Global X-ray Food & Pharmaceutical Inspection System Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Packaged Product Inspection Equipment, Bulk Product Inspection Equipment), By Application (Food, Pharmaceutical), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Semiconductors & ElectronicsGlobal X-ray Food & Pharmaceutical Inspection System Market Insights Forecasts to 2033

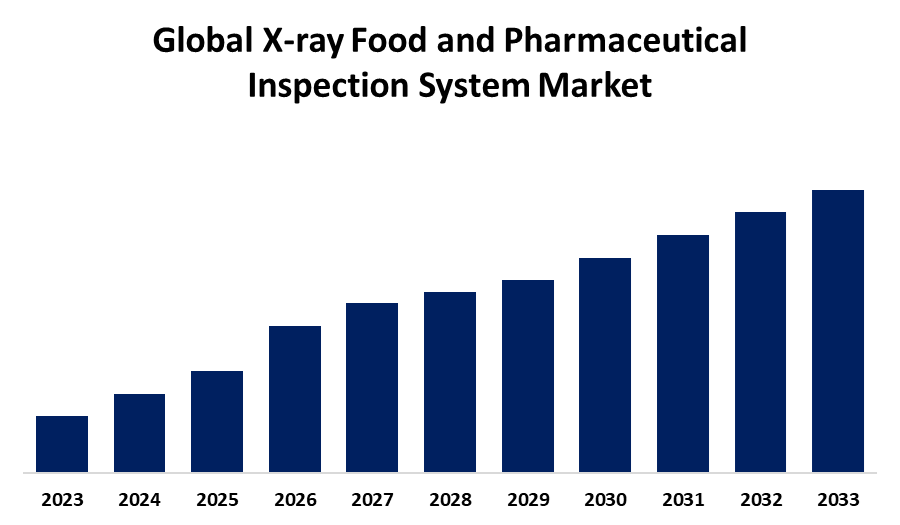

- The Market Size is Growing at a Substantial CAGR from 2023 to 2033

- The Worldwide X-ray Food & Pharmaceutical Inspection System Market Size is Expected to Hold a Significant Share by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The X-ray Food & Pharmaceutical Inspection System Market is anticipated to hold a significant share by 2033, growing at a substantial CAGR from 2023 to 2033. The global X-ray food and pharmaceutical inspection system market is a fast-emerging sector with growing opportunities in technological advancement, higher safety standards, and the need for quality control. Increasing investments in innovation by prominent players will help in broadening the reach of market growth in all regions.

Market Overview

The X-ray food and pharmaceutical inspection system detects contaminants using X-ray technology, ensuring product quality and maintaining safety standards. It detects foreign objects such as metal, glass, or plastic as well as defects in products on the production line. In food production, it ensures consumer safety, and in pharmaceuticals, it verifies the integrity and packaging of drugs. Moreover, the demand for food safety, consumer awareness, and strict regulations are increasingly driving the use of X-ray inspection systems in the food and pharmaceutical industries. Technological advancements include AI and faster processing for improved accuracy and efficiency. These systems ensure product quality, reduce manual inspection costs, and help verify drug safety. The expanding food processing and pharmaceutical sectors, coupled with the focus on sustainability, will further boost market growth. Furthermore, opportunities in the X-ray inspection market include growing demand for safer, higher-quality food and pharmaceuticals, particularly with increasing consumer awareness. Trends such as AI integration, enhanced automation, and a need for compliance with stricter regulations present opportunities for growth. Sustainable practices and increased dependence on packaged goods further propel market growth.

Report Coverage

This research report categorizes the global X-ray food & pharmaceutical inspection system market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global X-ray food & pharmaceutical inspection system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global X-ray food & pharmaceutical inspection system market.

Global X-ray Food and Pharmaceutical Inspection System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 – 2033 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 228 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Product Type, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Ishida, Loma Systems, Sesotec GmbH, Multivac Group, Dylog Hi-Tech, Bizerba, Techik, Anritsu Infivis, Mettler-Toledo, Minebea Intec, Thermo Fisher, WIPOTEC-OCS, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The key drivers of the X-ray inspection market are increased demand for product safety and quality control in industries, stricter global regulations, and advancement in inspection technology. The growing use of automated systems, increased concerns of contamination from consumers, and expansion in the food and pharmaceutical industries are leading to an increase in the demand for efficient and reliable X-ray inspection solutions. Moreover, governments around the world are implementing strong safety regulations to safeguard the health of the public and the environment. X-ray inspection is one of the main ways through which industries achieve these standards by detecting defects in pipelines, structures, and equipment, thus adhering to safety and quality requirements. For instance, in December 2022, the Japanese government granted Palau USD 1.85 million in grants and donated nine kinds of inspection equipment, such as mobile X-ray trucks, baggage screening machines, handheld scanners for narcotics and explosives, and non-invasive inspection systems. This equipment will improve the authorities' capacity to detect illegal products and enhance customs processes at airports, seaports, and post offices.

