Global Workforce Optimization Market Size, Share, and COVID-19 Impact Analysis, By Solution (Workforce Scheduling, Time & Attendance, Embedded Analytics, Absence Management, and Others), By Company Size (Large Enterprises and Small & Medium Enterprises (SMEs)), By Application (Academia, Automotive & Manufacturing, BFSI, Government, Healthcare, Retail, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Information & TechnologyGlobal Workforce Optimization Market Insights Forecasts to 2033

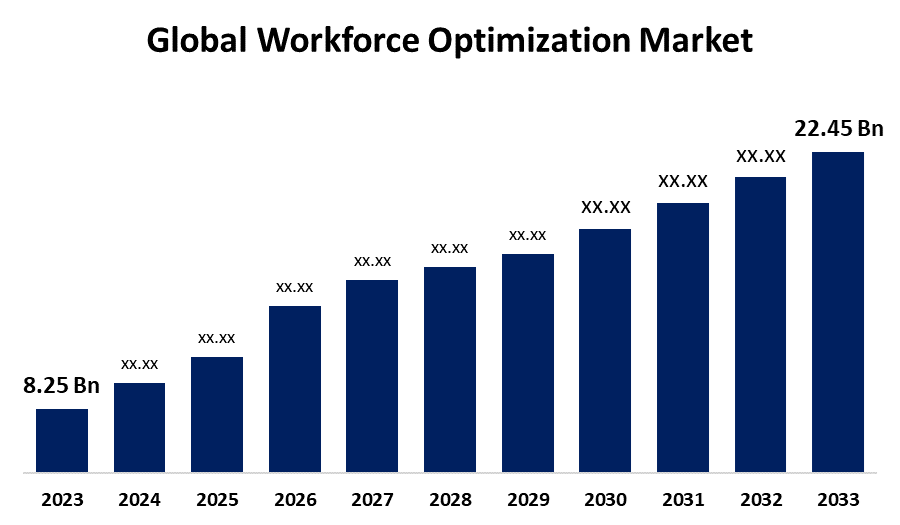

- The Global Workforce Optimization Market Size was Valued at USD 8.25 Billion in 2023

- The Market Size is Growing at a CAGR of 10.53% from 2023 to 2033

- The Worldwide Workforce Optimization Market Size is Expected to Reach USD 22.45 Billion by 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Workforce Optimization Market Size is Anticipated to Exceed USD 22.45 Billion by 2033, Growing at a CAGR of 10.53% from 2023 to 2033.

Market Overview

Workforce optimization describes the process used by employers to distribute their resources and employees, monitor attendance, and keep up with regulations and laws in the workplace that are continuously shifting. Effective workforce management maintains the productivity and cost-effective workforce, covering all the tasks and processes involved in efficiently staffing projects and ensuring the availability of the right labor mix at the right time and cost. Automation of time tracking for all employees and management of absences and leave with consideration to regional labor laws and reporting requirements are the features included in workforce management. The software utilizes a combination of historical intel from the company plus AI to help foresee staffing requirements ahead of time. They can automate actions such as tracking staff attendance and hours and putting together schedules that create the best fit for the envisaged picture. Other benefits include finance regulation, more accurate payroll, productivity enhancement, smarter schedule creation, and compliance risk minimization. The trend of incorporating workforce analytics solutions has become an emerging trend in the workforce management market. WFM Injixo is the workforce management platform incorporated with machine learning algorithms that analyze the historic contact data, identify patterns at interval, week, season, and yearly levels, and then make predictions down to interval level for a complete year into the future. AI has the potential to dynamically and automatically adjust staffing schedules and task allocations in response to changing contact volumes, employee availability, and service level achievement.

Report Coverage

This research report categorizes the market for the global workforce management market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global workforce optimization market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global workforce optimization market.

Global Workforce Optimization Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.25 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.53% |

| 2033 Value Projection: | USD 22.45 Billion |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Solution, By Application, By Region, By Company Size |

| Companies covered:: | Oracle Corporation, Ceridian HCM, Inc, WorkForce Software, LLC, Replicon, Infor, SAP SE, UKG Inc., NICE, ActiveOps PLC, Blue Yonder Group, Inc, EG Solutions, Reflexis Systems, Inc, SISQUAL Workforce Management, Lda., Kronos, and key key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

According to a report of March 2023 by Pew Research Center, 35% of workers in the United States with the option to work remotely do so full-time. An additional 41% use a hybrid work model. Thus, the rising prevalence of remote workforce is driving the demand for workforce management to manage remote teams effectively, enabling remote scheduling, performance monitoring, and resource allocation. The evolving need for automation surges the market growth. Furthermore, the increasing adoption of the workforce analytics approach is driving market growth. The development of advanced technologies like artificial intelligence (AI) and machine learning (ML) is contributing to market demand.

