Global Workforce Management Software Market Size, Share, and COVID-19 Impact Analysis, By Software Type (Workforce Scheduling and Optimization, Time and Attendance Management, Employee Performance Management, Workforce Analytics, and Others), By Deployment Model (On-premises, Cloud, and Others), By End User ( Retail, Healthcare, Manufacturing, BFSI, IT and Telecom, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Information & TechnologyGlobal Workforce Management Software Market Insights Forecasts to 2033

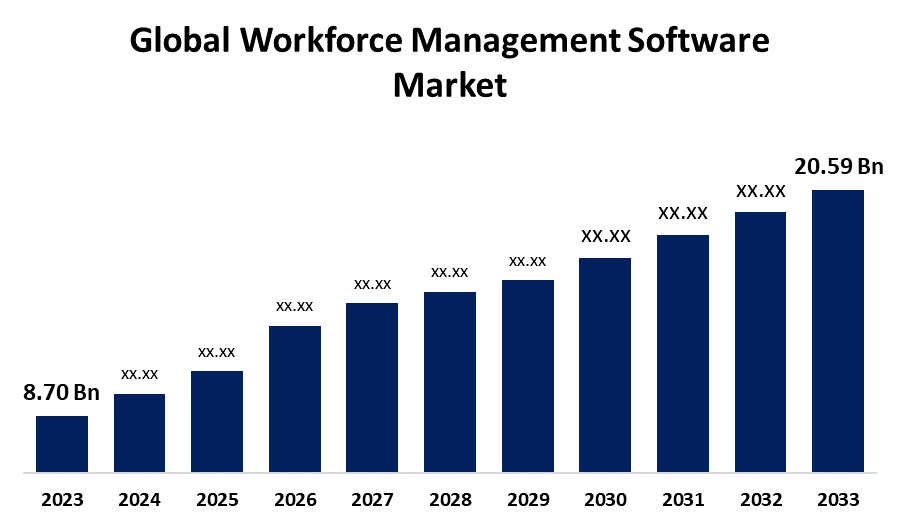

- The Global Workforce Management Software Market Size Was Estimated at USD 8.70 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 9.0% from 2023 to 2033

- The Worldwide Workforce Management Software Market Size is Expected to Reach USD 20.59 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Workforce Management Software Market Size is anticipated to Exceed USD 20.59 Billion by 2033, Growing at a CAGR of 9.0% from 2023 to 2033. The market growth is mostly due to technological advancements, such as AI and ML integration in WFM software, which are driving end users to adopt innovative solutions for optimized labor management and efficiency.

Market Overview

The workforce management software market refers to the market for software programs made to assist businesses in streamlining and optimizing personnel management. Numerous duties associated with human resources, such as scheduling, time tracking, payroll, attendance management, performance monitoring, and employee engagement, are managed by these software solutions. The market for workforce management is driven by the growing usage of cutting-edge technologies like artificial intelligence. The growing popularity of remote workforce solutions and the growing desire of small and medium-sized organizations for the Internet of Things will further increase the demand for workforce management. The labor management market will see greater growth prospects as a result of growing smartphone penetration and businesses' increased focus on HR analytics. Organizations may optimize their workforce, increase employee engagement, and save labor expenses by integrating analytics and machine learning into workforce management software.

Report Coverage

This research report categorizes the workforce management software market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the workforce management software market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the workforce management software market.

Workforce Management Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 8.70 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.0% |

| 2033 Value Projection: | USD 20.59 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Software Type, By Deployment Model, By End User |

| Companies covered:: | Atoss Software AG, ADP LLC, Blue Yonder Group Inc., Infor Group, IBM, Kronos Incorporated, Mitrefinch Ltd., NICE Systems Ltd, Reflexis Systems Inc., Sage Group PLC, 7shifts, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market is driven by technological developments to integrate AI and Machine Learning (ML) into WFM software. For example, Kronos developed AIMEE, an AI engine for human capital and labor management. AIMEE's personalized schedules guarantee that workers' abilities match the volume of customers and seasonal demand. It also provides advanced labor volume predictions. These developments motivate end users to employ state-of-the-art solutions to take advantage of their benefits. Cloud-based usage has been increasing with the introduction of widely accessible and reasonably priced mobile technology and the growing need for small and mid-sized organizations to have access to cost-effective technology solutions. These cloud-based solutions are as appealing to businesses looking to modernize their existing procedures as they are to SMEs purchasing their first system. Real-time data access, modifications, the long-term total cost of ownership, and the increasing need for software integration all help SMEs. These factors support market growth.

Restraining Factors

The market is hampered by the to achieve the benefits that any business desires, implementing new workforce management software can be an expensive and time-consuming process that needs to be done correctly. The majority of software-as-a-service evaluations focus on choosing a vendor that works well with and comparing feature sets to existing trouble areas due to these factors, market hampered during the forecast period.

