Global Wind Blade Recycling Market Size, Share, and COVID-19 Impact Analysis, By Process (Mechanical Recycling, Thermal Recycling, Chemical Recycling, and Others), By Material (Glass Fiber, Carbon Fiber, and Others), By Application (Energy, Construction, Transportation, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Wind Blade Recycling Market Insights Forecasts to 2033

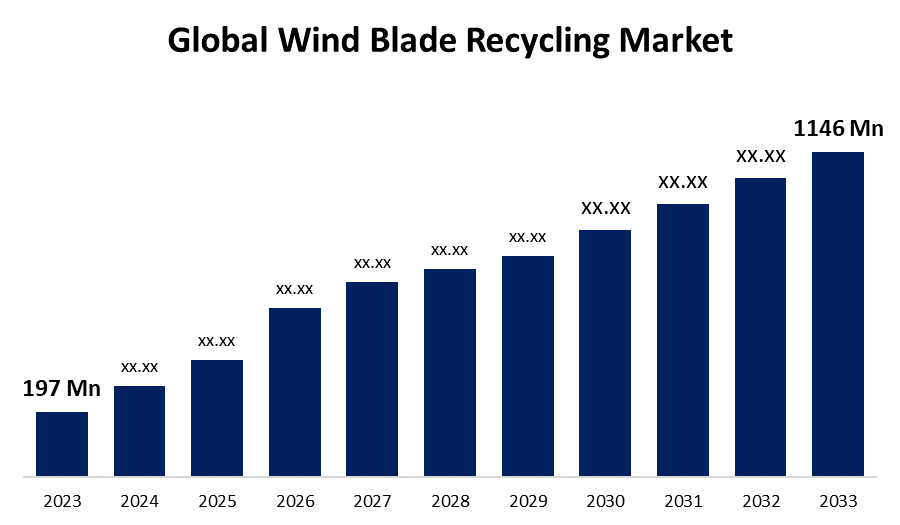

- The Global Wind Blade Recycling Market Size was estimated at USD 197 Million in 2023

- The Market Size is Expected to Grow at a CAGR of around 19.25% from 2023 to 2033

- The Worldwide Wind Blade Recycling Market Size is Expected to Reach USD 1146 Million by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Wind Blade Recycling Market Size is expected to cross USD 1146 Million by 2033, growing at a CAGR of 19.25% from 2023 to 2033.

Market Overview

The global wind blade recycling market is an industry that focuses on the sustainable disposal, reusing, and recycling of decommissioned wind turbine blades. These blades, which are generally comprised of composite materials such as fiberglass and carbon fiber, provide major waste management difficulties due to their longevity and non-biodegradability. The market covers a variety of recycling processes such as mechanical grinding, pyrolysis, and chemical processing to recover valuable materials for reuse in industries such as construction, automotive, and energy. Furthermore, the wind blade recycling market offers several potential, fueled primarily by the global trend toward sustainable energy solutions and a growing emphasis on circular economy concepts. One significant opportunity is to innovate and develop new recycling systems capable of efficiently processing complicated composite materials.

In addition, as companies and governments strive for more sustainable practices, there is an increased demand for innovative recycling technologies capable of recovering high-quality components from decommissioned wind blades. For instance, The United States Department of Energy (DOE) has released a report in January 2025, outlining recommendations for increasing the recycling and reuse of retired wind energy equipment and components in order to build a more circular economy and sustainable supply chain. Among other findings, the study shows that existing US infrastructure could handle 90% of the mass of decommissioned wind turbines. The remaining 10% will require new tactics and creative recycling ways to develop a more sustainable wind energy business. This research will help lead more than $20 million in previously announced investments from the Bipartisan Infrastructure Law to improve solutions that bridge this gap.

Report Coverage

This research report categorizes the wind blade recycling market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the wind blade recycling market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the wind blade recycling market.

