Global White Goods Packaging Market Size, Share, and COVID-19 Impact Analysis, By Type (Plastic and Paper & Paperboard), By Packaging Format (Air Bags, Foam Sheets, Corrugated Boxes, Rigid Plastic Containers, Shrink Films, and Others), By Application (Refrigerators, Washing Machines, Air Conditioners, Microwave Ovens, Dishwashers, Vacuum Cleaners, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Consumer GoodsGlobal White Goods Packaging Market Insights Forecasts to 2033

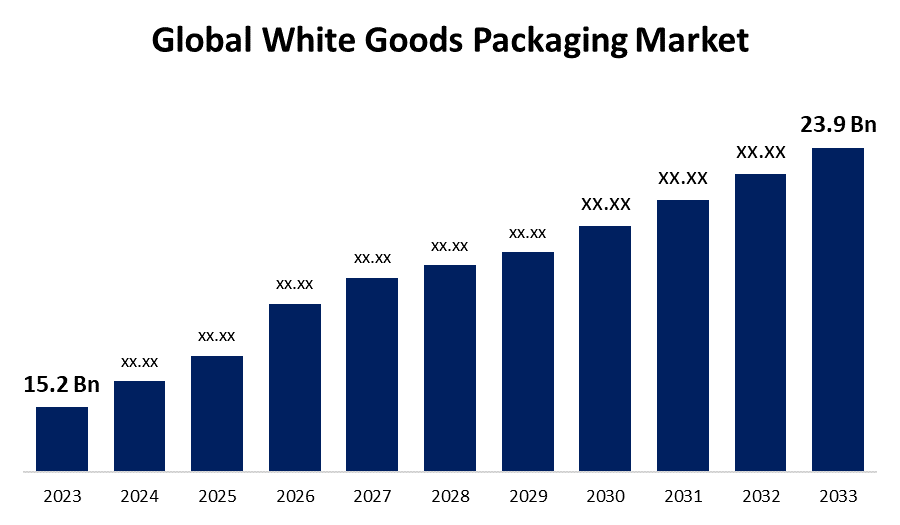

- The Global White Goods Packaging Market Size was Valued at USD 15.2 Billion in 2023

- The Market Size is Growing at a CAGR of 4.63% from 2023 to 2033

- The Worldwide White Goods Packaging Market Size is Expected to Reach USD 23.9 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global White Goods Packaging Market Size is Anticipated to Exceed USD 23.9 Billion by 2033, Growing at a CAGR of 4.63% from 2023 to 2033.

Market Overview

The materials and techniques used to package large home appliances like refrigerators, washers, dishwashers, and ovens are known to as "white goods packaging." Transportation protection, maintaining product integrity, ensuring the safety of customers and delivery workers, and serving as a platform for branding and product information serve as the main purposes of white goods packaging. White goods packaging frequently uses cardboard boxes, plastic bags or wraps for protection, styrofoam or polystyrene for cushioning, and molded foam inserts for increased security. The growth of the white goods packaging market is expected to be driven by the rising online sales of electronic devices resulting from the increased penetration of e-commerce across nations. The younger generation's increased use of electrical appliances and devices is driving up sales of white goods using online platforms. As a result, there is a growing need for white goods packaging that is safe and secure.

Report Coverage

This research report categorizes the white goods packaging market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the white goods packaging market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the white goods packaging market.

Global White Goods Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 15.2 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 4.63% |

| 2030 Value Projection: | USD 23.9 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By Packaging Format, By Application, By Regionb |

| Companies covered:: | Smurfit Kappa Plc, Sealed Air Corporation, Orlando Products Inc., UFP Technologies, Inc., AMETEK.Inc., DS Smith Plc, Desco Industries Inc., Summit Packaging Solutions, Delphon Industries, LLC, Protective Packaging Corporation, GWP Group Limited, FEURER Group GmbH, Empire Packages (P) Ltd., Parksons Packaging Ltd., and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The white goods packaging market is being driven by rising consumer demand for alternatives to packaging that are both safe and eco-friendly. To increase product security and reduce the effects on the environment, manufacturers are focusing on eco-friendly materials and innovative designs. The growth of the market is facilitated by technological advancements in packing materials and techniques and guarantees effective storage and transport of white goods. Due to strict rules and growing consumer awareness of waste management and recyclability, industry participants are also influencing the future of the white goods packaging market by utilizing responsible packaging methods.

