Global Wound Care Biologics Market Size, Share, and COVID-19 Impact Analysis, By Product (Biological Skin Substitutes and Topical Agents), By Wound Type (Ulcers, Surgical & Traumatic Wounds, and Burns), By End-User (Hospitals, Ambulatory Surgery Centers, and Burn Care Centers & Wound Clinics), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: HealthcareGlobal Wound Care Biologics Market Insights Forecasts to 2032.

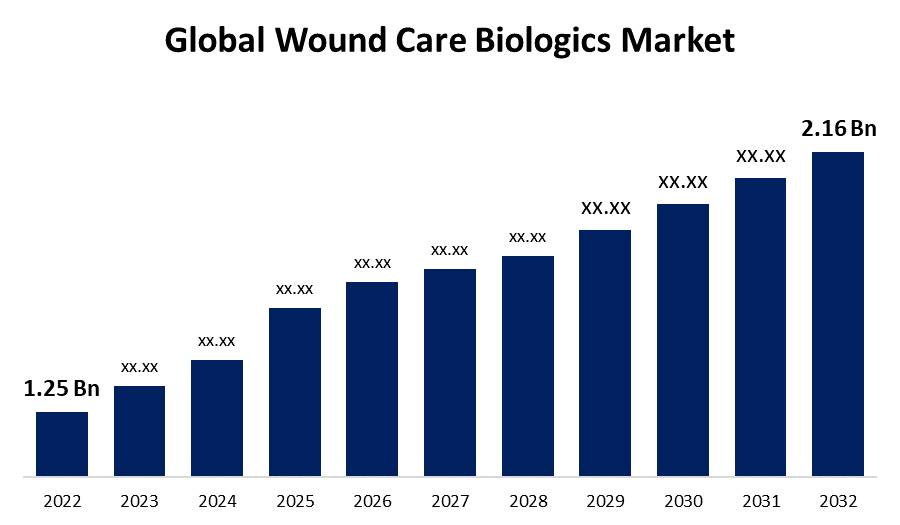

- The Global Wound Care Biologics Market Size was valued at USD 1.25 Billion in 2022.

- The Market is Growing at a CAGR of 5.6% from 2022 to 2032.

- The Worldwide Wound Care Biologics Market Size is expected to reach USD 2.16 Billion by 2032.

- Asia-Pacific is expected to Grow fastest during the forecast period.

Get more details on this report -

The Global Wound Care Biologics Market Size is expected to reach USD 2.16 Billion by 2032, at a CAGR of 5.6% during the forecast period 2022 to 2032.

Market Overview

Wound Care Biologics represent an innovative approach to healing complex and chronic wounds by utilizing biological materials to enhance the regenerative process. These advanced therapies harness the power of naturally occurring substances such as growth factors, cytokines, and extracellular matrices, which promote cell proliferation, angiogenesis, and tissue remodeling. By creating a favorable microenvironment, Wound Care Biologics accelerate wound closure, minimize infection risks, and stimulate the formation of healthy tissue. These biologic products are administered topically or via injection, catering to various wound types, including diabetic ulcers, pressure sores, and burns. Their potential to improve healing outcomes and alleviate patient suffering underscores their growing significance in modern wound management strategies.

Report Coverage

This research report categorizes the market for wound care biologics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the wound care biologics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the wound care biologics market.

Global Wound Care Biologics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.25 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.6% |

| 2032 Value Projection: | USD 2.16 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Wound Type, By End-User, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Smith & Nephew PLC, Organogenesis Inc., Integra LifeSciences, Stryker Corporation, Skye Biologics Holdings, LLC, Lynch Biologics, LLC, MTF Biologics, Molnlycke Health Care, MiMedx Inc., Marine Polymer Technologies Inc. and other key venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The wound care biologics market is propelled by a confluence of factors driving its growth and significance, the increasing prevalence of chronic wounds, including diabetic ulcers and pressure sores, due to aging populations and rising incidences of diabetes, amplifies the demand for innovative solutions like wound care biologics. Additionally, the growing awareness among healthcare professionals and patients regarding the potential benefits of biologics in expediting healing processes further fuels market expansion. The rising focus on improving patient outcomes and quality of life, coupled with a shift toward advanced wound management techniques, has elevated the adoption of biologics as a preferred choice. Moreover, the continuous advancements in biotechnology and regenerative medicine have led to the development of more refined and effective biologic products, attracting investments and boosting market growth. The pursuit of cost-effective and efficient wound care solutions drives research and development initiatives, resulting in the introduction of novel biologics with enhanced therapeutic potential. The integration of telemedicine and digital wound management technologies has also widened the reach of these biologics to remote areas and underserved populations, fostering market expansion. Overall, the synergy of demographic trends, medical awareness, technological progress, and economic considerations collectively propels the wound care biologics market forward.