Global Wind Blade Recycling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 197 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 19.25% |

| 023 – 2033 Value Projection: | USD 1146 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Process, By Material, By Application and By Region |

| Companies covered:: | Siemens Gamesa Renewable Energy Neocomp Acciona Energia Global Fiberglass Solutions TPI Composites REGEN Fiber GE Renewable Energy Carbon Rivers WindEurope Suez Recycling and Recovery Nordex SE Enel Green Power Veolia Vestas Wind Systems LM Wind Power Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The key drivers of market growth include a growing emphasis on sustainability and the circular economy, as well as expanded worldwide wind energy capacity, which leads to more decommissioned blades. As more wind farms are built to achieve renewable energy targets, a large number of wind turbines will eventually approach the end of their operational lifespans, which normally last 20-25 years. Furthermore, governments and environmental organizations around the world are implementing stricter waste disposal legislation, prohibiting the landfill disposal of composite materials, and supporting sustainable recycling techniques. Policies such as the EU's Circular Economy Action Plan and waste management rules in the United States and China are boosting market expansion. Moreover, wind blade recycling is becoming more efficient and cost-effective due to advances in mechanical, thermal, and chemical recycling technologies. Emerging alternatives, such as pyrolysis, solvolysis, and high-value composite reuse, are making recycling more economically viable.

Restraining Factors

One significant barrier is the high cost and technical complexity of recycling composite materials. Wind blades are challenging to recycle using conventional methods due to their complicated design and diverse material composition. Advanced recycling techniques, such as chemical and thermal recycling, necessitate significant investment in research, development, and infrastructure, which can be difficult for smaller businesses with limited resources.

Market Segmentation

The wind blade recycling market share is classified into process, material, and application.

- The mechanical recycling segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the process, the wind blade recycling market is divided into mechanical recycling, thermal recycling, chemical recycling, and others. Among these, the mechanical recycling segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The mechanical recycling process involves grinding and shredding wind turbine blades for reuse in construction and industrial applications, which is gaining interest since it uses less energy than chemical or thermal recycling. Strict landfill regulations, increased demand for recycled materials, and developments in mechanical processing technology are all significant growth factors.

- The glass fiber segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the material, the wind blade recycling market is divided into glass fiber, carbon fiber, and others. Among these, the glass fiber segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe. This is because glass fiber-reinforced composites (GFRP) are widely used in wind turbine blades. Glass fiber is widely chosen over carbon fiber because of its low cost, durability, and flexibility, making it the dominating material in wind blade manufacturing. As a result, the bulk of decommissioned wind blades necessitates specific recycling technologies for glass fiber recovery.

- The energy segment held the largest share in 2023 and is estimated to grow at a substantial CAGR during the predicted timeframe.

Based on the application, the wind blade recycling market is divided into energy, construction, transportation, and others. Among these, the energy segment held the largest share in 2023 and is estimated to grow at a substantial CAGR during the predicted timeframe. This is due to the growing use of co-processing and energy recovery options for retired wind turbine blades. Pyrolysis and cement kiln co-processing are two processes that allow for the extraction of energy from composite materials while lowering landfill trash, making them a preferred alternative for sustainable disposal. Wind blade materials have a high calorific value, making them excellent for energy recovery in industries like cement manufacturing, where recycled fibers can also be used as alternative fuels.

Regional Segment Analysis of the Wind Blade Recycling Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

