Global Wedding Loans Market Size, Share, and COVID-19 Impact Analysis, By Loan Amount (Small Loans, Medium Loans, and Large Loans), By Interest Rate (Fixed Interest Rate and Floating Interest Rate), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Wedding loans Market Insights Forecasts to 2033

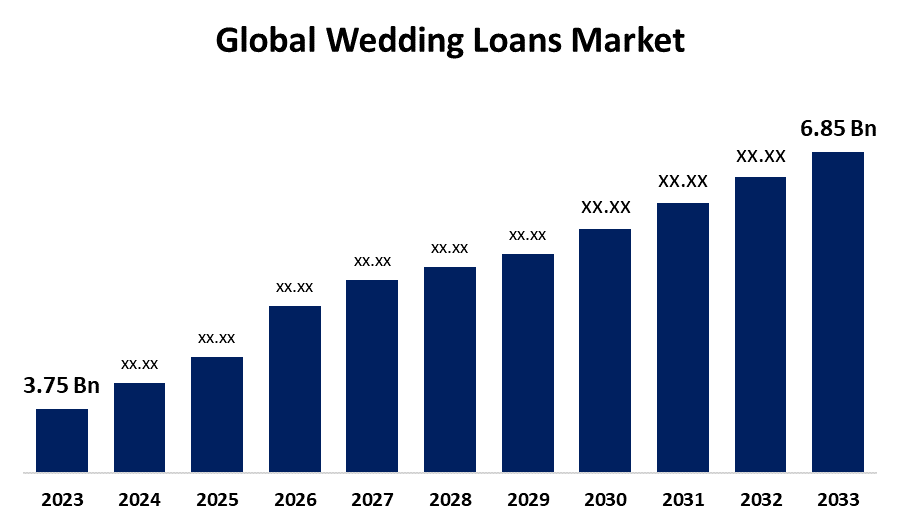

- The Global Wedding Loans Market Size was Valued at USD 3.75 Billion in 2023

- The Market Size is Growing at a CAGR of 6.21% from 2023 to 2033

- The Worldwide Wedding Loans Market Size is Expected to Reach USD 6.85 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Wedding Loans Market Size is anticipated to exceed USD 6.85 Billion by 2033, growing at a CAGR of 6.21% from 2023 to 2033.

Market Overview

A wedding loan, also referred to as a marriage loan, is a kind of personal loan intended to help consumer who need money to pay for wedding-related costs. It can make it easier for insurers to handle wedding-related costs, whether they are related to venue reservations, catering, decor, or buying bridal gowns and jewelry. Additionally, the expanding acceptability of non-traditional weddings, the rising expense of weddings, and the popularity of destination weddings are the main factors driving the wedding loans market. With couples hoping to create special and unforgettable experiences for themselves and their guests, destination weddings have grown in popularity in forecast years. Furthermore, the average wedding in the United States now costs over $30,000, indicating that wedding expenses have been rising. As a consequence, there is now a greater need for wedding loans as couples want to finance their big day without taking on a lot of debt.

Report Coverage

This research report categorizes the global wedding loans market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global wedding loans market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global wedding loans market.

Global Wedding Loans Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.75 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.21% |

| 2033 Value Projection: | USD 6.85 Billion |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Loan Amount, By Interest Rate, By Regional |

| Companies covered:: | LightStream, Lending Club, Discover Personal Loans, Earnest, SunTrust, Prosper Marketplace, Oportun, Finance of America, Marcus by Goldman Sachs, American Express, SoFi, Upstart, Avant, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Every year, between 340,000 and 350,000 destination weddings take place all over the world. The desire for unique and unforgettable experiences, the allure of exotic and stunning locations, and the increasing flexibility in wedding planning are the driving forces behind this trend. As couples often seek financial assistance to fund their dream weddings, these factors are further propelling the marriage loan market. Furthermore, in 2023, a nationwide survey found that 85% of Americans believe rising wedding expenses will impact their financial well-being, with 53% considering taking on debt to cover costs. This trend is driven by factors such as the increasing popularity of destination weddings, the desire for unique and memorable experiences, and the pressure to meet social expectations for lavish weddings. These elements are further propelling the marriage loan market, as couples seek financial assistance to fund their dream weddings.