Restraints & Challenges

The challenges of the X-ray inspection market include high initial costs, complex integration with existing systems, and the requirement for skilled operators. The technical limitations in inspecting some materials and regulatory compliance issues also hinder the adoption. Radiation safety issues and maintenance costs of the system also act as a market restraint.

Market Segmentation

The global X-ray food & pharmaceutical inspection system market share is classified into product type and application.

- The packaged product inspection equipment segment is expected to hold the largest share of the global X-ray food & pharmaceutical inspection system market during the forecast period.

Based on product type, the global X-ray food & pharmaceutical inspection system market is categorized as packaged product inspection equipment and bulk product inspection equipment. Among these, the packaged product inspection equipment segment is expected to hold the largest share of the global X-ray food & pharmaceutical inspection system market during the forecast period. This is mainly due to the increased demand for packaged food and pharmaceutical products, where stringent checks are required for safety and quality. Packaged products are more prone to contamination in manufacturing, and therefore, the inspection equipment is highly necessary to detect foreign objects, properly seal them, and ensure product integrity. Also, the rise in e-commerce and demand for packaged products has led to the usage of these systems in both the food and pharmaceutical industries.

- The pharmaceutical segment is expected to grow at the fastest CAGR during the forecast period.

Based on the application, the global X-ray food & pharmaceutical inspection system market is categorized as food and pharmaceutical. Among these, the pharmaceutical segment is expected to grow at the fastest CAGR during the forecast period. The demand for drug safety, regulatory requirements, and the integrity and packaging of pharmaceutical products are some factors driving growth. X-ray systems play a crucial role in detecting contaminants, tablet count verification, and assurance of packaging integrity. These are essential requirements for maintaining safety and compliance in the pharmaceutical industry. The expansion of global pharmaceutical production leads to increased demand for advanced inspection solutions.

Regional Segment Analysis of the Global X-ray Food & Pharmaceutical Inspection System Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global X-ray food & pharmaceutical inspection system market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global X-ray food & pharmaceutical inspection system market over the forecast period. The regional growth due to rigid food safety and pharmaceutical regulations such as FDA guidelines, this region is leading in adopting sophisticated technologies like AI-based inspection systems. Major manufacturers present in the region and very high consumer awareness also drive the demand for reliable product safety and quality solutions. Moreover, non-destructive testing techniques are used to assess the integrity and quality of materials and components. They comprise inspection, training, calibration, and equipment rental services. For instance, in May 2023, Previan Technologies Inc. acquired Sensor Networks, Inc. (SNI), a leading provider of sensing tools and technologies for advanced inspection and remote monitoring of safety-critical components. This acquisition brought SNI into the Previan Group, allowing the latter to tap into the NDT solutions provided by the Eddyfi Technologies business unit.

Asia Pacific is expected to grow at the fastest CAGR growth of the global X-ray food & pharmaceutical inspection system market during the forecast period. Its growth is driven by rapid industrialization, growing consumer demand for safe quality products, and growth within the food and pharmaceutical sectors. Moreover, better regulatory standards and the rising adoption of advanced inspection technologies contribute to growth in the region. Moreover, technological improvements, like AI-based X-ray systems, integration of machine learning, and improved resolution imaging, are improving inspection accuracy and efficiency. That said, leading players continue to invest in R&D and deepen investments in emerging markets such as Asia Pacific. Strategic partnerships and local manufacturing facilities enhance regional growth with innovative solutions and strengthen market hold.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global X-ray food & pharmaceutical inspection system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ishida

- Loma Systems

- Sesotec GmbH

- Multivac Group

- Dylog Hi-Tech

- Bizerba

- Techik

- Anritsu Infivis

- Mettler-Toledo

- Minebea Intec

- Thermo Fisher

- WIPOTEC-OCS

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In August 2023, Smith Detection presented two new dual-view X-ray scanners. One is the High Conveyor UHD X-Ray Scanner SDX100100 DV HC, designed for airports, parcel services, carriers and customs facilities. The Low Conveyor Model DV LC features a high-conveyor x-ray scanner capable of screening oversized baggage.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global X-ray food & pharmaceutical inspection system market based on the below-mentioned segments:

Global X-ray Food & Pharmaceutical Inspection System Market, By Product Type

- Packaged Product Inspection Equipment

- Bulk Product Inspection Equipment

Global X-ray Food & Pharmaceutical Inspection System Market, By Application

- Food

- Pharmaceutical

Global X-ray Food & Pharmaceutical Inspection System Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?