Global X-ray Machine Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Stationary, and Portable), By Technology (Analog, and Digital), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal X-ray Machine Manufacturing Market Insights Forecasts to 2033

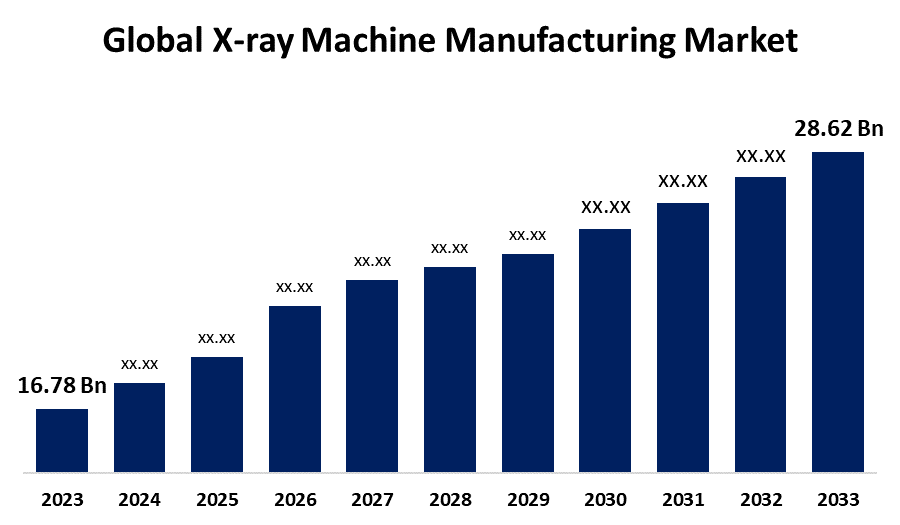

- The Global X-ray Machine Manufacturing Market Size was Valued at USD 16.78 Billion in 2023

- The Market Size is Growing at a CAGR of 5.48% from 2023 to 2033

- The Worldwide X-ray Machine Manufacturing Market Size is Expected to Reach USD 28.62 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global X-ray Machine Manufacturing Market Size is Anticipated to Exceed USD 28.62 Billion by 2033, Growing at a CAGR of 5.48% from 2023 to 2033.

Market Overview

An X-ray machine is a device that uses X-rays to produce images of the bones in the body. X-rays are used for a range of applications, X-rays are used to diagnose and delicacy a variety of conditions, such as broken bones, tumors, pneumonia, and dental problems. X-ray machines work by sending X-ray waves through the body, which are then recorded on a computer or film. Dense structures, like bone, block most of the X-rays and appear white on the image. Metal and contrast media also appear white.

According to the U.S. Food and Drug Administration, through the Food and Drug Administration Modernization Act of 1997 (FDAMA), the FDA has formally recognized several consensus standards related to X-ray imaging. When manufacturers submit premarket notifications to the FDA for marketing authorization, declarations of conformity to FDA-recognized consensus standards may obviate the need for manufacturers to provide data supporting the safety and effectiveness covered by the particular recognized standards to which the devices conform.

For instance, In January 2024, the Food and Drug Administration (FDA) granted 510(k) clearance for the artificial intelligence (AI)-enabled qXR for Lung Nodule (qXR-LN) software, which may enhance the detection of pulmonary nodules on chest X-rays.

Report Coverage

This research report categorizes the market for X-ray machine manufacturing based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the X-ray machine manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the X-ray machine manufacturing market.

Global X-ray Machine Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 16.78 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.48% |

| 2033 Value Projection: | USD 28.62 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 237 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product Type, By Technology, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Canon Inc., Fujifilm Holdings Corporation, GE Healthcare, Hitachi Medical Corporation, Hologic Inc., Philips Healthcare, Shimadzu Corporation, Siemens AG, North Star Imaging Inc., ZKTECO CO., LTD., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the key factors expected to augment the growth of the global X-ray machine manufacturing market during the forecast period is the increase in the prevalence of orthopedic diseases worldwide. Digital radiography is very helpful for examining the musculoskeletal system of trauma victims. Another factor driving the growth of the global X-ray machine manufacturing market is the increasing adoption of digital X-ray systems owing to their advantages. Along with the growing use of digital X-ray equipment, government restrictions and expenditures to upgrade infrastructure are anticipated to spur demand and have a favorable influence on market expansion.

Restraining Factors

The cost of acquiring and maintaining X-ray machines can be substantial, particularly for smaller healthcare facilities or those in developing regions. The high cost acts as a deterrent to market growth, limiting the accessibility of advanced medical imaging technologies. While X-ray machines are generally safe when used correctly, there is still concern regarding radiation exposure. Healthcare providers and patients alike have raised awareness about radiation risks, leading to some hesitancy in utilizing X-ray machines.

