM Couture Inc., Justin Alexander Inc., Louis Vuitton, V.E.W. Ltd., Kleinfeld Bridal Corp., Harrods Limited, Moonlight Bridal Design, Inc., Maggie Sottero Designs L.L.C., Pronovias Fashion Group, Rosa Clara, De La Cierva Y Nicolas, CUT S.r.l, Pronuptia de Paris SA., Yumi Katsura International Co., Ltd., Zuhair Murad, Alfred Angelo, Inc., Watters, Madeline Gardner, Sincerity Bridal, Sophia Tolli, Temperley London, Helen Rodrigues, Macy's, Inc., Monique Lhuillier, Naeem Khan, Paloma Blanca, Theia Couture, Vera Wang, David's Bridal Inc., Winnie Couture. And other key vendors.

-

3. Which segment holds the largest market share?The offline segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Wedding Gown Market?North America is dominating the Wedding Gown Market with the highest market share.

Need help to buy this report?