Restraining Factors

The Inflationary forces the cost of producing white goods packaging can be directly restrict by rising material prices, such as those of foam, plastic, and corrugated cardboard, which are pushed on by inflationary pressures.

Market Segmentation

The white goods packaging market share is classified into type, packaging format, and application.

- The plastic segment is estimated to hold the largest market revenue share through the projected period.

Based on the type, the white goods packaging market is classified into plastic and paper & paperboard. Among these, the plastic segment is estimated to hold the largest market revenue share through the projected period. White goods like electronics and appliances are most effectively safeguarded by plastic packaging, which protects them from physical harm, moisture, and dust while being transported and stored.

- The corrugated boxes segment is estimated to hold the largest market revenue share through the projected period.

Based on the packaging format, the white goods packaging market is classified into airbags, foam sheets, corrugated boxes, rigid plastic containers, shrink films, and others. Among these, the corrugated boxes segment is estimated to hold the largest market revenue share through the projected period. In general, corrugated boxes are less expensive compared to other types of packing. They are a popular option for packing a variety of white goods due to their affordability.

- The refrigerators segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the white goods packaging market is divided into refrigerators, washing machines, air conditioners, microwave ovens, dishwashers, vacuum cleaners, and others. Among these, the refrigerators segment is anticipated to hold the largest market share through the forecast period. Due to refrigerators being quite big and complicated appliances, careful packaging is required to guarantee protection during transportation. A wider market is created by the increased demand for specialist packaging solutions caused by this complexity.

Regional Segment Analysis of the White Goods Packaging Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the white goods packaging market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the white goods packaging market over the predicted timeframe. North America e-commerce industry is highly prevalent, which drives the need for durable packaging choices that can safeguard white products in transit. Demand for recyclable and environmentally friendly packaging materials is driven by rising environmental consciousness. Due to the rapid increase in the commercial sector's need for heating and cooling equipment, the United States is a significant market for white goods packaging.

Asia Pacific is expected to grow at the fastest CAGR growth of the white goods packaging market during the forecast period. Asia Pacific's market dynamics are being positively affected by the development in home appliance use in China and India. In the Asia Pacific region, there is a growing need for more dependable and effective solutions due to the expansion of the use of white goods packaging.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the white goods packaging market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Smurfit Kappa Plc

- Sealed Air Corporation

- Orlando Products Inc.

- UFP Technologies, Inc.

- AMETEK.Inc.

- DS Smith Plc

- Desco Industries Inc.

- Summit Packaging Solutions

- Delphon Industries, LLC

- Protective Packaging Corporation

- GWP Group Limited

- FEURER Group GmbH

- Empire Packages (P) Ltd.

- Parksons Packaging Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Innventure LLC, an enterprise growth engine, today announced that AeroFlexx, the flexible packaging company launched by Innventure, secured a new collaboration with European manufacturing company Chemipack.

- In October 2023, Versuni’s revamped packaging was initially being launched for Philips’ home appliances products, including its Air Purifier, Airfryer, Cordless Vacuum 800 series, Espresso Machine with LatteGo, and Steam Iron 3000 series.

- In April 2023, Koenig & Bauer AG and Sealed Air announced the signing of a non-binding letter of intent to deepen their strategic relationship in the field of digital printing equipment. The alliance will develop cutting-edge digital printing technology, tools, and services to greatly enhance packaging design capabilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the white goods packaging market based on the below-mentioned segments:

Global White Goods Packaging Market, By Type

- Plastic

- Paper & Paperboard

Global White Goods Packaging Market, By Packaging Format

- Air Bags

- Foam Sheets

- Corrugated Boxes

- Rigid Plastic Containers

- Shrink Films

- Others

Global White Goods Packaging Market, By Application

- Refrigerators

- Washing Machines

- Air Conditioners

- Microwave Ovens

- Dishwashers

- Vacuum Cleaners

- Others

Global White Goods Packaging Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the white goods packaging market over the forecast period?The White goods packaging market is projected to expand at a CAGR of 4.63% during the forecast period.

-

2. What is the market size of the white goods packaging market?The Global White Goods Packaging Market Size is Expected to Grow from USD 15.2 Billion in 2023 to USD 23.9 Billion by 2033, at a CAGR of 4.63% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the white goods packaging market?North America is anticipated to hold the largest share of the white goods packaging market over the predicted timeframe.

Need help to buy this report?