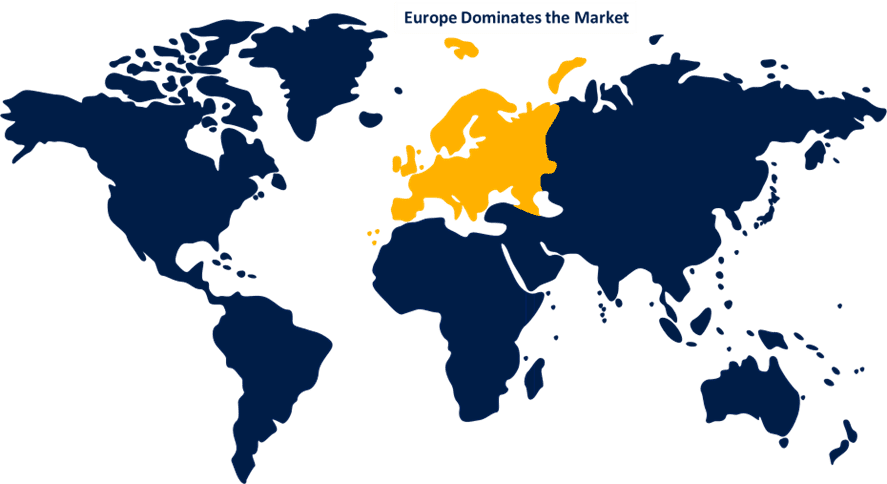

Europe is anticipated to hold the largest share of the wind blade recycling market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the wind blade recycling market over the predicted timeframe. This is due to stringent environmental rules, robust renewable energy programs, and efficient recycling infrastructure. The European Union's Circular Economy Action Plan, as well as landfill limits on composite debris, have expedited the deployment of wind turbine blade recycling technologies. Furthermore, nations such as Germany, Denmark, and the Netherlands are at the forefront of wind energy deployment, resulting in an increasing number of retired blades that must be disposed of sustainably. Furthermore, major investments in recycling technology, such as mechanical, chemical, and energy recovery methods, are helping Europe increase its market position. The region also benefits from strong relationships among wind energy companies, recyclers, and policymakers, which ensure a well-organized recycling environment.

North America is expected to grow at the fastest CAGR growth of the wind blade recycling market during the forecast period. This is due to rapid wind energy expansion, increased decommissioning of old wind farms, and a strong governmental push for sustainable waste management. The United States and Canada are experiencing a surge in wind power installations, resulting in an increasing volume of retired wind turbine blades that require appropriate recycling solutions. Government legislation and business environmental goals are major drivers of this expansion. The United States Environmental Protection Agency (EPA) and state-level rules promote landfill diversion and circular economy initiatives. In addition, leading wind energy firms and manufacturers are investing in advanced recycling technologies such as mechanical, pyrolysis, and cement co-processing processes to meet environmental regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the wind blade recycling market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens Gamesa Renewable Energy

- Neocomp

- Acciona Energia

- Global Fiberglass Solutions

- TPI Composites

- REGEN Fiber

- GE Renewable Energy

- Carbon Rivers

- WindEurope

- Suez Recycling and Recovery

- Nordex SE

- Enel Green Power

- Veolia

- Vestas Wind Systems

- LM Wind Power

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Regen Fiber launched a new wind turbine blade recycling facility in Fairfax, marking an important step in the attempt to solve the rising problem of wind turbine blade waste. This cutting-edge facility is intended to process decommissioned wind turbine blades, a growing worry as older turbines are retired and replaced by newer, more efficient types.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the wind blade recycling market based on the below-mentioned segments:

Global Wind Blade Recycling Market, By Process

- Mechanical Recycling

- Thermal Recycling

- Chemical Recycling

- Others

Global Wind Blade Recycling Market, By Material

- Glass Fiber

- Carbon Fiber

- Others

Global Wind Blade Recycling Market, By Application

- Energy

- Construction

- Transportation

- Others

Global Wind Blade Recycling Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the wind blade recycling market over the forecast period?The Wind Blade Recycling market is projected to expand at a CAGR of 19.25% during the forecast period.

-

2. What is the market size of the wind blade recycling market?The Global Wind Blade Recycling Market Size is Expected to Grow from USD 197 Million in 2023 to USD 1146 Million by 2033, at a CAGR of 19.25% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the wind blade recycling market?Europe is anticipated to hold the largest share of the wind blade recycling market over the predicted timeframe.

Need help to buy this report?