Market Segmentation

The workforce management software market share is classified into software type, deployment model, and end user.

- The time and attendance management segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the software type, the workforce management software market is divided into workforce scheduling and optimization, time and attendance management, employee performance management, workforce analytics, and others. Among these, the time and attendance management segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the necessity for increased productivity and efficiency in present work environments. Accurate time monitoring is becoming more and more important to businesses as a way to improve resource allocation, guarantee labor law compliance, and control labor expenditures. Additionally, strong time and attendance management solutions are essential for properly monitoring and managing remote workers as remote and flexible work arrangements become more common. Organizations are looking for these solutions to improve operational performance and expedite payroll procedures as a result of the increased focus on labor optimization, which is driving up demand overall.

- The cloud segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the deployment model, the workforce management software market is segmented into on-premises, cloud, and others. Among these, the cloud segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe. The demand for cloud-based workforce management software is fueled by the cloud's accessibility and scalability, which makes it perfect for companies of all kinds. It supports the expanding trend of remote and distributed workforces by enabling businesses to effectively manage their employees from any location. Because cloud solutions eliminate the need for on-premises equipment and maintenance, they also save money. Moreover, cloud-based systems are becoming more and more popular because of their flexibility and real-time data availability, which facilitate agile decision-making and increase workforce productivity and operational efficiency.

- The BFSI segment held the largest share in 2023 and is estimated to grow at a substantial CAGR during the predicted timeframe.

Based on the end user, the workforce management software market is classified into retail, healthcare, manufacturing, BFSI, IT and telecom, and others. Among these, the BFSI segment held the largest share in 2023 and is estimated to grow at a substantial CAGR during the predicted timeframe. The segment is an expansion to complicated operational requirements, strict regulatory constraints, and the vital significance of effective human resource management. Payroll management, leave tracking, and performance monitoring are just a few of the HR procedures that HSBC streamlines with workforce management software. Better labor management software is required by HR in financial institutions so that several jobs can be completed simultaneously in the forecast period.

Regional Segment Analysis of the Workforce Management Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the workforce management software market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the workforce management software market over the predicted timeframe. The market for workforce management in this region has been increasing recently. The key concerns in this field are boosting labor productivity and efficiency. By controlling a significant share of the market and doubling trading volumes to outperform other regions, the region became the leading dealer in the retail venture market. This scenario is the fault of nations such as the United States and Canada. In Canada, the e-commerce sector has been expanding significantly. Moreover, WFM systems are necessary for compliance with North America's strict labor laws, including overtime legislation, which further propels industrial expansion.

Asia Pacific is expected to grow at the fastest CAGR growth of the workforce management software market during the forecast period. The expansion of the region, one of the largest producers and exporters of goods. Australia, Japan, South Korea, Indonesia, India, and China are all major producers of various items. This area produces a wide range of things, including food items, software, UAVs, and autos. To produce this vast array of things, labor is necessary. This will also contribute to the growth of the workforce management software market in the area. The region's rapid growth rate is attributed to its large number of SMEs, which play a significant role in developing and utilizing workforce software and management solutions. Investments from small and medium-sized enterprises are also expected to boost the area. SMEs are spending money to expand their use of advanced technology and cloud-based personnel management systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the workforce management software market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Atoss Software AG

- ADP LLC

- Blue Yonder Group Inc.

- Infor Group

- IBM

- Kronos Incorporated

- Mitrefinch Ltd.

- NICE Systems Ltd

- Reflexis Systems Inc.

- Sage Group PLC

- 7shifts

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, in an exciting move that addresses the growing role of AI in modern business, Workday Inc. has unveiled a new workforce management system designed specifically for managing AI agents. Dubbed the Agent System of Record, this platform is aimed at businesses that are onboarding and managing digital agents, treating them similarly to human employees while tackling the unique challenges AI agents bring to the table.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the workforce management software market based on the below-mentioned segments:

Global Workforce Management Software Market, By Software Type

- Workforce Scheduling and Optimization

- Time and Attendance Management

- Employee Performance Management

- Workforce Analytics

- Others

Global Workforce Management Software Market, By Deployment Model

- On-premises

- Cloud

- Others

Global Workforce Management Software Market, By End User

- Retail

- Healthcare

- Manufacturing

- BFSI

- IT and Telecom

- Others

Global Workforce Management Software Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the workforce management software market over the forecast period?The workforce management software market is projected to expand at a CAGR of 9.0% during the forecast period.

-

2. What is the market size of the workforce management software market?The Global workforce management software Market Size is Expected to Grow from USD 8.70 Billion in 2023 to USD 20.59 Billion by 2033, at a CAGR of 9.0% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the workforce management software market?North America is anticipated to hold the largest share of the workforce management software market over the predicted timeframe.

Need help to buy this report?