Restraints & Challenges

Wedding loans' high interest rates are restricting the market's expansion by making them a less appealing choice for couples wishing to fund their nuptials. In addition to making it more difficult for couples to manage their debt after the wedding, high interest rates can lead to higher monthly payments and a higher total loan cost.

Market Segmentation

The global wedding loans market share is classified into loan amount and interest rate.

- The small loans segment is expected to hold the largest share of the global wedding loans market during the forecast period.

Based on the loan amount, the global wedding loans market is categorized as small loans, medium loans, and large loans. Among these, the small loans segment is expected to hold the largest share of the global wedding loans market during the forecast period.In this category, large loans are the most common, enabling couples to design lavish weddings with all the amenities and extras customer’s desire. The market development is driven by the growing trend of customization at weddings, leading couples to seek personalized financial solutions to fulfill their ideal celebrations.

- The fixed interest rate segment is expected to grow at the fastest CAGR during the forecast period.

Based on the interest rate, the global wedding loans market is categorized as fixed interest rate and floating interest rate. Among these, the fixed interest rate segment is expected to grow at the fastest CAGR during the forecast period. This is due to the fact that it gives customers a clear picture of the monthly installments and the entire cost of the loan. Couples planning a wedding benefit from predictability and transparency since it allows them to better budget their finances and avoid unexpected charges.

Regional Segment Analysis of the Global Wedding Loans Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global wedding loans market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global wedding loans market over the forecast period. Presently, rising wedding expenses are driving the North American wedding loan market and intensifying many couples' desire for an ideal wedding. The cost of the wedding is increased since a large percentage of couples in North America are looking for brides and suitable locations for the ceremony. As such, there has been a substantial rise in the number of North Americans seeking loans to cover these fees.

Asia-Pacific is expected to grow at the fastest CAGR growth of the global wedding loans market during the forecast period. The market for wedding loans in the area has grown as a consequence of lenders' convenience, quickness, and customized solutions. Couples now have an easier time getting the money they need to finance their ideal weddings because to the flexibility of loan amounts and terms. Stretch loans have gained popularity as an alternative to traditional wedding finance since they provide a different viewpoint on this age-old issue that can be adapted to suit different financial objectives and mindsets. Data examined by LenDenClub shows that the demand for wedding loans in India skyrocketed by 40% between 2020 and 2021.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global wedding loans market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LightStream

- Lending Club

- Discover Personal Loans

- Earnest

- SunTrust

- Prosper Marketplace

- Oportun

- Finance of America

- Marcus by Goldman Sachs

- American Express

- SoFi

- Upstart

- Avant

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In December 2023, a cutting-edge new loan app that provides personalized wedding financing was introduced by Tata Capital, a well-known financial services firm and member of the renowned Tata Group. For loans for which consumers are pre-qualified, the app provides immediate paperless approval. Borrowers can obtain funds without having to deal with time-consuming paperwork by following a straightforward application, check, and fund transfer procedure.

Market Segment

- This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global wedding loans market based on the below-mentioned segments:

Global Wedding Loans Market, By Loan Amount

- Small Loans

- Medium Loans

- Large Loans

Global Wedding Loans Market, By Interest Rate

- Fixed Interest Rate

- Floating Interest Rate

Global Wedding Loans Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global wedding loans market over the forecast period?The global wedding loans market size is expected to grow from USD 3.75 billion in 2023 to USD 6.85 billion by 2033, at a CAGR of 6.21% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global wedding loans market?North America is projected to hold the largest share of the global wedding loans market over the forecast period.

-

3. Who are the top key players in the global wedding loans market?LightStream, Lending Club, Discover Personal Loans, Earnest, SunTrust, Prosper Marketplace, Oportun, Finance of America, Marcus by Goldman Sachs, American Express, SoFi, Upstart, Avant, and others.

Need help to buy this report?