Restraining Factors

The wound care biologics market faces certain constraints that impact its growth trajectory. High costs associated with biologic treatments pose a significant barrier, limiting access for some patients and healthcare systems. Regulatory complexities and approval processes for new biologic products can lead to delays and uncertainties in market entry. Additionally, the requirement for specialized storage and handling of biologics adds logistical challenges. Limited insurance coverage for these treatments and potential adverse effects may also deter widespread adoption.

Market Segmentation

- In 2022, the biological skin substitutes segment accounted for around 67.3% market share

On the basis of the product, the global wound care biologics market is segmented into biological skin substitutes and topical agents. The biological skin substitutes segment has emerged as the leading market player within wound care biologics due to its compelling attributes. These substitutes, often derived from human or animal tissues, offer a three-dimensional scaffold that mimics natural skin structure, promoting effective wound healing and tissue regeneration. Their close resemblance to native skin properties enhances integration and reduces rejection risks. Moreover, their versatility in treating various wound types, including burns and diabetic ulcers, has driven their widespread adoption. These factors collectively position biological skin substitutes as the dominant force in the wound care biologics market.

- The ulcers segment held the largest market with more than 35.4% revenue share in 2022

Based on the wound type, the global wound care biologics market is segmented into ulcers, surgical & traumatic wounds, and burns. The ulcers segment has emerged as the dominant market segment within the wound care biologics industry due to compelling reasons. Chronic ulcers, such as diabetic foot ulcers and venous ulcers, represent a significant healthcare challenge globally. Wound care biologics offer targeted and advanced therapeutic solutions for promoting healing in these complex and stubborn wounds. The unique biological properties of these treatments, including growth factors and cytokines, address the underlying issues of impaired wound healing. The efficacy of wound care biologics in accelerating ulcer closure, reducing infection risks, and improving overall patient outcomes has propelled their widespread adoption, making the ulcers segment the largest driver of the market's growth.

- The hospitals segment held the largest market with more than 48.6% revenue share in 2022

Based on the end-user, the global wound care biologics market is segmented into hospitals, ambulatory surgery centers, and burn care centers & wound clinics. The hospitals segment has emerged as the dominant market player within the context of wound care biologics due to several pivotal factors. Hospitals serve as primary healthcare centers, handling a diverse range of wounds, including complex and chronic cases. They possess the requisite infrastructure and expertise to administer advanced biologic treatments effectively. The availability of skilled medical professionals, surgical facilities, and specialized wound care units in hospitals enhances the utilization of wound care biologics. Furthermore, hospitals' capacity to provide comprehensive care, from diagnosis to treatment and follow-up, makes them a natural hub for the adoption and implementation of biologic therapies, solidifying their position as the largest market segment.

Regional Segment Analysis of the Wound Care Biologics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 33.5% revenue share in 2022.

Get more details on this report -

Based on region, North America dominates the wound care biologics market due to advanced healthcare infrastructure, high prevalence of chronic wounds, and increasing geriatric population drive demand for innovative wound healing solutions. Extensive research and development activities, coupled with regulatory support for biologic therapies, further bolster market growth. Additionally, strong awareness among healthcare professionals and patients, along with higher healthcare expenditure, contribute to North America's prominent position in the wound care biologics market.

Asia Pacific's wound care biologics market is projected for rapid expansion due to the region's large population, increasing prevalence of chronic wounds, and growing healthcare infrastructure create a robust demand for advanced wound healing solutions. Rising healthcare awareness, evolving regulatory frameworks, and escalating investments in biotechnology drive the adoption of wound care biologics. Additionally, improving economic conditions and rising disposable incomes contribute to the projected accelerated growth of the market in Asia Pacific.

Recent Developments

- In July 2022, Tides Medical, a biologics business, has introduced Artacent AC, a tri-layer skin graft developed for use in the treatment of complicated or difficult-to-treat wounds.

- In May 2022, MIMEDX has been awarded USD 4.6 million by the Department of Defence to study PURION processed Dehydrated Human Amnion Chorion Membrane (DHACM) in order to enhance the treatment of battle victim wounds and burns.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global wound care biologics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Smith & Nephew PLC

- Organogenesis Inc.

- Integra LifeSciences

- Stryker Corporation

- Skye Biologics Holdings, LLC

- Lynch Biologics, LLC

- MTF Biologics

- Molnlycke Health Care

- MiMedx Inc.

- Marine Polymer Technologies Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global wound care biologics market based on the below-mentioned segments:

Wound Care Biologics Market, By Product

- Biological Skin Substitutes

- Topical Agents

Wound Care Biologics Market, By Wound Type

- Ulcers

- Surgical & Traumatic Wounds

- Burns

Wound Care Biologics Market, By End-User

- Hospitals

- Ambulatory Surgery Centers

- Burn Care Centers & Wound Clinics

Wound Care Biologics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?