Restraining Factors

The diverse and stringent regulatory labor laws as well as data protection regulations and industry-specific mandates are significantly restraining the global workforce management market owing to the uncertainty and costs associated with achieving and maintaining regulatory compliance.

Market Segmentation

The global workforce optimization market share is classified into solution, company size, and application.

- The time & management segment dominated the market with the largest revenue share in 2023.

Based on the solution, the global workforce optimization market is categorized into workforce scheduling, time & attendance, embedded analytics, absence management, and others. Among these, the time & management segment dominated the market with the largest revenue share in 2023. Time management system ensures compliance with labor laws or labor union agreements that provide visibility and control over the most costly and valuable resource (employees). Time and attendance management systems have widespread application in various industries including manufacturing, healthcare, and retail.

- The large enterprises segment accounted for the largest market share in 2023.

Based on the company size, the global workforce optimization market is categorized into large enterprises and small & medium enterprises (SMEs). Among these, the large enterprises segment accounted for the largest market share in 2023. Large enterprise's workflow management comprises of multiple locations, a diverse workforce, and management of complex shift scheduling. There is a rising demand for workforce management in large enterprise segments to streamline their operations, optimize resource utilization, and enhance overall productivity.

- The BFSI segment accounted for the largest share of the global workforce optimization market during the forecast period.

Based on the application, the global workforce optimization market is categorized into academia, automotive & manufacturing, BFSI, government, healthcare, retail, and others. Among these, the BFSI segment accounted for the largest share of the global workforce optimization market during the forecast period. The workload volume of money transfer transactions inherently changes dramatically in hours. There is an increasing need for labor scheduling and labor budgeting solutions in the industry is propelling the market in the BFSI segment.

Regional Segment Analysis of the Global Workforce Optimization Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the global workforce optimization market over the predicted timeframe.

Get more details on this report -

Europe is projected to hold the largest share of the global workforce optimization market over the forecast period. European countries have provisions for various leave entitlements, including annual, maternity/paternity, parental, and sick leave that surges the market demand for workflow management. The development such as automated workforce operations is also contributing to drive market growth in the region. In the region, Germany held the largest market while the UK was the fastest growing market.

Asia-Pacific is expected to grow at the fastest CAGR growth of the global workforce optimization market during the forecast period. The rising government initiatives and investments in digitization are driving market growth in the region. The growing number of automation projects and the adoption in the IT sector, specifically among the SMEs enhance the productivity of the company. In the Asia-Pacific region, China held the largest market share of workforce management while India is the fastest-growing market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global workforce optimization market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Oracle Corporation

- Ceridian HCM, Inc

- WorkForce Software, LLC

- Replicon

- Infor

- SAP SE

- UKG Inc.

- NICE

- ActiveOps PLC

- Blue Yonder Group, Inc

- EG Solutions

- Reflexis Systems, Inc

- SISQUAL Workforce Management, Lda.

- Kronos

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, Strata Decision Technology (Strata), a pioneer and leader in the development of cloud-based financial planning, analytics, and performance tools for healthcare, announced the launch of its Real-Time Workforce Management (RTWM) solution, designed to address the financial and operational goals of nursing leaders.

- In March 2023, UJET, Inc., the intelligent, modern contact center platform, announced UJET WFM, in partnership with Google Cloud. UJET WFM offers highly accurate forecasting, scheduling and real-time adherence monitoring to improve remote contact center agent performance, satisfaction, and the overall customer experience.

- In January 2023, Accenture (NYSE: ACN) and UKG, a leading provider of HR, payroll, and workforce management solutions for all people, are collaborating to help Ardent Health Services improve workforce visibility and agility across its network of 30 hospitals and 200 sites of care.

- In May 2023, WorkAxle, a leading workforce management (WFM) solutions provider, and TalenTeam, SAP Gold Partner and Human Experience Management expert, are proud and excited to announce a strategic partnership. This collaboration aims to empower organizations in Europe and the Middle East with cutting-edge solutions that optimize workforce management processes and drive operational efficiency.

- In July 2022, Procore Technologies, Inc. (NYSE: PCOR), a leading global provider of construction management software, announced the launch of a new solution, Procore Workforce Management, which features two key products — Field Productivity and Workforce Planning, formerly known as LaborChart.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global workforce optimization market based on the below-mentioned segments:

Global Workforce Optimization Market, By Solution

- Workforce Scheduling

- Time & Attendance

- Embedded Analytics

- Absence Management

- Others

Global Workforce Optimization Market, By Company Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Global Workforce Optimization Market, By Application

- Academia

- Automotive & Manufacturing

- BFSI

- Government

- Healthcare

- Retail

- Others

Global Workforce Optimization Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?