Market Segmentation

The X-ray machine manufacturing market share is classified into type and application.

- The stationary segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the X-ray machine manufacturing market is classified into stationary and portable. Among these, the stationary segment is estimated to hold the highest market revenue share through the projected period. This is attributed to their cost-effectiveness and the lower initial investment required compared to more advanced imaging technologies. In addition, stationary systems are preferred in many developing countries where technological adoption is slower, as they provide essential imaging capabilities without the need for high-end equipment. Their fixed nature also ensures consistent performance and ease of maintenance, making them a practical choice for facilities with limited resources.

- The digital segment is anticipated to hold the largest market share through the forecast period.

Based on the technology, the X-ray machine manufacturing market is divided into analog and digital. Among these, the digital segment is anticipated to hold the largest market share through the forecast period. This growth can be attributed primarily to the increasing demand for digital systems. Digital technology produces high-contrast resolution images while using lower levels of ionizing radiation, owing to its advanced flat panel detectors (FPD). This capability not only improves image quality but also reduces patient exposure to radiation, making it a preferred choice in medical imaging. In addition, digital systems are known for their efficiency, compact design, and rapid image viewing capabilities, which streamline the imaging process and enhance overall workflow in healthcare settings. The growing adoption of DR technology by healthcare providers to improve diagnostic accuracy and operational efficiency is expected further to drive the segment's growth throughout the forecast period.

Regional Segment Analysis of the X-ray Machine Manufacturing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the X-ray machine manufacturing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the X-ray machine manufacturing market over the predicted timeframe. The growing need for imaging technologies in the regional medical and industrial sectors is expected to favor the X-ray machine market. Demand for x-ray equipment with digital imaging capability is increasing due to the growing requirement for medical diagnostic imaging. Due to customers' high disposable incomes and access to health insurance, the United States has the world's largest market for medical imaging. Due to sedentary lifestyles (little physical activity) and bad eating practices, the United States has seen a rise in the population of elderly people and an increase in the prevalence of chronic illnesses. Additionally, it is projected that expanding medical infrastructure expansions would fuel demand in the US market for medical X-ray equipment.Bottom of Form

Asia Pacific is expected to grow at the fastest CAGR growth of the X-ray machine manufacturing market during the forecast period. Countries like China and India are the main factors driving the market expansion in Asia-Pacific. With the rise in the burden of chronic diseases, increasing number of diagnostic centers, rise in adoption of digital X-ray systems, and well-established healthcare infrastructure in this region, China is predicted to expand rapidly. Additionally, the market will be significantly impacted by the expanding use of digital X-ray equipment, which has benefits including excellent image quality and faster processing. X-ray machines are growing in popularity in the Indian market. Demand for analog systems is anticipated as procurement rises in tier II and tier III cities while tier 1 cities switch to their digital counterparts.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the X-ray machine manufacturing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Canon Inc.

- Fujifilm Holdings Corporation

- GE Healthcare

- Hitachi Medical Corporation

- Hologic Inc.

- Philips Healthcare

- Shimadzu Corporation

- Siemens AG

- North Star Imaging Inc.

- ZKTECO CO., LTD.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Pinnacle X-Ray Solutions, LLC, a manufacturer of non-destructive testing and inspection systems, announced the acquisition of Willick Engineering Co, Inc., a supplier of non-destructive testing (NDT) X-ray equipment and provider of related services to the military, aerospace, and medical device sectors, headquartered in Santa Fe Springs, CA. Financial terms of the transaction were not disclosed.

- In July 2023, Nikon Americas Inc, the US subsidiary of Nikon Corporation (Nikon), purchased the US company Avonix Imaging LLC (Avonix) Minnesota, USA which since 2015 has been a strategic X-ray CT (computed tomography) equipment manufacturing partner to Nikon Industrial Metrology Business Unit (IMBU). Siemens Healthineers announced that the Multix Impact E digital radiography X-ray machine will now be manufactured in India.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the X-ray machine manufacturing market based on the below-mentioned segments:

Global X-ray Machine Manufacturing Market, By Product Type

- Stationary

- Portable

Global X-ray Machine Manufacturing Market, By Technology

- Analog

- Digital

Global X-ray Machine Manufacturing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the X-ray machine manufacturing market over the forecast period?The X-ray machine manufacturing market is projected to expand at a CAGR of 5.48% during the forecast period.

-

2. What is the market size of the X-ray machine manufacturing market?The Global X-ray Machine Manufacturing Market Size is Expected to Grow from USD 16.78 Billion in 2023 to USD 28.62 Billion by 2033, at a CAGR of 5.48% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the X-ray machine manufacturing market?North America is anticipated to hold the largest share of the X-ray machine manufacturing market over the predicted timeframe.

Need help to buy this report?